Skandia Global Funds plc - Self Bank

Skandia Global Funds plc - Self Bank

Skandia Global Funds plc - Self Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

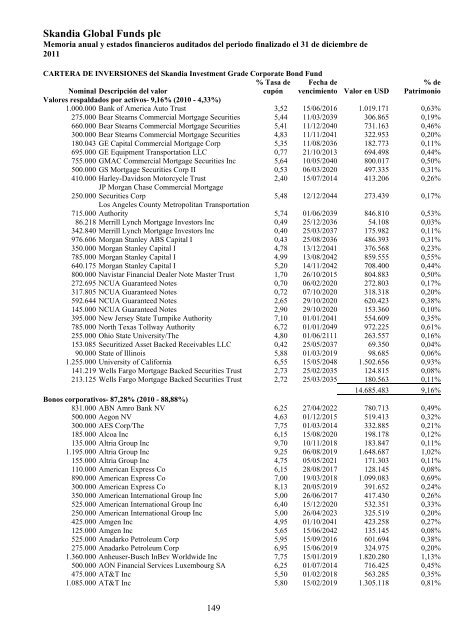

<strong>Skandia</strong> <strong>Global</strong> <strong>Funds</strong> <strong>plc</strong><br />

Memoria anual y estados financieros auditados del periodo finalizado el 31 de diciembre de<br />

2011<br />

CARTERA DE INVERSIONES del <strong>Skandia</strong> Investment Grade Corporate Bond Fund<br />

% Tasa de<br />

Nominal Descripción del valor<br />

cupón<br />

Fecha de<br />

vencimiento Valor en USD<br />

% de<br />

Patrimonio<br />

Valores respaldados por activos- 9,16% (2010 - 4,33%)<br />

1.000.000 <strong>Bank</strong> of America Auto Trust 3,52 15/06/2016 1.019.171 0,63%<br />

275.000 Bear Stearns Commercial Mortgage Securities 5,44 11/03/2039 306.865 0,19%<br />

660.000 Bear Stearns Commercial Mortgage Securities 5,41 11/12/2040 731.163 0,46%<br />

300.000 Bear Stearns Commercial Mortgage Securities 4,83 11/11/2041 322.953 0,20%<br />

180.043 GE Capital Commercial Mortgage Corp 5,35 11/08/2036 182.773 0,11%<br />

695.000 GE Equipment Transportation LLC 0,77 21/10/2013 694.498 0,44%<br />

755.000 GMAC Commercial Mortgage Securities Inc 5,64 10/05/2040 800.017 0,50%<br />

500.000 GS Mortgage Securities Corp II 0,53 06/03/2020 497.335 0,31%<br />

410.000 Harley-Davidson Motorcycle Trust 2,40 15/07/2014 413.206 0,26%<br />

JP Morgan Chase Commercial Mortgage<br />

250.000 Securities Corp 5,48 12/12/2044 273.439 0,17%<br />

Los Angeles County Metropolitan Transportation<br />

715.000 Authority 5,74 01/06/2039 846.810 0,53%<br />

86.218 Merrill Lynch Mortgage Investors Inc 0,49 25/12/2036 54.108 0,03%<br />

342.840 Merrill Lynch Mortgage Investors Inc 0,40 25/03/2037 175.982 0,11%<br />

976.606 Morgan Stanley ABS Capital I 0,43 25/08/2036 486.393 0,31%<br />

350.000 Morgan Stanley Capital I 4,78 13/12/2041 376.568 0,23%<br />

785.000 Morgan Stanley Capital I 4,99 13/08/2042 859.555 0,55%<br />

640.175 Morgan Stanley Capital I 5,20 14/11/2042 708.400 0,44%<br />

800.000 Navistar Financial Dealer Note Master Trust 1,70 26/10/2015 804.883 0,50%<br />

272.695 NCUA Guaranteed Notes 0,70 06/02/2020 272.803 0,17%<br />

317.805 NCUA Guaranteed Notes 0,72 07/10/2020 318.318 0,20%<br />

592.644 NCUA Guaranteed Notes 2,65 29/10/2020 620.423 0,38%<br />

145.000 NCUA Guaranteed Notes 2,90 29/10/2020 153.360 0,10%<br />

395.000 New Jersey State Turnpike Authority 7,10 01/01/2041 554.609 0,35%<br />

785.000 North Texas Tollway Authority 6,72 01/01/2049 972.225 0,61%<br />

255.000 Ohio State University/The 4,80 01/06/2111 263.557 0,16%<br />

153.085 Securitized Asset Backed Receivables LLC 0,42 25/05/2037 69.350 0,04%<br />

90.000 State of Illinois 5,88 01/03/2019 98.685 0,06%<br />

1.255.000 University of California 6,55 15/05/2048 1.502.656 0,93%<br />

141.219 Wells Fargo Mortgage Backed Securities Trust 2,73 25/02/2035 124.815 0,08%<br />

213.125 Wells Fargo Mortgage Backed Securities Trust 2,72 25/03/2035 180.563 0,11%<br />

14.685.483 9,16%<br />

Bonos corporativos- 87,28% (2010 - 88,88%)<br />

831.000 ABN Amro <strong>Bank</strong> NV 6,25 27/04/2022 780.713 0,49%<br />

500.000 Aegon NV 4,63 01/12/2015 519.413 0,32%<br />

300.000 AES Corp/The 7,75 01/03/2014 332.885 0,21%<br />

185.000 Alcoa Inc 6,15 15/08/2020 198.178 0,12%<br />

135.000 Altria Group Inc 9,70 10/11/2018 183.847 0,11%<br />

1.195.000 Altria Group Inc 9,25 06/08/2019 1.648.687 1,02%<br />

155.000 Altria Group Inc 4,75 05/05/2021 171.303 0,11%<br />

110.000 American Express Co 6,15 28/08/2017 128.145 0,08%<br />

890.000 American Express Co 7,00 19/03/2018 1.099.083 0,69%<br />

300.000 American Express Co 8,13 20/05/2019 391.652 0,24%<br />

350.000 American International Group Inc 5,00 26/06/2017 417.430 0,26%<br />

525.000 American International Group Inc 6,40 15/12/2020 532.351 0,33%<br />

250.000 American International Group Inc 5,00 26/04/2023 325.519 0,20%<br />

425.000 Amgen Inc 4,95 01/10/2041 423.258 0,27%<br />

125.000 Amgen Inc 5,65 15/06/2042 135.145 0,08%<br />

525.000 Anadarko Petroleum Corp 5,95 15/09/2016 601.694 0,38%<br />

275.000 Anadarko Petroleum Corp 6,95 15/06/2019 324.975 0,20%<br />

1.360.000 Anheuser-Busch InBev Worldwide Inc 7,75 15/01/2019 1.820.280 1,13%<br />

500.000 AON Financial Services Luxembourg SA 6,25 01/07/2014 716.425 0,45%<br />

475.000 AT&T Inc 5,50 01/02/2018 563.285 0,35%<br />

1.085.000 AT&T Inc 5,80 15/02/2019 1.305.118 0,81%<br />

149