Skandia Global Funds plc - Self Bank

Skandia Global Funds plc - Self Bank

Skandia Global Funds plc - Self Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

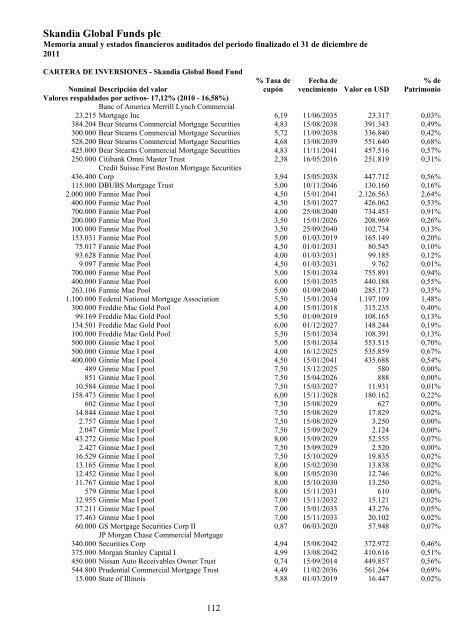

<strong>Skandia</strong> <strong>Global</strong> <strong>Funds</strong> <strong>plc</strong><br />

Memoria anual y estados financieros auditados del periodo finalizado el 31 de diciembre de<br />

2011<br />

CARTERA DE INVERSIONES - <strong>Skandia</strong> <strong>Global</strong> Bond Fund<br />

Nominal Descripción del valor<br />

Valores respaldados por activos- 17,12% (2010 - 16,58%)<br />

% Tasa de<br />

cupón<br />

Fecha de<br />

vencimiento Valor en USD<br />

% de<br />

Patrimonio<br />

Banc of America Merrill Lynch Commercial<br />

Mortgage Inc 6,19 11/06/2035 23.317 0,03%<br />

23.215<br />

384.204 Bear Stearns Commercial Mortgage Securities 4,83 15/08/2038 391.343 0,49%<br />

300.000 Bear Stearns Commercial Mortgage Securities 5,72 11/09/2038 336.840 0,42%<br />

528.200 Bear Stearns Commercial Mortgage Securities 4,68 13/08/2039 551.640 0,68%<br />

425.000 Bear Stearns Commercial Mortgage Securities 4,83 11/11/2041 457.516 0,57%<br />

250.000 Citibank Omni Master Trust 2,38 16/05/2016 251.819 0,31%<br />

Credit Suisse First Boston Mortgage Securities<br />

Corp 3,94 15/05/2038 447.712 0,56%<br />

436.400<br />

115.000 DBUBS Mortgage Trust 5,00 10/11/2046 130.160 0,16%<br />

2.000.000 Fannie Mae Pool 4,50 15/01/2041 2.126.563 2,64%<br />

400.000 Fannie Mae Pool 4,50 15/01/2027 426.062 0,53%<br />

700.000 Fannie Mae Pool 4,00 25/08/2040 734.453 0,91%<br />

200.000 Fannie Mae Pool 3,50 15/01/2026 208.969 0,26%<br />

100.000 Fannie Mae Pool 3,50 25/09/2040 102.734 0,13%<br />

153.031 Fannie Mae Pool 5,00 01/03/2019 165.149 0,20%<br />

75.017 Fannie Mae Pool 4,50 01/01/2031 80.545 0,10%<br />

93.628 Fannie Mae Pool 4,00 01/03/2031 99.185 0,12%<br />

9.097 Fannie Mae Pool 4,50 01/03/2031 9.762 0,01%<br />

700.000 Fannie Mae Pool 5,00 15/01/2034 755.891 0,94%<br />

400.000 Fannie Mae Pool 6,00 15/01/2035 440.188 0,55%<br />

263.106 Fannie Mae Pool 5,00 01/09/2040 285.173 0,35%<br />

1.100.000 Federal National Mortgage Association 5,50 15/01/2034 1.197.109 1,48%<br />

300.000 Freddie Mac Gold Pool 4,00 15/01/2018 315.235 0,40%<br />

99.169 Freddie Mac Gold Pool 5,50 01/09/2019 108.165 0,13%<br />

134.501 Freddie Mac Gold Pool 6,00 01/12/2027 148.244 0,19%<br />

100.000 Freddie Mac Gold Pool 5,50 15/01/2034 108.391 0,13%<br />

500.000 Ginnie Mae I pool 5,00 15/01/2034 553.515 0,70%<br />

500.000 Ginnie Mae I pool 4,00 16/12/2025 535.859 0,67%<br />

400.000 Ginnie Mae I pool 4,50 15/01/2041 435.688 0,54%<br />

489 Ginnie Mae I pool 7,50 15/12/2025 580 0,00%<br />

851 Ginnie Mae I pool 7,50 15/04/2026 888 0,00%<br />

10.584 Ginnie Mae I pool 7,50 15/03/2027 11.931 0,01%<br />

158.473 Ginnie Mae I pool 6,00 15/11/2028 180.162 0,22%<br />

602 Ginnie Mae I pool 7,50 15/08/2029 627 0,00%<br />

14.844 Ginnie Mae I pool 7,50 15/08/2029 17.829 0,02%<br />

2.757 Ginnie Mae I pool 7,50 15/08/2029 3.250 0,00%<br />

2.047 Ginnie Mae I pool 7,50 15/09/2029 2.124 0,00%<br />

43.272 Ginnie Mae I pool 8,00 15/09/2029 52.555 0,07%<br />

2.427 Ginnie Mae I pool 7,50 15/09/2029 2.520 0,00%<br />

16.529 Ginnie Mae I pool 7,50 15/10/2029 19.835 0,02%<br />

13.165 Ginnie Mae I pool 8,00 15/02/2030 13.838 0,02%<br />

12.452 Ginnie Mae I pool 8,00 15/05/2030 12.746 0,02%<br />

11.767 Ginnie Mae I pool 8,00 15/10/2030 13.250 0,02%<br />

579 Ginnie Mae I pool 8,00 15/11/2031 610 0,00%<br />

12.955 Ginnie Mae I pool 7,00 15/11/2032 15.121 0,02%<br />

37.211 Ginnie Mae I pool 7,00 15/01/2033 43.276 0,05%<br />

17.463 Ginnie Mae I pool 7,00 15/11/2033 20.102 0,02%<br />

60.000 GS Mortgage Securities Corp II 0,87 06/03/2020 57.948 0,07%<br />

JP Morgan Chase Commercial Mortgage<br />

Securities Corp 4,94 15/08/2042 372.972 0,46%<br />

340.000<br />

375.000 Morgan Stanley Capital I 4,99 13/08/2042 410.616 0,51%<br />

450.000 Nissan Auto Receivables Owner Trust 0,74 15/09/2014 449.857 0,56%<br />

544.800 Prudential Commercial Mortgage Trust 4,49 11/02/2036 561.264 0,69%<br />

15.000 State of Illinois 5,88 01/03/2019 16.447 0,02%<br />

112