COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

To our Shareholders Interim Management Report Interim Financial Statements<br />

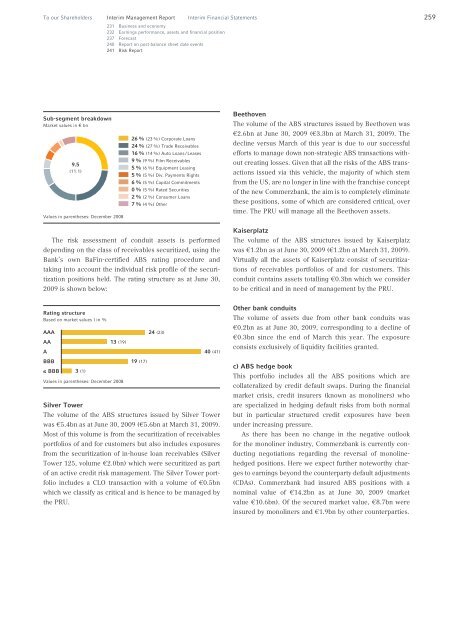

Sub-segment breakdown<br />

Market values in € bn<br />

9.5<br />

(11.1)<br />

Values in parentheses: December 2008<br />

231 Business and economy<br />

232 Earnings performance, assets and financial position<br />

237 Forecast<br />

240 Report on post-balance sheet date events<br />

241 Risk Report<br />

The risk assessment of conduit assets is performed<br />

depending on the class of receivables securitized, using the<br />

Bank’s own BaFin-certified ABS rating procedure and<br />

taking into account the individual risk profile of the securitization<br />

positions held. The rating structure as at June 30,<br />

2009 is shown below:<br />

Rating structure<br />

Based on market values | in %<br />

AAA<br />

AA<br />

A<br />

BBB<br />

≤ BBB<br />

3 (1)<br />

13 (19)<br />

Values in parentheses: December 2008<br />

26 % (23 %) Corporate Loans<br />

24 % (27 %) Trade Receivables<br />

16 % (14 %) Auto Loans / Leases<br />

9%(9 %) Film Receivables<br />

5 % (6 %) Equipment Leasing<br />

5 % (5 %) Div. Payments Rights<br />

6 % (5 %) Capital Commitments<br />

0 % (5 %) Rated Securities<br />

2 % (2 %) Consumer Loans<br />

7%(4 %) Other<br />

19 (17)<br />

24 (23)<br />

40 (41)<br />

Silver Tower<br />

The volume of the ABS structures issued by Silver Tower<br />

was €5.4bn as at June 30, 2009 (€5.6bn at March 31, 2009).<br />

Most of this volume is from the securitization of receivables<br />

portfolios of and for customers but also includes exposures<br />

from the securitization of in-house loan receivables (Silver<br />

Tower 125, volume €2.0bn) which were securitized as part<br />

of an active credit risk management. The Silver Tower portfolio<br />

includes a CLO transaction with a volume of €0.5bn<br />

which we classify as critical and is hence to be managed by<br />

the PRU.<br />

Beethoven<br />

The volume of the ABS structures issued by Beethoven was<br />

€2.6bn at June 30, 2009 (€3.3bn at March 31, 2009). The<br />

decline versus March of this year is due to our successful<br />

efforts to manage down non-strategic ABS transactions without<br />

creating losses. Given that all the risks of the ABS transactions<br />

issued via this vehicle, the majority of which stem<br />

from the US, are no longer in line with the franchise concept<br />

of the new Commerzbank, the aim is to completely eliminate<br />

these positions, some of which are considered critical, over<br />

time. The PRU will manage all the Beethoven assets.<br />

Kaiserplatz<br />

The volume of the ABS structures issued by Kaiserplatz<br />

was €1.2bn as at June 30, 2009 (€1.2bn at March 31, 2009).<br />

Virtually all the assets of Kaiserplatz consist of securitizations<br />

of receivables portfolios of and for customers. This<br />

conduit contains assets totalling €0.3bn which we consider<br />

to be critical and in need of management by the PRU.<br />

Other bank conduits<br />

The volume of assets due from other bank conduits was<br />

€0.2bn as at June 30, 2009, corresponding to a decline of<br />

€0.3bn since the end of March this year. The exposure<br />

consists exclusively of liquidity facilities granted.<br />

c) ABS hedge book<br />

This portfolio includes all the ABS positions which are<br />

collateralized by credit default swaps. During the financial<br />

market crisis, credit insurers (known as monoliners) who<br />

are specialized in hedging default risks from both normal<br />

but in particular structured credit exposures have been<br />

under increasing pressure.<br />

As there has been no change in the negative outlook<br />

for the monoliner industry, Commerzbank is currently conducting<br />

negotiations regarding the reversal of monolinehedged<br />

positions. Here we expect further noteworthy charges<br />

to earnings beyond the counterparty default adjustments<br />

(CDAs). Commerzbank had insured ABS positions with a<br />

nominal value of €14.2bn as at June 30, 2009 (market<br />

value €10.6bn). Of the secured market value, €8.7bn were<br />

insured by monoliners and €1.9bn by other counterparties.<br />

259