COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

264 Commerzbank Interim Report as of June 30, 2009<br />

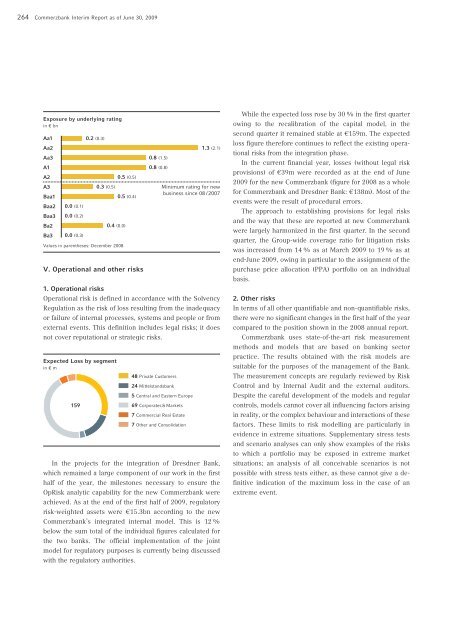

Exposure by underlying rating<br />

in € bn<br />

Aa1<br />

Aa2<br />

Aa3<br />

A1<br />

A2<br />

A3<br />

Baa1<br />

Baa2<br />

Baa3<br />

Ba2<br />

Ba3<br />

0.0 (0.1)<br />

0.0 (0.2)<br />

0.0 (0.3)<br />

0.2 (0.3)<br />

0.3 (0.5)<br />

0.4 (0.0)<br />

Values in parentheses: December 2008<br />

0.5 (0.5)<br />

0.5 (0.4)<br />

V. Operational and other risks<br />

0.8 (1.5)<br />

0.8 (0.8)<br />

1.3 (2.1)<br />

1. Operational risks<br />

Operational risk is defined in accordance with the Solvency<br />

Regulation as the risk of loss resulting from the inadequacy<br />

or failure of internal processes, systems and people or from<br />

external events. This definition includes legal risks; it does<br />

not cover reputational or strategic risks.<br />

Expected Loss by segment<br />

in € m<br />

159<br />

48 Private Customers<br />

24 Mittelstandsbank<br />

Minimum rating for new<br />

business since 08 /2007<br />

5 Central and Eastern Europe<br />

69 Corporates & Markets<br />

7 Commercial Real Estate<br />

7 Other and Consolidation<br />

In the projects for the integration of Dresdner Bank,<br />

which remained a large component of our work in the first<br />

half of the year, the milestones necessary to ensure the<br />

OpRisk analytic capability for the new Commerzbank were<br />

achieved. As at the end of the first half of 2009, regulatory<br />

risk-weighted assets were €15.3bn according to the new<br />

Commerzbank’s integrated internal model. This is 12 %<br />

below the sum total of the individual figures calculated for<br />

the two banks. The official implementation of the joint<br />

model for regulatory purposes is currently being discussed<br />

with the regulatory authorities.<br />

While the expected loss rose by 30 % in the first quarter<br />

owing to the recalibration of the capital model, in the<br />

second quarter it remained stable at €159m. The expected<br />

loss figure therefore continues to reflect the existing operational<br />

risks from the integration phase.<br />

In the current financial year, losses (without legal risk<br />

provisions) of €39m were recorded as at the end of June<br />

2009 for the new Commerzbank (figure for 2008 as a whole<br />

for Commerzbank and Dresdner Bank: €138m). Most of the<br />

events were the result of procedural errors.<br />

The approach to establishing provisions for legal risks<br />

and the way that these are reported at new Commerzbank<br />

were largely harmonized in the first quarter. In the second<br />

quarter, the Group-wide coverage ratio for litigation risks<br />

was increased from 14 % as at March 2009 to 19 % as at<br />

end-June 2009, owing in particular to the assignment of the<br />

purchase price allocation (PPA) portfolio on an individual<br />

basis.<br />

2. Other risks<br />

In terms of all other quantifiable and non-quantifiable risks,<br />

there were no significant changes in the first half of the year<br />

compared to the position shown in the 2008 annual report.<br />

Commerzbank uses state-of-the-art risk measurement<br />

methods and models that are based on banking sector<br />

practice. The results obtained with the risk models are<br />

suitable for the purposes of the management of the Bank.<br />

The measurement concepts are regularly reviewed by Risk<br />

Control and by Internal Audit and the external auditors.<br />

Despite the careful development of the models and regular<br />

controls, models cannot cover all influencing factors arising<br />

in reality, or the complex behaviour and interactions of these<br />

factors. These limits to risk modelling are particularly in<br />

evidence in extreme situations. Supplementary stress tests<br />

and scenario analyses can only show examples of the risks<br />

to which a portfolio may be exposed in extreme market<br />

situations; an analysis of all conceivable scenarios is not<br />

possible with stress tests either, as these cannot give a definitive<br />

indication of the maximum loss in the case of an<br />

extreme event.