- Page 1 and 2:

PimaCommunityCollege 2011-2012 Cata

- Page 3 and 4:

Message from the Chancellor Welcome

- Page 5 and 6:

Academic Calendar Fall Semester 201

- Page 7 and 8:

How This Catalog Can Help Students

- Page 9 and 10:

Pima County Community College Distr

- Page 11 and 12:

Community Campus As Tucson, Pima Co

- Page 13 and 14:

Desert Vista Campus In 1986, Pima C

- Page 15 and 16:

Downtown Campus Since its beginning

- Page 17 and 18:

East Campus In 1980, Pima Community

- Page 19 and 20:

The Northwest Campus brings a full

- Page 21 and 22:

West Campus The West Campus enrolls

- Page 23 and 24:

Admissions, Registration and Record

- Page 25 and 26:

eing homeschooled may enroll for mo

- Page 27 and 28:

Assignment of Student Identificatio

- Page 29 and 30:

iB credit tables. Contact a Pima Co

- Page 31 and 32:

International Baccalaureate (IB) Ta

- Page 33 and 34:

there are three ways to register fo

- Page 35 and 36:

a. notified via college email that

- Page 37 and 38:

Tuition and Fees the following info

- Page 39 and 40:

If a class (or classes) must be can

- Page 41 and 42:

Financial assistance Pima Community

- Page 43 and 44:

PCC Foundation Scholarships every y

- Page 45 and 46:

student services and student Life P

- Page 47 and 48:

up to 60 days from the start of the

- Page 49 and 50:

Transcripts Unofficial transcripts

- Page 51 and 52:

Educational Options Pima Community

- Page 53 and 54:

Earning a Degree or Certificate Pim

- Page 55 and 56:

c. a grade of "P" cannot be used fo

- Page 57 and 58:

Analysis and Critical Thinking Requ

- Page 59 and 60:

AGEC-S Categorical Requirements Min

- Page 61 and 62:

HUM 252 Western Humanities ii 3 i,g

- Page 63 and 64:

AGEC Categorical Requirement: Mathe

- Page 65 and 66:

Ztr SBig agEC Social and Behavioral

- Page 67 and 68:

c) Second Language: (continued) SPa

- Page 69 and 70:

Educational Programs, Degrees and C

- Page 71 and 72:

Occupational Programs EDuCational P

- Page 73 and 74:

Occupational Programs - continued S

- Page 75 and 76:

Occupational Programs - continued H

- Page 77 and 78:

Occupational Programs - continued T

- Page 79 and 80:

Accounting learn the skills and kno

- Page 81 and 82:

mgt 110 Human relations in Business

- Page 83 and 84:

Required Support Courses Pos 201 am

- Page 85 and 86:

American Indian Studies American In

- Page 87 and 88:

Core Concentrations: - A grade of C

- Page 89 and 90:

Geospatial Information Studies and

- Page 91 and 92:

Arts gain knowledge and experience

- Page 93 and 94:

Fiber Art art 180* Weaving i: four-

- Page 95 and 96:

Required Support Courses- A grade o

- Page 97 and 98:

Core Options: - A grade of C or bet

- Page 99 and 100:

Required Core Courses - A grade of

- Page 101 and 102:

Arizona General Education Curriculu

- Page 103 and 104:

Course Number Course Title Credit H

- Page 105 and 106:

Automotive Technology Begin a caree

- Page 107 and 108:

Aviation Technology gain skills and

- Page 109 and 110:

Course Number Course Title Credit H

- Page 111 and 112:

Biology study the science of living

- Page 113 and 114:

Building and Construction Technolog

- Page 115 and 116:

Facilities Maintenance (Concentrati

- Page 117 and 118:

Home Maintenance and Repair: Limite

- Page 119 and 120:

Solar Installer — Certificate for

- Page 121 and 122:

Core Concentrations: - A grade of C

- Page 123 and 124:

Plumbing (Concentration Code: BCtP)

- Page 125 and 126:

Advanced Business — Certificate f

- Page 127 and 128:

Wrt 101* Writing i (F-Sp-Su) sun# E

- Page 129 and 130:

Business administration Electives.

- Page 131 and 132:

General Education Requirements - A

- Page 133 and 134:

Bus 205* statistical methods in Eco

- Page 135 and 136:

Logistics and Supply Chain Manageme

- Page 137 and 138:

Logistics and Supply Chain Manageme

- Page 139 and 140:

Chemistry study the composition, pr

- Page 141 and 142:

Clinical Research Coordinator — A

- Page 143 and 144:

Computer Aided Drafting Prepare for

- Page 145 and 146:

Computer Aided Drafting — Associa

- Page 147 and 148:

Computer Information Systems Prepar

- Page 149 and 150:

General Education Requirements - A

- Page 151 and 152:

Systems Administration/Networking

- Page 153 and 154:

Computer Software Applications Comp

- Page 155 and 156:

Culinary Arts set your culinary car

- Page 157 and 158:

Dental Studies Complete programs to

- Page 159 and 160:

Program Prerequisites student must

- Page 161 and 162:

Course Number Course Title Credit H

- Page 163 and 164:

Partial Dentures Technologist — C

- Page 165 and 166:

Digital Arts — Associate of Appli

- Page 167 and 168:

Digital Arts — Post Degree Certif

- Page 169 and 170:

Animation (Concentration Code: mDfa

- Page 171 and 172:

Humanities and social science requi

- Page 173 and 174:

Digital Animation and Production (C

- Page 175 and 176:

Education from infancy through high

- Page 177 and 178:

Early Childhood Studies — Associa

- Page 179 and 180:

Earth/Space Science or Physical Sci

- Page 181 and 182:

K-12 Education Prepare to become an

- Page 183 and 184:

second language . . . . . . . . . .

- Page 185 and 186:

Education Endorsement — Middle Sc

- Page 187 and 188:

Required Core Options - A grade of

- Page 189 and 190:

Emergency Medical Technology Basic

- Page 191 and 192:

Engineering Engineering—Associate

- Page 193 and 194:

Chemical Engineering Concentration

- Page 195 and 196:

Systems Engineering Concentration (

- Page 197 and 198:

Fire Science — Associate of Appli

- Page 199 and 200:

Fitness and Sport Sciences learn to

- Page 201 and 202:

Forensics and Crime Scene Technolog

- Page 203 and 204:

General Studies General Studies —

- Page 205 and 206:

Health Information Technology Healt

- Page 207 and 208:

Medical Billing and Coding Specialt

- Page 209 and 210:

Honors Honors Program — Certifica

- Page 211 and 212:

Hotel and Restaurant Management —

- Page 213 and 214:

Interior Design understand the basi

- Page 215 and 216:

iDE 222* Visual Communications ii (

- Page 217 and 218:

Course Number Course Title Credit H

- Page 219 and 220:

lEa 106* lEa Community and Police r

- Page 221 and 222:

Literature Explore the world’s li

- Page 223 and 224:

Course Number Course Title Credit H

- Page 225 and 226:

Machine Tool Technology — Certifi

- Page 227 and 228:

Course Number Course Title Credit H

- Page 229 and 230:

Computer Numerical Control (CNC) Pr

- Page 231 and 232:

Medical Assistant Medical Assistant

- Page 233 and 234:

Program Prerequisites students must

- Page 235 and 236:

Nursing gain skills in patient care

- Page 237 and 238:

Practical Nursing — Certificate f

- Page 239 and 240:

Office and Administrative Professio

- Page 241 and 242:

Health Information Technology — C

- Page 243 and 244: Paralegal Prepare for entry-level p

- Page 245 and 246: Paralegal - Post-Degree Certificate

- Page 247 and 248: PHt 190lB* Pharmacy technician inte

- Page 249 and 250: Phlebotomy Phlebotomy — Certifica

- Page 251 and 252: Political Science Associate of Arts

- Page 253 and 254: Pre-Dentistry students interested i

- Page 255 and 256: Pre-Medicine students interested in

- Page 257 and 258: Pre-Veterinary students interested

- Page 259 and 260: Public Safety and Emergency Service

- Page 261 and 262: General Education Requirements - A

- Page 263 and 264: Bio 160in with a grade of C or bett

- Page 265 and 266: Social Services — Associate of Ar

- Page 267 and 268: ssE 285* foundations of social Work

- Page 269 and 270: Social Services Substance Abuse Cer

- Page 271 and 272: Sociology Sociology — Associate o

- Page 273 and 274: Spanish a student planning to obtai

- Page 275 and 276: Technical Writing and Communication

- Page 277 and 278: Technology — Associate of Applied

- Page 279 and 280: Therapeutic Massage Therapeutic Mas

- Page 281 and 282: Therapeutic Massage — Associate o

- Page 283 and 284: Translation and Interpretation Tran

- Page 285 and 286: Course Number Course Title Credit H

- Page 287 and 288: tDt 108* Proficiency Development (*

- Page 289 and 290: Program Prerequisites reading asses

- Page 291 and 292: Writing learn to communicate effect

- Page 293: Course Numbering System and Prerequ

- Page 297 and 298: ACC 260 Principles of Fraud Examina

- Page 299 and 300: AJS 280 Terrorism in the 21st Centu

- Page 301 and 302: ANS 276 Equine Conformation and Per

- Page 303 and 304: ANT 180 Artifact Identification: Tu

- Page 305 and 306: ANT 275 Archaeological Excavation I

- Page 307 and 308: Archaeology For courses numbered 09

- Page 309 and 310: ARC 276 Archaeological Surveying I

- Page 311 and 312: ART 120 Sculptural Design 3 cr. hrs

- Page 313 and 314: ART 175 Ferrous Metalwork: Blacksmi

- Page 315 and 316: ART 232 Digital Photography II 4 cr

- Page 317 and 318: ART 288 Portfolio Preparation 3 cr.

- Page 319 and 320: APD 067 Watercolor III 2 cr. hrs. 4

- Page 321 and 322: AST 105 Life in the Universe 3 cr.

- Page 323 and 324: AUT 142 Automotive Heating, Ventila

- Page 325 and 326: AVM 203 Structural Repair V 4 cr. h

- Page 327 and 328: AVIATION TECHNOLOGY AVM 226 Engine

- Page 329 and 330: AVIONICS TECHNICIAN TRAINING ATT 10

- Page 331 and 332: Biology For courses numbered 098, 1

- Page 333 and 334: BIO 183IN Marine Biology 4 cr. hrs.

- Page 335 and 336: Building and Construction Technolog

- Page 337 and 338: BUILDING/CONSTRUCTION TECHNOLOGY BC

- Page 339 and 340: BCT 190 Fieldwork for Construction

- Page 341 and 342: BUILDING/CONSTRUCTION TECHNOLOGY BC

- Page 343 and 344: BUS 299 Introduction to Co-op: Busi

- Page 345 and 346:

CHM 128 Forensic Chemistry 3 cr. hr

- Page 347 and 348:

CHM 152LB General Chemistry II Lab

- Page 349 and 350:

CHILD DEVELOPMENT ASSOCIATE CDA 121

- Page 351 and 352:

CDA 276 Preparing a NAEYC Classroom

- Page 353 and 354:

CRC 296 Clinical Research Independe

- Page 355 and 356:

CAD 199 Introduction to Co-op: Comp

- Page 357 and 358:

CAD 282 Advanced Parametric Modelin

- Page 359 and 360:

COMPUTER INFORMATION SYSTEMS CIS 14

- Page 361 and 362:

COMPUTER INFORMATION SYSTEMS CIS 22

- Page 363 and 364:

CIS 278 C++ and Object-Oriented Pro

- Page 365 and 366:

COMPUTER SOFTWARE APPLICATIONS CSA

- Page 367 and 368:

COMPUTER SOFTWARE APPLICATIONS CSA

- Page 369 and 370:

CSA 266 Dreamweaver for Microsoft W

- Page 371 and 372:

CUL 110 Food Service Nutrition 2 cr

- Page 373 and 374:

CUL 260 Bakery and Pastry Productio

- Page 375 and 376:

DNC 216 Teaching Methods for Dance

- Page 377 and 378:

DAE 163LC Oral Radiography Clinical

- Page 379 and 380:

DHE 107 Oral Embryology and Histolo

- Page 381 and 382:

DHE 160LC Clinical Skills Enhanceme

- Page 383 and 384:

DHE 260LC Clinical Skills Enhanceme

- Page 385 and 386:

DLT 201 Dental Laboratory I 2 cr. h

- Page 387 and 388:

DAR 115 Digital Video Editing 4 cr.

- Page 389 and 390:

DAR 177 Location Sound for Film and

- Page 391 and 392:

DAR 225 Advanced Video Production 4

- Page 393 and 394:

DAR 255 Television Commercial Desig

- Page 395 and 396:

DAR 277 Film/Video Production Finan

- Page 397 and 398:

DCP 104 Direct Care Professional: D

- Page 399 and 400:

ECE 117 Child Growth and Developmen

- Page 401 and 402:

ECE 200 Foundations of Early Childh

- Page 403 and 404:

Economics For courses numbered 098,

- Page 405 and 406:

EDU 201 Diversity in Education 3 cr

- Page 407 and 408:

EDU 254 Literacy Development in the

- Page 409 and 410:

EDU 275 Classroom Management 3 cr.

- Page 411 and 412:

EDU 290 Internship 8 cr. hrs. 40 pe

- Page 413 and 414:

EDUCATION - SPECIAL EDUCATION EDS 2

- Page 415 and 416:

EDS 290B Internship II 2 cr. hrs. 1

- Page 417 and 418:

EMERGENCY MEDICAL TECHNOLOGY EMT 10

- Page 419 and 420:

EMERGENCY MEDICAL TECHNOLOGY EMT 14

- Page 421 and 422:

EMERGENCY MEDICAL TECHNOLOGY EMT 22

- Page 423 and 424:

EMT 248LC ALS Advanced Practicum: V

- Page 425 and 426:

ENG 110IN Solid State Chemistry 4 c

- Page 427 and 428:

ENGLISH AS A SECOND LANGUAGE ESL 05

- Page 429 and 430:

ENGLISH AS A SECOND LANGUAGE ESL 08

- Page 431 and 432:

ENV 251 OSHA 40: Hazardous Material

- Page 433 and 434:

FASHION DESIGN AND CLOTHING FDC 135

- Page 435 and 436:

Finance For courses numbered 098, 1

- Page 437 and 438:

FSC 121 Trench Rescue for First Res

- Page 439 and 440:

FSC 168 Special Hazard Tactical Pro

- Page 441 and 442:

FSC 272 Leadership III for Fire Ser

- Page 443 and 444:

FITNESS AND SPORT SCIENCES FSS 243A

- Page 445 and 446:

FSS 281 Personal Trainer Exam Prepa

- Page 447 and 448:

FITNESS AND WELLNESS FAW 106F4 Indi

- Page 449 and 450:

FITNESS AND WELLNESS FAW 123F1 Sals

- Page 451 and 452:

FAW 131 Indoor Cycling 1 cr. hrs. 2

- Page 453 and 454:

FAW 155F1 Tennis I 1 cr. hrs. 2 per

- Page 455 and 456:

Food Science and Nutrition For cour

- Page 457 and 458:

GAM 214 Digital Arts Business and P

- Page 459 and 460:

Geology For courses numbered 098, 1

- Page 461 and 462:

Geospatial Information Studies For

- Page 463 and 464:

Health Care For courses numbered 09

- Page 465 and 466:

HEALTH INFORMATION TECHNOLOGY HIT 1

- Page 467 and 468:

HIS 113 Chinese Civilization 3 cr.

- Page 469 and 470:

HIS 245 Abraham Lincoln and the Ame

- Page 471 and 472:

Hotel and Restaurant Management For

- Page 473 and 474:

Human Resources Management For cour

- Page 475 and 476:

IDE 152 Color and Lighting Theory 3

- Page 477 and 478:

ITP 203 Linguistics of American Sig

- Page 479 and 480:

Italian For courses numbered 098, 1

- Page 481 and 482:

JRN 196 Journalism Independent Proj

- Page 483 and 484:

Latin For courses numbered 098, 198

- Page 485 and 486:

LAW ENFORCEMENT ACADEMY LEA 202 LEA

- Page 487 and 488:

Literature For courses numbered 098

- Page 489 and 490:

LOGISTICS AND SUPPLY CHAIN MANAGEME

- Page 491 and 492:

MAC 155 Computer Numerical Control

- Page 493 and 494:

MGT 276 Human Resources 3 cr. hrs.

- Page 495 and 496:

MAT 086 Prealgebra 3 cr. hrs. 3 per

- Page 497 and 498:

MAT 122A Intermediate Algebra: Modu

- Page 499 and 500:

MAT 172 Finite Mathematics 3 cr. hr

- Page 501 and 502:

MDA 122 Medical Assistant Clinical

- Page 503 and 504:

MLT 251 Clinical Microbiology 5 cr.

- Page 505 and 506:

MUS 116 Pima Community College Orch

- Page 507 and 508:

MUS 149 Opera Workshop 2 cr. hrs. 3

- Page 509 and 510:

MUS 296 Independent Studies in Musi

- Page 511 and 512:

MUSIC STUDIO INSTRUCTION MUP 171 St

- Page 513 and 514:

MUSIC STUDIO INSTRUCTION MUP 271 St

- Page 515 and 516:

NRS 180LC Transition to Practical N

- Page 517 and 518:

NRA 102 Patient Care Technician 1 c

- Page 519 and 520:

OFFICE AND ADMINISTRATIVE PROFESSIO

- Page 521 and 522:

PAR 104 Paralegal Ethics 3 cr. hrs.

- Page 523 and 524:

PAR 211 Legal Writing 3 cr. hrs. 3

- Page 525 and 526:

PHT 181 Interprofessional Relations

- Page 527 and 528:

Physics For courses numbered 098, 1

- Page 529 and 530:

PHY 221LB Introduction to Waves and

- Page 531 and 532:

Portuguese For courses numbered 098

- Page 533 and 534:

PSY 210 Introduction to Biopsycholo

- Page 535 and 536:

Public Administration For courses n

- Page 537 and 538:

RAD 175LB Medical Imaging Technolog

- Page 539 and 540:

Reading For courses numbered 098, 1

- Page 541 and 542:

RLS 205 Real Estate Finance 3 cr. h

- Page 543 and 544:

MLA 101 Foundation of the Air Force

- Page 545 and 546:

NSP 200 Naval Laboratory II 2 cr. h

- Page 547 and 548:

RTH 241 Critical Care Therapeutics

- Page 549 and 550:

RUS 202 Intermediate Russian II SUN

- Page 551 and 552:

SLG 101 American Sign Language I 4

- Page 553 and 554:

SSE 160 Introduction to Youth Servi

- Page 555 and 556:

SSE 292 Social Services Field Exper

- Page 557 and 558:

SOC 289 Topics in Community Involve

- Page 559 and 560:

SPA 102HC Elementary Spanish II for

- Page 561 and 562:

SPA 253 Intermediate Spanish for Sp

- Page 563 and 564:

STU 102D Transition from College to

- Page 565 and 566:

STU 220C Employment Success Strateg

- Page 567 and 568:

Surface Mining Technology For cours

- Page 569 and 570:

SURFACE MINING TECHNOLOGY SMT 190 S

- Page 571 and 572:

TEC 113 Problem Solving for Electro

- Page 573 and 574:

TEC 132LB Computer Systems Servicin

- Page 575 and 576:

TEC 288 Optical Testing 4 cr. hrs.

- Page 577 and 578:

THE 220 Stage Lighting 3 cr. hrs. 3

- Page 579 and 580:

TMA 203IN Therapeutic Massage Pract

- Page 581 and 582:

Translation and Interpretation Stud

- Page 583 and 584:

TVL 211 Tour Direction and Tour Gro

- Page 585 and 586:

TDT 118 Basic Vehicle Operations an

- Page 587 and 588:

VSC 295 Independent Research in Vet

- Page 589 and 590:

VET 200 Anesthetic and Surgical Nur

- Page 591 and 592:

WLD 262 Gas Tungsten Arc Welding 4

- Page 593 and 594:

WST 280 Feminist Research Methods 3

- Page 595 and 596:

WRT 100B Writing Fundamentals: Modu

- Page 597 and 598:

WRT 106A Writing Fundamentals for N

- Page 599 and 600:

WRT 140 Writing and Editing Technic

- Page 601 and 602:

WRT 254B Advanced Professional Comm

- Page 603 and 604:

Workforce Response Programs The pro

- Page 605 and 606:

Business and Industry The Business

- Page 607 and 608:

Basic Business and Industry Technol

- Page 609 and 610:

Environmental Technology Environmen

- Page 611 and 612:

General Education Requirements - A

- Page 613 and 614:

Leadership Leadership Development C

- Page 615 and 616:

Water and Wastewater These programs

- Page 617 and 618:

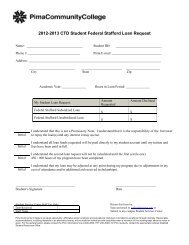

Center for Training (CTD) and Devel

- Page 619 and 620:

Database Applications - Certificate

- Page 621 and 622:

BO 814 Diagnostic Coding . . . . .

- Page 623 and 624:

Optional Modules: BO 920 microsoft

- Page 625 and 626:

Pantry Cook - Certificate for Direc

- Page 627 and 628:

Surgical Technologist - Certificate

- Page 629 and 630:

Selected Policies, Governance and F

- Page 631 and 632:

the complaint as soon as possible.

- Page 633 and 634:

Northwest Campus Dr. Alex Kajstura,

- Page 635 and 636:

Dr. Ann Christensen, Biology (1992)

- Page 637 and 638:

Dr. Manuel M. Hinojosa, Writing (20

- Page 639 and 640:

Dr. Jeffrey P. Neubauer, Psychology

- Page 641 and 642:

C. Ann Tousley, Writing (1992) B.S.

- Page 643 and 644:

Associate of Arts (AA) degree degre

- Page 645 and 646:

E early Childhood education and Chi

- Page 647 and 648:

Marketing Courses (MKT) 492 Mathema

- Page 649:

Transfer of Credits For Military Se