AFSCME Contract - MMB Home - Minnesota Management & Budget

AFSCME Contract - MMB Home - Minnesota Management & Budget

AFSCME Contract - MMB Home - Minnesota Management & Budget

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

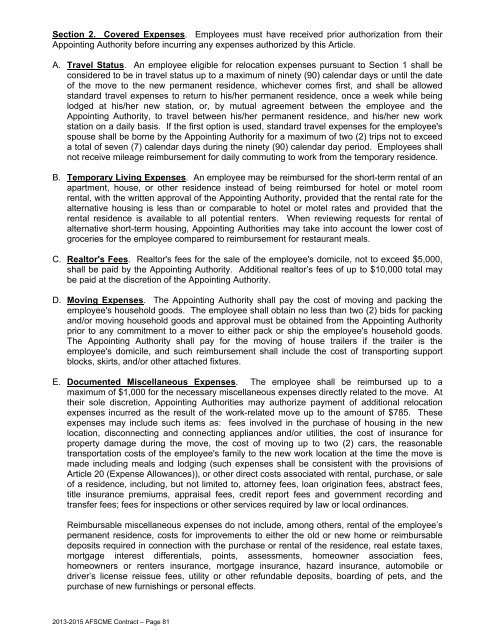

Section 2. Covered Expenses. Employees must have received prior authorization from their<br />

Appointing Authority before incurring any expenses authorized by this Article.<br />

A. Travel Status. An employee eligible for relocation expenses pursuant to Section 1 shall be<br />

considered to be in travel status up to a maximum of ninety (90) calendar days or until the date<br />

of the move to the new permanent residence, whichever comes first, and shall be allowed<br />

standard travel expenses to return to his/her permanent residence, once a week while being<br />

lodged at his/her new station, or, by mutual agreement between the employee and the<br />

Appointing Authority, to travel between his/her permanent residence, and his/her new work<br />

station on a daily basis. If the first option is used, standard travel expenses for the employee's<br />

spouse shall be borne by the Appointing Authority for a maximum of two (2) trips not to exceed<br />

a total of seven (7) calendar days during the ninety (90) calendar day period. Employees shall<br />

not receive mileage reimbursement for daily commuting to work from the temporary residence.<br />

B. Temporary Living Expenses. An employee may be reimbursed for the short-term rental of an<br />

apartment, house, or other residence instead of being reimbursed for hotel or motel room<br />

rental, with the written approval of the Appointing Authority, provided that the rental rate for the<br />

alternative housing is less than or comparable to hotel or motel rates and provided that the<br />

rental residence is available to all potential renters. When reviewing requests for rental of<br />

alternative short-term housing, Appointing Authorities may take into account the lower cost of<br />

groceries for the employee compared to reimbursement for restaurant meals.<br />

C. Realtor's Fees. Realtor's fees for the sale of the employee's domicile, not to exceed $5,000,<br />

shall be paid by the Appointing Authority. Additional realtor’s fees of up to $10,000 total may<br />

be paid at the discretion of the Appointing Authority.<br />

D. Moving Expenses. The Appointing Authority shall pay the cost of moving and packing the<br />

employee's household goods. The employee shall obtain no less than two (2) bids for packing<br />

and/or moving household goods and approval must be obtained from the Appointing Authority<br />

prior to any commitment to a mover to either pack or ship the employee's household goods.<br />

The Appointing Authority shall pay for the moving of house trailers if the trailer is the<br />

employee's domicile, and such reimbursement shall include the cost of transporting support<br />

blocks, skirts, and/or other attached fixtures.<br />

E. Documented Miscellaneous Expenses. The employee shall be reimbursed up to a<br />

maximum of $1,000 for the necessary miscellaneous expenses directly related to the move. At<br />

their sole discretion, Appointing Authorities may authorize payment of additional relocation<br />

expenses incurred as the result of the work-related move up to the amount of $785. These<br />

expenses may include such items as: fees involved in the purchase of housing in the new<br />

location, disconnecting and connecting appliances and/or utilities, the cost of insurance for<br />

property damage during the move, the cost of moving up to two (2) cars, the reasonable<br />

transportation costs of the employee's family to the new work location at the time the move is<br />

made including meals and lodging (such expenses shall be consistent with the provisions of<br />

Article 20 (Expense Allowances)), or other direct costs associated with rental, purchase, or sale<br />

of a residence, including, but not limited to, attorney fees, loan origination fees, abstract fees,<br />

title insurance premiums, appraisal fees, credit report fees and government recording and<br />

transfer fees; fees for inspections or other services required by law or local ordinances.<br />

Reimbursable miscellaneous expenses do not include, among others, rental of the employee’s<br />

permanent residence, costs for improvements to either the old or new home or reimbursable<br />

deposits required in connection with the purchase or rental of the residence, real estate taxes,<br />

mortgage interest differentials, points, assessments, homeowner association fees,<br />

homeowners or renters insurance, mortgage insurance, hazard insurance, automobile or<br />

driver’s license reissue fees, utility or other refundable deposits, boarding of pets, and the<br />

purchase of new furnishings or personal effects.<br />

2013-2015 <strong>AFSCME</strong> <strong>Contract</strong> – Page 81