COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 8 Commerzbank Interim Report as of June 30, 2009<br />

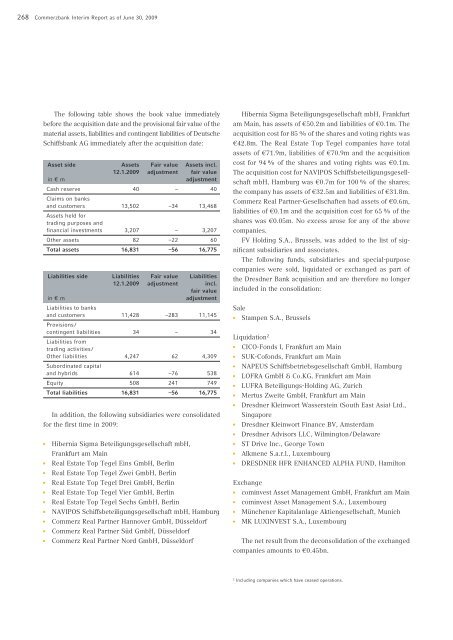

The following table shows the book value immediately<br />

before the acquisition date and the provisional fair value of the<br />

material assets, liabilities and contingent liabilities of Deutsche<br />

Schiffsbank AG immediately after the acquisition date:<br />

Asset side Assets Fair value Assets incl.<br />

12.1.2009 adjustment fair value<br />

in € m adjustment<br />

Cash reserve 40 – 40<br />

Claims on banks<br />

and customers 13,502 –34 13,4 8<br />

Assets held for<br />

trading purposes and<br />

financial investments 3,207 – 3,207<br />

Other assets 82 –22 0<br />

Total assets 16,831 –56 16,775<br />

Liabilities side Liabilities Fair value Liabilities<br />

12.1.2009 adjustment incl.<br />

fair value<br />

in € m<br />

Liabilities to banks<br />

adjustment<br />

and customers<br />

Provisions /<br />

11,428 –283 11,145<br />

contingent liabilities<br />

Liabilities from<br />

trading activities /<br />

34 – 34<br />

Other liabilities<br />

Subordinated capital<br />

4,247 2 4,309<br />

and hybrids 14 –7 538<br />

Equity 508 241 749<br />

Total liabilities 16,831 –56 16,775<br />

In addition, the following subsidiaries were consolidated<br />

for the first time in 2009:<br />

Hibernia Sigma Beteiligungsgesellschaft mbH,<br />

Frankfurt am Main<br />

Real Estate Top Tegel Eins GmbH, Berlin<br />

Real Estate Top Tegel Zwei GmbH, Berlin<br />

Real Estate Top Tegel Drei GmbH, Berlin<br />

Real Estate Top Tegel Vier GmbH, Berlin<br />

Real Estate Top Tegel Sechs GmbH, Berlin<br />

NAVIPOS Schiffsbeteiligungsgesellschaft mbH, Hamburg<br />

Commerz Real Partner Hannover GmbH, Düsseldorf<br />

Commerz Real Partner Süd GmbH, Düsseldorf<br />

Commerz Real Partner Nord GmbH, Düsseldorf<br />

Hibernia Sigma Beteiligungsgesellschaft mbH, Frankfurt<br />

am Main, has assets of €50.2m and liabilities of €0.1m. The<br />

acquisition cost for 85 % of the shares and voting rights was<br />

€42.8m. The Real Estate Top Tegel companies have total<br />

assets of €71.9m, liabilities of €70.9m and the acquisition<br />

cost for 94 % of the shares and voting rights was €0.1m.<br />

The acquisition cost for NAVIPOS Schiffsbeteiligungsgesellschaft<br />

mbH, Hamburg was €0.7m for 100 % of the shares;<br />

the company has assets of €32.5m and liabilities of €31.8m.<br />

Commerz Real Partner-Gesellschaften had assets of €0.6m,<br />

liabilities of €0.1m and the acquisition cost for 65 % of the<br />

shares was €0.05m. No excess arose for any of the above<br />

companies.<br />

FV Holding S.A., Brussels, was added to the list of significant<br />

subsidiaries and associates.<br />

The following funds, subsidiaries and special-purpose<br />

companies were sold, liquidated or exchanged as part of<br />

the Dresdner Bank acquisition and are therefore no longer<br />

included in the consolidation:<br />

Sale<br />

Stampen S.A., Brussels<br />

Liquidation2 CICO-Fonds I, Frankfurt am Main<br />

SUK-Cofonds, Frankfurt am Main<br />

NAPEUS Schiffsbetriebsgesellschaft GmbH, Hamburg<br />

LOFRA GmbH & Co.KG, Frankfurt am Main<br />

LUFRA Beteiligungs-Holding AG, Zurich<br />

Mertus Zweite GmbH, Frankfurt am Main<br />

Dresdner Kleinwort Wasserstein (South East Asia) Ltd.,<br />

Singapore<br />

Dresdner Kleinwort Finance BV, Amsterdam<br />

Dresdner Advisors LLC, Wilmington/Delaware<br />

ST Drive Inc., George Town<br />

Alkmene S.a.r.l., Luxembourg<br />

DRESDNER HFR ENHANCED ALPHA FUND, Hamilton<br />

Exchange<br />

cominvest Asset Management GmbH, Frankfurt am Main<br />

cominvest Asset Management S.A., Luxembourg<br />

Münchener Kapitalanlage Aktiengesellschaft, Munich<br />

MK LUXINVEST S.A., Luxembourg<br />

The net result from the deconsolidation of the exchanged<br />

companies amounts to €0.45bn.<br />

2 Including companies which have ceased operations.