COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

To our Shareholders Interim Management Report Interim Financial Statements<br />

231 Business and economy<br />

232 Earnings performance, assets and financial position<br />

237 Forecast<br />

240 Report on post-balance sheet date events<br />

241 Risk Report<br />

Market price risk fell significantly during the second<br />

quarter. The fall was driven by two factors. Firstly, the financial<br />

market situation eased a little after two particularly<br />

turbulent preceding quarters. The steep declines in share<br />

prices and substantial widening in credit spreads were<br />

halted, and a correction ensued, with considerable rallies in<br />

places. This was accompanied by a decline in the general<br />

level of financial market volatility, which also led to a<br />

reduction in value at risk. The second factor driving the<br />

reduction in reported risk was that risk positions were<br />

systematically managed down. As part of the integration<br />

of Dresdner Bank, risk positions reducible at an early<br />

stage were identified. This provided the basis for rapidly<br />

and systematically reducing risks in selected areas in<br />

response to the market recovery.<br />

Since January 2009, a consolidated daily risk report for<br />

Commerzbank and Dresdner Bank has been compiled to<br />

monitor and manage market price risk. Since the merger on<br />

May 11, 2009, the two banks have, in general, no longer<br />

been treated as separate for reporting purposes, and the<br />

report is now compiled on the basis of the new Commerzbank<br />

structure. Value at risk and stress test limits for the new<br />

structure were promptly introduced for daily monitoring<br />

purposes.<br />

Market risk in the trading book<br />

A comparison between the VaR figures in Commerzbank’s<br />

trading book at June 30, 2009, and those at March 31, 2009,<br />

clearly illustrates the reduction in risk described above.<br />

Credit spread risks still account for the lion’s share of the<br />

total value at risk, but the breakdown of risks by asset class<br />

has clearly improved.<br />

The emphasis remains on reducing risks, which is done<br />

with the active involvement of the risk function. To this end,<br />

selected positions have been transferred to the Portfolio<br />

Restructuring Unit (PRU), set up for the specific purpose of<br />

VaR contribution by risk type /<br />

VaR (99 % confidence level, 1-day holding period)<br />

in € m 31.03.2009 30.06.2009<br />

Credit spreads 38.2 28.8<br />

Interest Rate 15.2 14.7<br />

Equity 11.6 14.6<br />

FX 3.6 2.3<br />

Commodities 2.8 1.0<br />

Total 71.4 61.4<br />

risk reduction. The PRU is now responsible for a substantial<br />

part of the credit spread risk. Nevertheless in other units<br />

besides the PRU, the de-risking /optimization of portfolios<br />

is still ongoing.<br />

As conditions in some segments of the financial markets<br />

remain difficult, it is still not possible to use mark-tomarket<br />

valuation methods in all instances. Mark-to-model<br />

valuation is therefore used for some risk exposures, in particular<br />

for ABS positions.<br />

Market risk in the banking book<br />

Commerzbank also manages market risk in its banking<br />

books. These are mainly credit spread risks in the Public<br />

Finance portfolio with the positions held by subsidiaries<br />

Eurohypo and EEPK and exposures in the Treasury portfolios<br />

and equity price risks in the equity investments<br />

portfolio.<br />

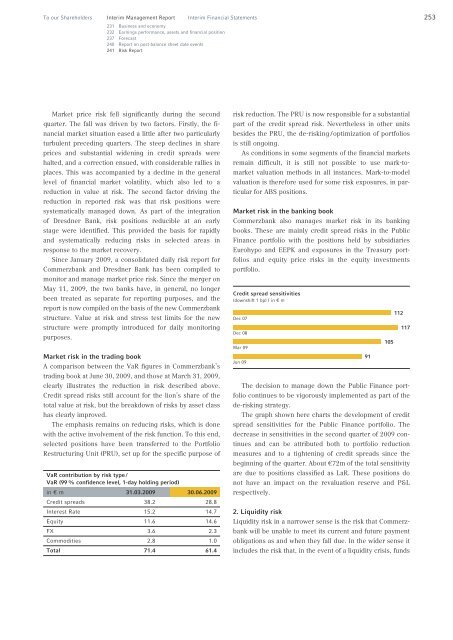

Credit spread sensitivities<br />

(downshift 1 bp) | in € m<br />

Dec 07<br />

Dec 08<br />

Mar 09<br />

Jun 09<br />

The decision to manage down the Public Finance portfolio<br />

continues to be vigorously implemented as part of the<br />

de-risking strategy.<br />

The graph shown here charts the development of credit<br />

spread sensitivities for the Public Finance portfolio. The<br />

decrease in sensitivities in the second quarter of 2009 continues<br />

and can be attributed both to portfolio reduction<br />

measures and to a tightening of credit spreads since the<br />

beginning of the quarter. About €72m of the total sensitivity<br />

are due to positions classified as LaR. These positions do<br />

not have an impact on the revaluation reserve and P&L<br />

respectively.<br />

2. Liquidity risk<br />

Liquidity risk in a narrower sense is the risk that Commerzbank<br />

will be unable to meet its current and future payment<br />

obligations as and when they fall due. In the wider sense it<br />

includes the risk that, in the event of a liquidity crisis, funds<br />

91<br />

105<br />

112<br />

117<br />

253