COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

256 Commerzbank Interim Report as of June 30, 2009<br />

small- and medium-sized enterprises (SME). Guarantors in<br />

this case are European countries and the European Investment<br />

Bank (EIB). Of the above-mentioned €6.2bn government<br />

guaranteed ABSs, some €5.6bn are managed outside<br />

the PRU, while the remaining €0.6bn are managed by the<br />

PRU. These relate to the “K2” portfolio, all the assets of<br />

which are managed by the PRU.<br />

US CDOs of ABSs and US RMBSs, the latter of which<br />

include both prime and non-prime RMBSs, will have an<br />

ongoing negative impact in 2009. While the growth in<br />

past-due mortgage loans is slowing, the rate of foreclosures<br />

in the US real estate market is very high. These foreclosures<br />

and the rising unemployment rate in the US will<br />

continue to depress house prices in the US over the near term.<br />

In the first half of this year, the following charges<br />

resulted on an aggregated basis for ABS secondary market:<br />

P&L impacts from fair value remeasurement and from<br />

impairments in the amount of €1.1bn and charges to the<br />

revaluation reserve for not-yet-impaired positions in the<br />

banking book in the amount of €0.3bn. Key drivers were US<br />

RMBSs, US CDOs of ABSs, CDOs of large corporates,<br />

CMBS / CRE CDOs and non-US RMBSs.<br />

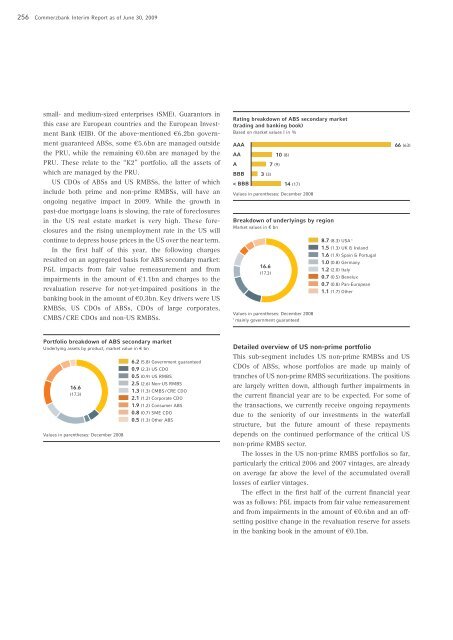

Portfolio breakdown of ABS secondary market<br />

Underlying assets by product, market value in € bn<br />

16.6<br />

(17.3)<br />

Values in parentheses: December 2008<br />

6.2 (5.8) Government guaranteed<br />

0.9 (2.3) US CDO<br />

0.5 (0.9) US RMBS<br />

2.5 (2.6) Non-US RMBS<br />

1.3 (1.3) CMBS / CRE CDO<br />

2.1 (1.2) Corporate CDO<br />

1.9 (1.2) Consumer ABS<br />

0.8 (0.7) SME CDO<br />

0.5 (1.3) Other ABS<br />

Rating breakdown of ABS secondary market<br />

(trading and banking book)<br />

Based on market values | in %<br />

AAA<br />

AA<br />

A<br />

BBB<br />

< BBB<br />

3 (3)<br />

7 (9)<br />

10 (8)<br />

14 (17)<br />

Values in parentheses: December 2008<br />

Breakdown of underlyings by region<br />

Market values in € bn<br />

16.6<br />

(17.3)<br />

Values in parentheses: December 2008<br />

1 mainly government guaranteed<br />

8.7 (8.3) USA 1<br />

1.5 (1.3) UK & Ireland<br />

1.6 (1.9) Spain & Portugal<br />

1.0 (0.8) Germany<br />

1.2 (2.0) Italy<br />

0.7 (0.5) Benelux<br />

0.7 (0.8) Pan-European<br />

1.1 (1.7) Other<br />

66 (63)<br />

Detailed overview of US non-prime portfolio<br />

This sub-segment includes US non-prime RMBSs and US<br />

CDOs of ABSs, whose portfolios are made up mainly of<br />

tranches of US non-prime RMBS securitizations. The positions<br />

are largely written down, although further impairments in<br />

the current financial year are to be expected. For some of<br />

the transactions, we currently receive ongoing repayments<br />

due to the seniority of our investments in the waterfall<br />

structure, but the future amount of these repayments<br />

depends on the continued performance of the critical US<br />

non-prime RMBS sector.<br />

The losses in the US non-prime RMBS portfolios so far,<br />

particularly the critical 2006 and 2007 vintages, are already<br />

on average far above the level of the accumulated overall<br />

losses of earlier vintages.<br />

The effect in the first half of the current financial year<br />

was as follows: P&L impacts from fair value remeasurement<br />

and from impairments in the amount of €0.6bn and an offsetting<br />

positive change in the revaluation reserve for assets<br />

in the banking book in the amount of €0.1bn.