COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

To our Shareholders Interim Management Report Interim Financial Statements<br />

2 9 Overall results<br />

272 Consolidated balance sheet<br />

273 Statement of changes in equity<br />

274 Cash flow statement<br />

275 Notes to the income statement<br />

284 Notes to the balance sheet<br />

290 Other notes<br />

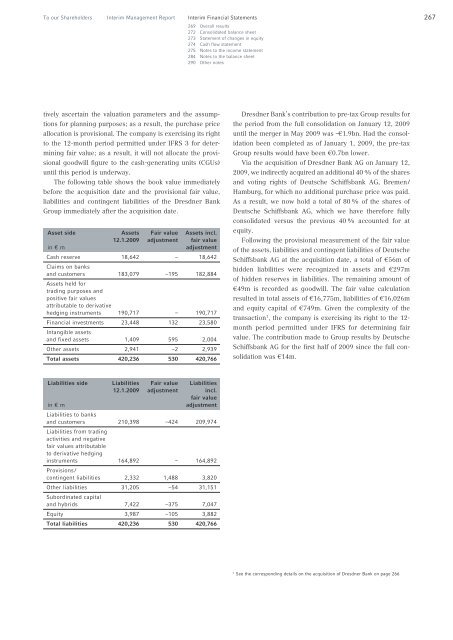

tively ascertain the valuation parameters and the assump-<br />

tions for planning purposes; as a result, the purchase price<br />

allocation is provisional. The company is exercising its right<br />

to the 12-month period permitted under IFRS 3 for deter-<br />

mining fair value; as a result, it will not allocate the provi-<br />

sional goodwill figure to the cash-generating units (CGUs)<br />

until this period is underway.<br />

The following table shows the book value immediately<br />

before the acquisition date and the provisional fair value,<br />

liabilities and contingent liabilities of the Dresdner Bank<br />

Group immediately after the acquisition date.<br />

Asset side Assets Fair value Assets incl.<br />

12.1.2009 adjustment fair value<br />

in € m adjustment<br />

Cash reserve<br />

Claims on banks<br />

18, 42 – 18, 42<br />

and customers<br />

Assets held for<br />

trading purposes and<br />

positive fair values<br />

attributable to derivative<br />

183,079 –195 182,884<br />

hedging instruments 190,717 – 190,717<br />

Financial investments<br />

Intangible assets<br />

23,448 132 23,580<br />

and fixed assets 1,409 595 2,004<br />

Other assets 2,941 –2 2,939<br />

Total assets 420,236 530 420,766<br />

Liabilities side Liabilities Fair value Liabilities<br />

12.1.2009 adjustment incl.<br />

fair value<br />

in € m<br />

Liabilities to banks<br />

adjustment<br />

and customers<br />

Liabilities from trading<br />

activities and negative<br />

fair values attributable<br />

to derivative hedging<br />

210,398 –424 209,974<br />

instruments<br />

Provisions /<br />

1 4,892 – 1 4,892<br />

contingent liabilities 2,332 1,488 3,820<br />

Other liabilities<br />

Subordinated capital<br />

31,205 –54 31,151<br />

and hybrids 7,422 –375 7,047<br />

Equity 3,987 –105 3,882<br />

Total liabilities 420,236 530 420,766<br />

Dresdner Bank’s contribution to pre-tax Group results for<br />

the period from the full consolidation on January 12, 2009<br />

until the merger in May 2009 was –€1.9bn. Had the consol-<br />

idation been completed as of January 1, 2009, the pre-tax<br />

Group results would have been €0.7bn lower.<br />

Via the acquisition of Dresdner Bank AG on January 12,<br />

2009, we indirectly acquired an additional 40 % of the shares<br />

and voting rights of Deutsche Schiffsbank AG, Bremen/<br />

Hamburg, for which no additional purchase price was paid.<br />

As a result, we now hold a total of 80 % of the shares of<br />

Deutsche Schiffsbank AG, which we have therefore fully<br />

consolidated versus the previous 40 % accounted for at<br />

equity.<br />

Following the provisional measurement of the fair value<br />

of the assets, liabilities and contingent liabilities of Deutsche<br />

Schiffsbank AG at the acquisition date, a total of €56m of<br />

hidden liabilities were recognized in assets and €297m<br />

of hidden reserves in liabilities. The remaining amount of<br />

€49m is recorded as goodwill. The fair value calculation<br />

resulted in total assets of €16,775m, liabilities of €16,026m<br />

and equity capital of €749m. Given the complexity of the<br />

transaction1 , the company is exercising its right to the 12month<br />

period permitted under IFRS for determining fair<br />

value. The contribution made to Group results by Deutsche<br />

Schiffsbank AG for the first half of 2009 since the full consolidation<br />

was €14m.<br />

1 See the corresponding details on the acquisition of Dresdner Bank on page 2<br />

2 7