COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

To our Shareholders Interim Management Report Interim Financial Statements<br />

231 Business and economy<br />

232 Earnings performance, assets and financial position<br />

237 Forecast<br />

240 Report on post-balance sheet date events<br />

241 Risk Report<br />

IV. Special portfolios with particular risks<br />

1. Asset-backed securities (ABSs)<br />

In the first half of the current year the following charges<br />

to earnings resulted from ABS investments: P&L impacts<br />

from fair value remeasurement and from impairments in<br />

the amount of €1.5bn and charges to the revaluation<br />

reserve for not-yet-impaired positions in the banking book<br />

in the amount of €0.3bn. Key drivers here were US CDOs<br />

of ABSs and non-US RMBS / CDOs from unhedged and<br />

monoline-hedged ABS holdings as well as exposures in<br />

the CMBS / CRE CDOs and large corporate CDO asset<br />

classes.<br />

The 2009 financial year will again bring high charges in<br />

the ABS portfolio of Commerzbank, although we expect the<br />

The rating distribution for the individual ABS sub-portfolios<br />

listed in this section of the risk report are based on<br />

the ratings valid as at June 30, 2009; they also represent the<br />

ratings relevant for Basel II.<br />

a) ABS secondary market<br />

These are investments in ABS securities that were made by<br />

Commerzbank as part of its replacement credit business or<br />

in its function as arranger and market maker in these products.<br />

very poor performance by US non-prime RMBSs and US<br />

CDOs of ABSs to spread to other asset classes such as<br />

CMBSs, RMBSs and CDO Corporates due to the worsening<br />

recession in the US and in major European economies. The<br />

crisis will no longer be confined to the financial markets but<br />

will have an increasing impact on the real economy.<br />

The ongoing tight liquidity situation in the secondary<br />

markets for ABSs is presenting great challenges to our<br />

planned reduction with a market value of €26.3bn of those<br />

ABS portfolios identified as critical (critical in this context<br />

means that we expect further losses in market value or – in<br />

the case of conduit investments, which have not yet registered<br />

losses – we cannot exclude the possibility of losses<br />

over time). Given this environment we do not expect an<br />

efficient reduction of this exposure in 2009.<br />

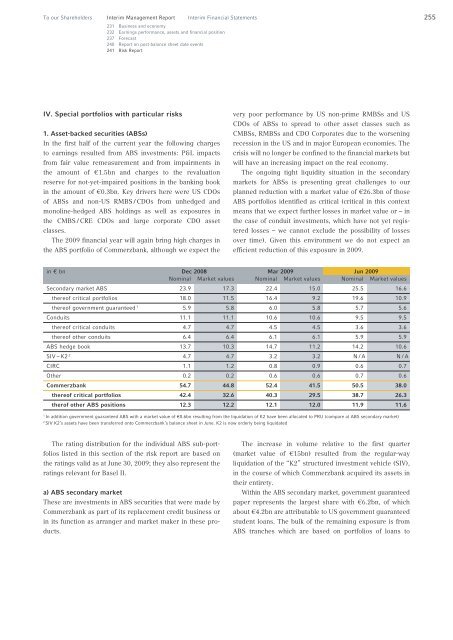

in € bn Dec 2008 Mar 2009 Jun 2009<br />

Nominal Market values Nominal Market values Nominal Market values<br />

Secondary market ABS 23.9 17.3 22.4 15.0 25.5 16.6<br />

thereof critical portfolios 18.0 11.5 16.4 9.2 19.6 10.9<br />

thereof government guaranteed 1 5.9 5.8 6.0 5.8 5.7 5.6<br />

Conduits 11.1 11.1 10.6 10.6 9.5 9.5<br />

thereof critical conduits 4.7 4.7 4.5 4.5 3.6 3.6<br />

thereof other conduits 6.4 6.4 6.1 6.1 5.9 5.9<br />

ABS hedge book 13.7 10.3 14.7 11.2 14.2 10.6<br />

SIV – K2 2 4.7 4.7 3.2 3.2 N/A N/A<br />

CIRC 1.1 1.2 0.8 0.9 0.6 0.7<br />

Other 0.2 0.2 0.6 0.6 0.7 0.6<br />

Commerzbank 54.7 44.8 52.4 41.5 50.5 38.0<br />

thereof critical portfolios 42.4 32.6 40.3 29.5 38.7 26.3<br />

therof other ABS positions 12.3 12.2 12.1 12.0 11.9 11.6<br />

1 In addition government guaranteed ABS with a market value of €0.6bn resulting from the liquidation of K2 have been allocated to PRU (compare a) ABS secondary market)<br />

2 SIV K2’s assets have been transferred onto Commerzbank’s balance sheet in June. K2 is now orderly being liquidated<br />

The increase in volume relative to the first quarter<br />

(market value of €15bn) resulted from the regular-way<br />

liquidation of the “K2” structured investment vehicle (SIV),<br />

in the course of which Commerzbank acquired its assets in<br />

their entirety.<br />

Within the ABS secondary market, government guaranteed<br />

paper represents the largest share with €6.2bn, of which<br />

about €4.2bn are attributable to US government guaranteed<br />

student loans. The bulk of the remaining exposure is from<br />

ABS tranches which are based on portfolios of loans to<br />

255