COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

252 Commerzbank Interim Report as of June 30, 2009<br />

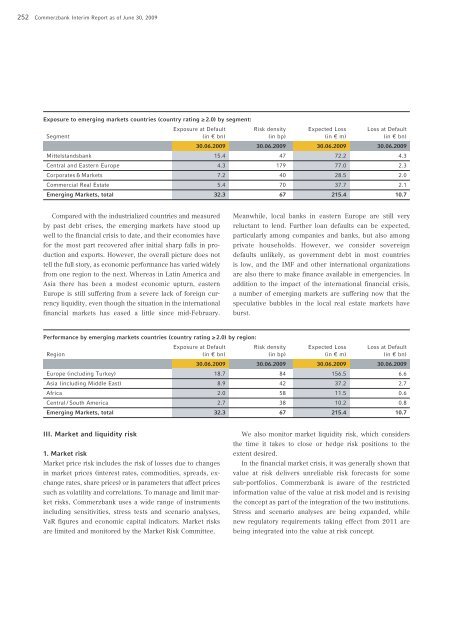

Exposure to emerging markets countries (country rating ≥ 2.0) by segment:<br />

Exposure at Default Risk density Expected Loss Loss at Default<br />

Segment (in € bn) (in bp) (in € m) (in € bn)<br />

30.06.2009 30.06.2009 30.06.2009 30.06.2009<br />

Mittelstandsbank 15.4 47 72.2 4.3<br />

Central and Eastern Europe 4.3 179 77.0 2.3<br />

Corporates & Markets 7.2 40 28.5 2.0<br />

Commercial Real Estate 5.4 70 37.7 2.1<br />

Emerging Markets, total 32.3 67 215.4 10.7<br />

Compared with the industrialized countries and measured<br />

by past debt crises, the emerging markets have stood up<br />

well to the financial crisis to date, and their economies have<br />

for the most part recovered after initial sharp falls in production<br />

and exports. However, the overall picture does not<br />

tell the full story, as economic performance has varied widely<br />

from one region to the next. Whereas in Latin America and<br />

Asia there has been a modest economic upturn, eastern<br />

Europe is still suffering from a severe lack of foreign currency<br />

liquidity, even though the situation in the international<br />

financial markets has eased a little since mid-February.<br />

III. Market and liquidity risk<br />

1. Market risk<br />

Market price risk includes the risk of losses due to changes<br />

in market prices (interest rates, commodities, spreads, exchange<br />

rates, share prices) or in parameters that affect prices<br />

such as volatility and correlations. To manage and limit market<br />

risks, Commerzbank uses a wide range of instruments<br />

including sensitivities, stress tests and scenario analyses,<br />

VaR figures and economic capital indicators. Market risks<br />

are limited and monitored by the Market Risk Committee.<br />

Meanwhile, local banks in eastern Europe are still very<br />

reluctant to lend. Further loan defaults can be expected,<br />

particularly among companies and banks, but also among<br />

private households. However, we consider sovereign<br />

defaults unlikely, as government debt in most countries<br />

is low, and the IMF and other international organizations<br />

are also there to make finance available in emergencies. In<br />

addition to the impact of the international financial crisis,<br />

a number of emerging markets are suffering now that the<br />

speculative bubbles in the local real estate markets have<br />

burst.<br />

Performance by emerging markets countries (country rating ≥ 2.0) by region:<br />

Exposure at Default Risk density Expected Loss Loss at Default<br />

Region (in € bn) (in bp) (in € m) (in € bn)<br />

30.06.2009 30.06.2009 30.06.2009 30.06.2009<br />

Europe (including Turkey) 18.7 84 156.5 6.6<br />

Asia (including Middle East) 8.9 42 37.2 2.7<br />

Africa 2.0 58 11.5 0.6<br />

Central / South America 2.7 38 10.2 0.8<br />

Emerging Markets, total 32.3 67 215.4 10.7<br />

We also monitor market liquidity risk, which considers<br />

the time it takes to close or hedge risk positions to the<br />

extent desired.<br />

In the financial market crisis, it was generally shown that<br />

value at risk delivers unreliable risk forecasts for some<br />

sub-portfolios. Commerzbank is aware of the restricted<br />

information value of the value at risk model and is revising<br />

the concept as part of the integration of the two institutions.<br />

Stress and scenario analyses are being expanded, while<br />

new regulatory requirements taking effect from 2011 are<br />

being integrated into the value at risk concept.