COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

248 Commerzbank Interim Report as of June 30, 2009<br />

The volume of corporate loans in the CRE segment – the<br />

loans unsecured by mortgages that are extended on large<br />

real estate portfolios (such as REITS and funds) against<br />

financial covenants or share pledges – was €3.9bn as at the<br />

reporting date (March 2009: €4.1bn). As before, the focus is<br />

on the US (€2.4bn). Following the decision to concentrate<br />

solely on real estate financing in future, all corporate loans<br />

have now been categorized as discontinued business. The<br />

portfolio is being managed down gradually.<br />

b) Shipping<br />

With the financial market crisis spilling over into the global<br />

real economy, conditions for the maritime transport industry<br />

have also deteriorated severely. The situation has been<br />

exacerbated by the increasing deliveries of newbuildings<br />

into the market while cargo volumes have fallen, leading to<br />

substantial losses for liner companies. Economic stimulus<br />

packages (infrastructure measures) introduced around the<br />

world and increasing cancellations / postponements of<br />

newbuilding orders have only been able to partially cushion<br />

the effect, leading to uneven performance across the main<br />

segments of the shipping industry during the reporting<br />

period.<br />

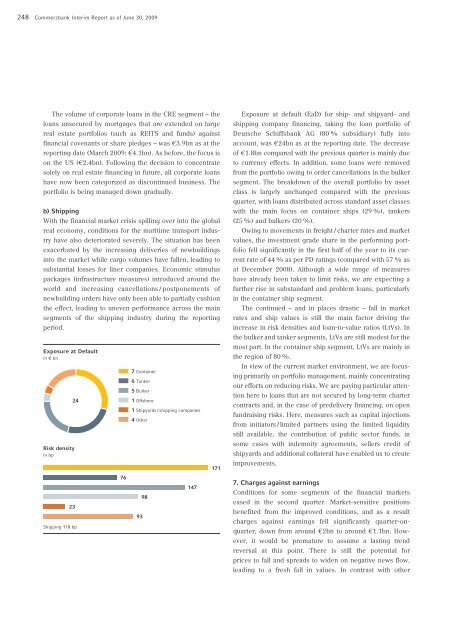

Exposure at Default<br />

in € bn<br />

Risk density<br />

in bp<br />

23<br />

24<br />

Shipping 118 bp<br />

76<br />

7 Container<br />

6 Tanker<br />

5 Bulker<br />

1 Offshore<br />

1 Shipyards / shipping companies<br />

4 Other<br />

93<br />

98<br />

147<br />

171<br />

Exposure at default (EaD) for ship- and shipyard- and<br />

shipping company financing, taking the loan portfolio of<br />

Deutsche Schiffsbank AG (80 % subsidiary) fully into<br />

account, was €24bn as at the reporting date. The decrease<br />

of €1.8bn compared with the previous quarter is mainly due<br />

to currency effects. In addition, some loans were removed<br />

from the portfolio owing to order cancellations in the bulker<br />

segment. The breakdown of the overall portfolio by asset<br />

class is largely unchanged compared with the previous<br />

quarter, with loans distributed across standard asset classes<br />

with the main focus on container ships (29 %), tankers<br />

(25 %) and bulkers (20 %).<br />

Owing to movements in freight / charter rates and market<br />

values, the investment grade share in the performing portfolio<br />

fell significantly in the first half of the year to its current<br />

rate of 44 % as per PD ratings (compared with 57 % as<br />

at December 2008). Although a wide range of measures<br />

have already been taken to limit risks, we are expecting a<br />

further rise in substandard and problem loans, particularly<br />

in the container ship segment.<br />

The continued – and in places drastic – fall in market<br />

rates and ship values is still the main factor driving the<br />

increase in risk densities and loan-to-value ratios (LtVs). In<br />

the bulker and tanker segments, LtVs are still modest for the<br />

most part. In the container ship segment, LtVs are mainly in<br />

the region of 80 %.<br />

In view of the current market environment, we are focusing<br />

primarily on portfolio management, mainly concentrating<br />

our efforts on reducing risks. We are paying particular attention<br />

here to loans that are not secured by long-term charter<br />

contracts and, in the case of predelivery financing, on open<br />

fundraising risks. Here, measures such as capital injections<br />

from initiators / limited partners using the limited liquidity<br />

still available, the contribution of public sector funds, in<br />

some cases with indemnity agreements, sellers credit of<br />

shipyards and additional collateral have enabled us to create<br />

improvements.<br />

7. Charges against earnings<br />

Conditions for some segments of the financial markets<br />

eased in the second quarter. Market-sensitive positions<br />

benefited from the improved conditions, and as a result<br />

charges against earnings fell significantly quarter-onquarter,<br />

down from around €2bn to around €1.1bn. However,<br />

it would be premature to assume a lasting trend<br />

reversal at this point. There is still the potential for<br />

prices to fall and spreads to widen on negative news flow,<br />

leading to a fresh fall in values. In contrast with other