COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

To our Shareholders Interim Management Report Interim Financial Statements<br />

231 Business and economy<br />

232 Earnings performance, assets and financial position<br />

237 Forecast<br />

240 Report on post-balance sheet date events<br />

241 Risk Report<br />

Compared to the first quarter of 2009 the increase in<br />

default volume results from the segments Corporates &<br />

Markets CEE and Mittelstandsbank. In the Mittelstandsbank<br />

segment and especially in Central and Eastern Europe the<br />

recession led to an overall increased number of defaults<br />

while in the Corporates & Markets segment once again bulk<br />

cases were the drivers of the higher default volume. In the<br />

CRE segment no additional bulk cases occurred and the<br />

default portfolio could slightly be decreased compared to<br />

the first quarter of 2009. Also in the Private Customers segment<br />

the inflow was more then offset by work out activities<br />

and a slight net decrease was achieved compared to the first<br />

quarter of 2009. Due to difficult conditions further increase<br />

of the default portfolio is to be expected in the course of the<br />

Counterparty default adjustments fell slightly in the<br />

second quarter of 2009. In the case of monoliner counterparties,<br />

the market value of some of the hedged positions<br />

recovered in the second quarter, so that the CDAs in this<br />

category were slightly reduced even though there was no<br />

substantial improvement in the creditworthiness of the<br />

counterparties.<br />

Furthermore, hedges with credit derivatives product<br />

companies (CDPCs) as the credit insurers are concluded.<br />

Through rating downgrades and defaults of insured loans,<br />

the liquidity and capital situation of the CDPCs during the<br />

financial market crisis has considerably worsened so that<br />

the insolvency of a few CDPCs cannot be ruled out. In the<br />

second quarter, the Bank set aside a valuation allowance<br />

for one of the two CDPCs, as this counterparty can no longer<br />

be expected to meet its future liabilities in full. In return,<br />

the CDA made for this counterparty was reversed.<br />

second half of 2009 – influenced by specific bulk cases and<br />

similar to the increase of impairments.<br />

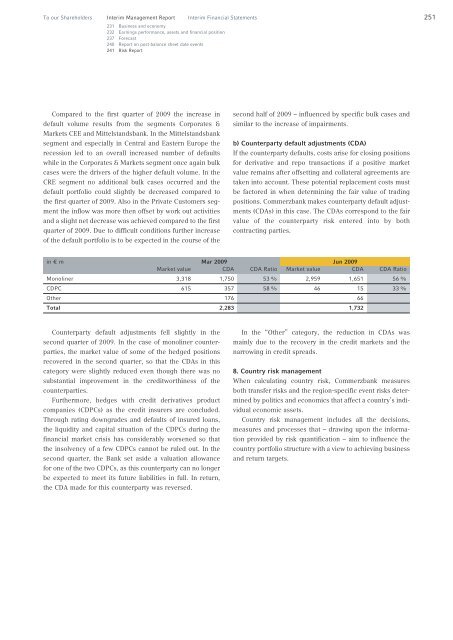

b) Counterparty default adjustments (CDA)<br />

If the counterparty defaults, costs arise for closing positions<br />

for derivative and repo transactions if a positive market<br />

value remains after offsetting and collateral agreements are<br />

taken into account. These potential replacement costs must<br />

be factored in when determining the fair value of trading<br />

positions. Commerzbank makes counterparty default adjustments<br />

(CDAs) in this case. The CDAs correspond to the fair<br />

value of the counterparty risk entered into by both<br />

contracting parties.<br />

in € m Mar 2009 Jun 2009<br />

Market value CDA CDA Ratio Market value CDA CDA Ratio<br />

Monoliner 3,318 1,750 53 % 2,959 1,651 56 %<br />

CDPC 615 357 58 % 46 15 33 %<br />

Other 176 66<br />

Total 2,283 1,732<br />

In the “Other” category, the reduction in CDAs was<br />

mainly due to the recovery in the credit markets and the<br />

narrowing in credit spreads.<br />

8. Country risk management<br />

When calculating country risk, Commerzbank measures<br />

both transfer risks and the region-specific event risks determined<br />

by politics and economics that affect a country’s individual<br />

economic assets.<br />

Country risk management includes all the decisions,<br />

measures and processes that – drawing upon the information<br />

provided by risk quantification – aim to influence the<br />

country portfolio structure with a view to achieving business<br />

and return targets.<br />

251