statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

statistique, théorie et gestion de portefeuille - Docs at ISFA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88 3. Distributions exponentielles étirées contre distributions régulièrement variables<br />

Our purpose here has been to revisit a generally accepted fact th<strong>at</strong> the tails of the distributions of r<strong>et</strong>urns<br />

present a power-like behavior. Although there are some disagreements concerning the exact value of the<br />

power indices (the majority of previous workers accepts in<strong>de</strong>x values b<strong>et</strong>ween 3 and 3.5, <strong>de</strong>pending on the<br />

particular ass<strong>et</strong> and the investig<strong>at</strong>ed time interval), the power-like character of the tails of distributions of<br />

r<strong>et</strong>urns is not subjected to doubts. Often, the conviction of the existence of a power-like tail is based on<br />

the Gne<strong>de</strong>nko theorem st<strong>at</strong>ing the existence of only three possible types of limit distributions of normalized<br />

maxima (a finite maximum value, an exponential tail, and a power-like tail) tog<strong>et</strong>her with the exclusion of<br />

the first two types by experimental evi<strong>de</strong>nce. The power-like character of the log-r<strong>et</strong>urn tail ¯F(x) follows<br />

then simply from the power-like distribution of maxima. However, in this chain of arguments, the conditions<br />

nee<strong>de</strong>d for the fulfillment of the corresponding m<strong>at</strong>hem<strong>at</strong>ical theorems are often omitted and not discussed<br />

properly. In addition, wi<strong>de</strong>ly used arguments in favor of power law tails invoke the self-similarity of the d<strong>at</strong>a<br />

but are often assumptions r<strong>at</strong>her than experimental evi<strong>de</strong>nce or consequences of economic and financial<br />

laws.<br />

Here, we have shown th<strong>at</strong> standard st<strong>at</strong>istical estim<strong>at</strong>ors of heavy tails are much less efficient th<strong>at</strong> often<br />

assumed and cannot in general clearly distinguish b<strong>et</strong>ween a power law tail and a Str<strong>et</strong>ched Exponential<br />

tail even in the absence of long-range <strong>de</strong>pen<strong>de</strong>nce in the vol<strong>at</strong>ility. In fact, this can be r<strong>at</strong>ionalized by our<br />

discovery th<strong>at</strong>, in a certain limit where the exponent c of the str<strong>et</strong>ched exponential pdf goes to zero (tog<strong>et</strong>her<br />

with condition (26) as seen in the <strong>de</strong>riv<strong>at</strong>ion (27)), the str<strong>et</strong>ched exponential pdf tends to the Par<strong>et</strong>o distribution.<br />

Thus, the Par<strong>et</strong>o (or power law) distribution can be approxim<strong>at</strong>ed with any <strong>de</strong>sired accuracy on an<br />

arbitrary interval by a suitable adjustment of the pair (c,d) of the param<strong>et</strong>ers of the str<strong>et</strong>ched exponential<br />

pdf. We have then turned to param<strong>et</strong>ric tests which indic<strong>at</strong>e th<strong>at</strong> the class of Str<strong>et</strong>ched Exponential distribution<br />

provi<strong>de</strong>s a significantly b<strong>et</strong>ter fit to empirical r<strong>et</strong>urns than the Par<strong>et</strong>o, the exponential or the incompl<strong>et</strong>e<br />

Gamma distributions. All our tests are consistent with the conclusion th<strong>at</strong> the Str<strong>et</strong>ched Exponential mo<strong>de</strong>l<br />

provi<strong>de</strong>s the best effective apparent and parsimonious mo<strong>de</strong>l to account for the empirical d<strong>at</strong>a.<br />

However, this does not mean th<strong>at</strong> the str<strong>et</strong>ched exponential (SE) mo<strong>de</strong>l is the correct <strong>de</strong>scription of the tails<br />

of empirical distributions of r<strong>et</strong>urns. Again, as already mentioned, the strength of the SE mo<strong>de</strong>l comes<br />

from the fact th<strong>at</strong> it encompasses the Par<strong>et</strong>o mo<strong>de</strong>l in the tail and offers a b<strong>et</strong>ter <strong>de</strong>scription in the bulk of<br />

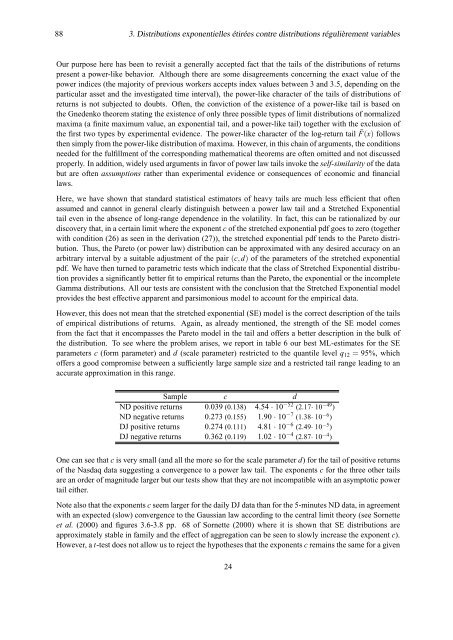

the distribution. To see where the problem arises, we report in table 6 our best ML-estim<strong>at</strong>es for the SE<br />

param<strong>et</strong>ers c (form param<strong>et</strong>er) and d (scale param<strong>et</strong>er) restricted to the quantile level q12 = 95%, which<br />

offers a good compromise b<strong>et</strong>ween a sufficiently large sample size and a restricted tail range leading to an<br />

accur<strong>at</strong>e approxim<strong>at</strong>ion in this range.<br />

Sample c d<br />

ND positive r<strong>et</strong>urns 0.039 (0.138) 4.54 · 10 −52 (2.17· 10 −49 )<br />

ND neg<strong>at</strong>ive r<strong>et</strong>urns 0.273 (0.155) 1.90 · 10 −7 (1.38· 10 −6 )<br />

DJ positive r<strong>et</strong>urns 0.274 (0.111) 4.81 · 10 −6 (2.49· 10 −5 )<br />

DJ neg<strong>at</strong>ive r<strong>et</strong>urns 0.362 (0.119) 1.02 · 10 −4 (2.87· 10 −4 )<br />

One can see th<strong>at</strong> c is very small (and all the more so for the scale param<strong>et</strong>er d) for the tail of positive r<strong>et</strong>urns<br />

of the Nasdaq d<strong>at</strong>a suggesting a convergence to a power law tail. The exponents c for the three other tails<br />

are an or<strong>de</strong>r of magnitu<strong>de</strong> larger but our tests show th<strong>at</strong> they are not incomp<strong>at</strong>ible with an asymptotic power<br />

tail either.<br />

Note also th<strong>at</strong> the exponents c seem larger for the daily DJ d<strong>at</strong>a than for the 5-minutes ND d<strong>at</strong>a, in agreement<br />

with an expected (slow) convergence to the Gaussian law according to the central limit theory (see Sorn<strong>et</strong>te<br />

<strong>et</strong> al. (2000) and figures 3.6-3.8 pp. 68 of Sorn<strong>et</strong>te (2000) where it is shown th<strong>at</strong> SE distributions are<br />

approxim<strong>at</strong>ely stable in family and the effect of aggreg<strong>at</strong>ion can be seen to slowly increase the exponent c).<br />

However, a t-test does not allow us to reject the hypotheses th<strong>at</strong> the exponents c remains the same for a given<br />

24