COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

230 Commerzbank Interim Report as of June 30, 2009<br />

Commerzbank share price improves slightly<br />

in the second quarter<br />

In the second quarter, the environment for banking stocks<br />

was impacted by various developments. Although the German<br />

and European economies are expected to have contracted<br />

further in the second quarter, they are likely to have<br />

stabilized recently. Many economic sentiment indicators<br />

are once again pointing upward. The general situation on<br />

the financial markets has also relaxed somewhat over the<br />

past three months, and there is less uncertainty than there<br />

was in the first quarter of 2009. Overall, these improved<br />

conditions for equities had a positive effect on the DAX<br />

and an even more positive impact on financial stocks in the<br />

eurozone, with Commerzbank being no exception. As at<br />

30 June 2009, Commerzbank shares were quoted at €4.43,<br />

some 10 % above their value at the end of the first quarter<br />

(€4.02).<br />

At the beginning of April, Commerzbank shares resumed<br />

their upward trend that began at the end of the first<br />

quarter, posting gains that were largely in line with those of<br />

the Dow Jones EURO STOXX Banks index. Positive corporate<br />

news flow and strong first-quarter figures from various<br />

European banks were responsible for the recovery. However,<br />

profit-taking put an end to the upward momentum on<br />

May 11, after Commerzbank shares had reached their peak<br />

in the second quarter. The shares recovered slightly following<br />

a brief correction. After subsequently moving sideways<br />

for some time, there was another one-week correction<br />

phase in mid-June before Commerzbank shares stabilized<br />

Highlights of the Commerzbank share<br />

1.1.-30.6.2009 1.1.-30.6.2008<br />

Shares outstanding as of 30.6.<br />

in million units 1,181.4 657.2<br />

Xetra intraday prices in €<br />

High 6.93 26.53<br />

Low 2.22 16.40<br />

as of 30.6. 4.43 18.84<br />

Daily turnover 1 in million units<br />

High 48.6 24.8<br />

Low 2.7 2.2<br />

Average 13.8 8.9<br />

Earnings per share (EPS) in € –1.78 1.67<br />

Book value per share 2 in €<br />

as of 30.6. 10.41 21.13<br />

Market value / Book value<br />

as of 30.6. 0.43 0.89<br />

1 Total German Stock Exchanges;<br />

2 excl. silent participations, cash flow hedges and minority interests.<br />

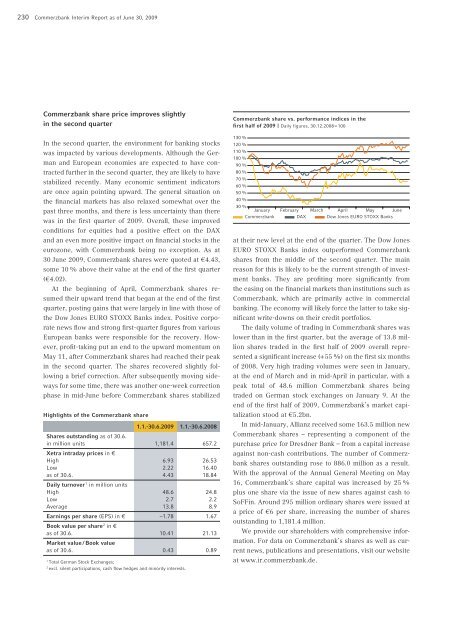

Commerzbank share vs. performance indices in the<br />

first half of 2009 | Daily figures, 30.12.2008 = 100<br />

130%<br />

120%<br />

110%<br />

100%<br />

90 %<br />

80 %<br />

70 %<br />

60 %<br />

50 %<br />

40 %<br />

30 %<br />

January February March April May June<br />

Commerzbank DAX Dow Jones EURO STOXX Banks<br />

at their new level at the end of the quarter. The Dow Jones<br />

EURO STOXX Banks index outperformed Commerzbank<br />

shares from the middle of the second quarter. The main<br />

reason for this is likely to be the current strength of investment<br />

banks. They are profiting more significantly from<br />

the easing on the financial markets than institutions such as<br />

Commerzbank, which are primarily active in commercial<br />

banking. The economy will likely force the latter to take significant<br />

write-downs on their credit portfolios.<br />

The daily volume of trading in Commerzbank shares was<br />

lower than in the first quarter, but the average of 13.8 million<br />

shares traded in the first half of 2009 overall represented<br />

a significant increase (+55 %) on the first six months<br />

of 2008. Very high trading volumes were seen in January,<br />

at the end of March and in mid-April in particular, with a<br />

peak total of 48.6 million Commerzbank shares being<br />

traded on German stock exchanges on January 9. At the<br />

end of the first half of 2009, Commerzbank’s market capitalization<br />

stood at €5.2bn.<br />

In mid-January, Allianz received some 163.5 million new<br />

Commerzbank shares – representing a component of the<br />

purchase price for Dresdner Bank – from a capital increase<br />

against non-cash contributions. The number of Commerzbank<br />

shares outstanding rose to 886.0 million as a result.<br />

With the approval of the Annual General Meeting on May<br />

16, Commerzbank’s share capital was increased by 25 %<br />

plus one share via the issue of new shares against cash to<br />

SoFFin. Around 295 million ordinary shares were issued at<br />

a price of €6 per share, increasing the number of shares<br />

outstanding to 1,181.4 million.<br />

We provide our shareholders with comprehensive information.<br />

For data on Commerzbank’s shares as well as current<br />

news, publications and presentations, visit our website<br />

at www.ir.commerzbank.de.