statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

384 12. Gestion <strong>de</strong>s risques grands <strong>et</strong> extrêmes<br />

where:<br />

λ<br />

+<br />

i =<br />

l =<br />

A similar expression holds for λ – i , which is obtained by simply replacing<br />

the limit u → 1 by u → 0 in the <strong>de</strong>finition of l. λ ± i is non-zero as long<br />

as l remains finite, th<strong>at</strong> is, when the tail of the distribution of the factor is<br />

not thinner than the tail of the idiosyncr<strong>at</strong>ic noise εi . Therefore, two conditions<br />

must hold for the coefficient of tail <strong>de</strong>pen<strong>de</strong>nce to be non-zero:<br />

the factor must be intrinsically ‘wild’ (to use the terminology of Man<strong>de</strong>lbrot,<br />

1997) so th<strong>at</strong> its distribution is regularly varying; and<br />

the factor must be sufficiently ‘wild’ in its intrinsic variability, so th<strong>at</strong> its<br />

influence is not domin<strong>at</strong>ed by the idiosyncr<strong>at</strong>ic component of the ass<strong>et</strong>.<br />

Then, the amplitu<strong>de</strong> of λ ± i is d<strong>et</strong>ermined by the tra<strong>de</strong>-off b<strong>et</strong>ween the rel<strong>at</strong>ive<br />

tail behaviours of the factor and the idiosyncr<strong>at</strong>ic noise.<br />

As an example, l<strong>et</strong> us consi<strong>de</strong>r th<strong>at</strong> the factor and the idiosyncr<strong>at</strong>ic noise<br />

follow Stu<strong>de</strong>nt distribution with νY and ν <strong>de</strong>grees of freedom and scale<br />

εi<br />

factor σY and σ respectively. Expression (7) leads to:<br />

εi<br />

λi = 0 if νY > νεi<br />

λi =<br />

1<br />

1<br />

σεi<br />

ν<br />

if νY = νε= ν<br />

i<br />

+ ( βσ i Y)<br />

−1<br />

lim<br />

u→1<br />

Y<br />

ν<br />

l { 1 β } i<br />

( )<br />

( )<br />

FXu −1<br />

F u<br />

λ = 1 if ν < ν<br />

i Y<br />

The tail <strong>de</strong>pen<strong>de</strong>nce <strong>de</strong>creases when the idiosyncr<strong>at</strong>ic vol<strong>at</strong>ility increases<br />

rel<strong>at</strong>ive to the factor vol<strong>at</strong>ility. Therefore, λi <strong>de</strong>creases in periods<br />

of high idiosyncr<strong>at</strong>ic vol<strong>at</strong>ility and increases in periods of high mark<strong>et</strong><br />

vol<strong>at</strong>ility. From the viewpoint of the tail <strong>de</strong>pen<strong>de</strong>nce, the vol<strong>at</strong>ility of an<br />

ass<strong>et</strong> is not relevant. Wh<strong>at</strong> is governing extreme co-movement is the rel<strong>at</strong>ive<br />

weights of the different components of the vol<strong>at</strong>ility of the ass<strong>et</strong>.<br />

Figure 1 compares the coefficient of tail <strong>de</strong>pen<strong>de</strong>nce as a function of<br />

the correl<strong>at</strong>ion coefficient for the bivari<strong>at</strong>e Stu<strong>de</strong>nt distribution (expression<br />

(4)) and for the factor mo<strong>de</strong>l with the factor and the idiosyncr<strong>at</strong>ic noise<br />

following Stu<strong>de</strong>nt distributions (equ<strong>at</strong>ion (8)). Contrary to the coefficient<br />

of tail <strong>de</strong>pen<strong>de</strong>nce of the Stu<strong>de</strong>nt factor mo<strong>de</strong>l, the tail <strong>de</strong>pen<strong>de</strong>nce of the<br />

(elliptical) Stu<strong>de</strong>nt distribution does not vanish for neg<strong>at</strong>ive correl<strong>at</strong>ion coefficients.<br />

For large values of the correl<strong>at</strong>ion coefficient, the former is always<br />

larger than the l<strong>at</strong>ter.<br />

Once the coefficients of tail <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween the ass<strong>et</strong>s and the<br />

common factor are known, the coefficient of tail <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween any<br />

two ass<strong>et</strong>s Xi and Xj with a common factor Y is simply equal to the weakest<br />

tail <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween the ass<strong>et</strong>s and their common factor:<br />

λ min λ , λ<br />

(9)<br />

= { }<br />

ij i j<br />

This result is very intuitive: since the <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween the two ass<strong>et</strong>s<br />

is due to their common factor, this <strong>de</strong>pen<strong>de</strong>nce cannot be stronger than<br />

the weakest <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween each of the ass<strong>et</strong>s and the factor.<br />

Practical implement<strong>at</strong>ion and consequences<br />

The two m<strong>at</strong>hem<strong>at</strong>ical results (4) and (7) have a very important practical<br />

effect for estim<strong>at</strong>ing the coefficient of tail <strong>de</strong>pen<strong>de</strong>nce. As we have already<br />

pointed out, its direct estim<strong>at</strong>ion is essentially impossible since, by <strong>de</strong>finition,<br />

the number of observ<strong>at</strong>ions goes to zero as the probability level of<br />

the quantile goes to zero (or one). In contrast, the formulas (4) and (7–9)<br />

tell us th<strong>at</strong> one has just to estim<strong>at</strong>e a tail in<strong>de</strong>x and a correl<strong>at</strong>ion coefficient.<br />

These estim<strong>at</strong>ions can be reasonably accur<strong>at</strong>e because they make<br />

use of a significant part of the d<strong>at</strong>a beyond the few extremes targ<strong>et</strong>ed by<br />

λ. Moreover, equ<strong>at</strong>ion (7) does not explicitly assume a power law behaviour,<br />

but only a regularly varying behaviour, which is far more general. In<br />

1<br />

max ,<br />

εi<br />

(7)<br />

(8)<br />

A. Coefficients of tail <strong>de</strong>pen<strong>de</strong>nce<br />

Lower tail <strong>de</strong>pen<strong>de</strong>nce Upper tail <strong>de</strong>pen<strong>de</strong>nce<br />

Bristol-Myers Squibb 0.16 (0.03) 0.14 (0.01)<br />

Chevron 0.05 (0.01) 0.03 (0.01)<br />

Hewl<strong>et</strong>t-Packard 0.13 (0.01) 0.12 (0.01)<br />

Coca-Cola 0.12 (0.01) 0.09 (0.01)<br />

Minnesota Mining & MFG 0.07 (0.01) 0.06 (0.01)<br />

Philip Morris 0.04 (0.01) 0.04 (0.01)<br />

Procter & Gamble 0.12 (0.02) 0.09 (0.01)<br />

Pharmacia 0.06 (0.01) 0.04 (0.01)<br />

Schering-Plough 0.12 (0.01) 0.11 (0.01)<br />

Texaco 0.04 (0.01) 0.03 (0.01)<br />

Texas Instruments 0.17 (0.02) 0.12 (0.01)<br />

Walgreen 0.11 (0.01) 0.09 (0.01)<br />

This table presents the coefficients of lower and upper tail <strong>de</strong>pen<strong>de</strong>nce with the S&P<br />

500 in<strong>de</strong>x for a s<strong>et</strong> of 12 major stocks tra<strong>de</strong>d on the New York Stock Exchange from<br />

January 1991 to December 2000. The numbers in brack<strong>et</strong>s give the estim<strong>at</strong>ed standard<br />

<strong>de</strong>vi<strong>at</strong>ion of the empirical coefficients of tail <strong>de</strong>pen<strong>de</strong>nce<br />

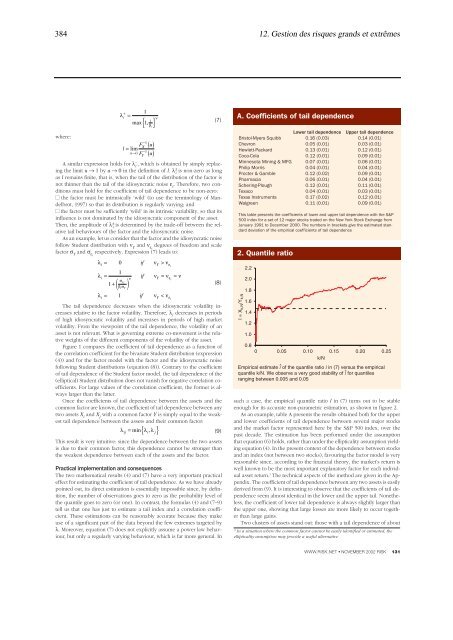

2. Quantile r<strong>at</strong>io<br />

I = X k,N /Y k,N<br />

2.2<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0 0.05 0.10 0.15 0.20 0.25<br />

k/N<br />

^<br />

Empirical estim<strong>at</strong>e l of the quantile r<strong>at</strong>io l in (7) versus the empirical<br />

^<br />

quantile k/N. We observe a very good stability of l for quantiles<br />

ranging b<strong>et</strong>ween 0.005 and 0.05<br />

such a case, the empirical quantile r<strong>at</strong>io l in (7) turns out to be stable<br />

enough for its accur<strong>at</strong>e non-param<strong>et</strong>ric estim<strong>at</strong>ion, as shown in figure 2.<br />

As an example, table A presents the results obtained both for the upper<br />

and lower coefficients of tail <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween several major stocks<br />

and the mark<strong>et</strong> factor represented here by the S&P 500 in<strong>de</strong>x, over the<br />

past <strong>de</strong>ca<strong>de</strong>. The estim<strong>at</strong>ion has been performed un<strong>de</strong>r the assumption<br />

th<strong>at</strong> equ<strong>at</strong>ion (6) holds, r<strong>at</strong>her than un<strong>de</strong>r the ellipticality assumption yielding<br />

equ<strong>at</strong>ion (4). In the present context of the <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween stocks<br />

and an in<strong>de</strong>x (not b<strong>et</strong>ween two stocks), favouring the factor mo<strong>de</strong>l is very<br />

reasonable since, according to the financial theory, the mark<strong>et</strong>’s r<strong>et</strong>urn is<br />

well known to be the most important explan<strong>at</strong>ory factor for each individual<br />

ass<strong>et</strong> r<strong>et</strong>urn. 3 The technical aspects of the m<strong>et</strong>hod are given in the Appendix.<br />

The coefficient of tail <strong>de</strong>pen<strong>de</strong>nce b<strong>et</strong>ween any two ass<strong>et</strong>s is easily<br />

<strong>de</strong>rived from (9). It is interesting to observe th<strong>at</strong> the coefficients of tail <strong>de</strong>pen<strong>de</strong>nce<br />

seem almost i<strong>de</strong>ntical in the lower and the upper tail. Non<strong>et</strong>heless,<br />

the coefficient of lower tail <strong>de</strong>pen<strong>de</strong>nce is always slightly larger than<br />

the upper one, showing th<strong>at</strong> large losses are more likely to occur tog<strong>et</strong>her<br />

than large gains.<br />

Two clusters of ass<strong>et</strong>s stand out: those with a tail <strong>de</strong>pen<strong>de</strong>nce of about<br />

3 In a situ<strong>at</strong>ion where the common factor cannot be easily i<strong>de</strong>ntified or estim<strong>at</strong>ed, the<br />

ellipticality assumption may provi<strong>de</strong> a useful altern<strong>at</strong>ive<br />

WWW.RISK.NET ● NOVEMBER 2002 RISK 131