Méthodes numériques en finance

Méthodes numériques en finance

Méthodes numériques en finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

15 ELEMENTS BIBLIOGRAPHIQUES 217<br />

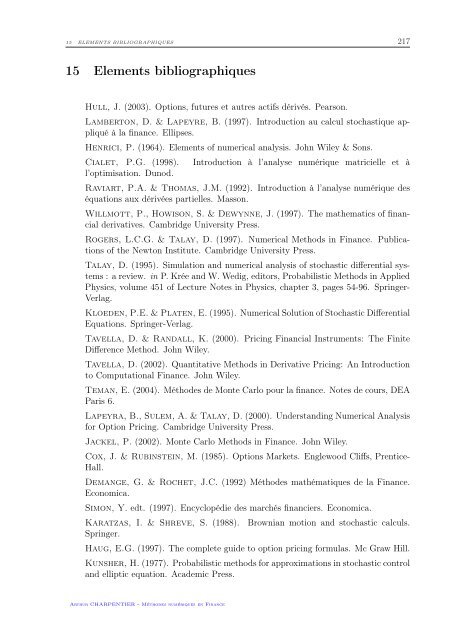

15 Elem<strong>en</strong>ts bibliographiques<br />

Hull, J. (2003). Options, futures et autres actifs dérivés. Pearson.<br />

Lamberton, D. & Lapeyre, B. (1997). Introduction au calcul stochastique appliqué<br />

à la <strong>finance</strong>. Ellipses.<br />

H<strong>en</strong>rici, P. (1964). Elem<strong>en</strong>ts of numerical analysis. John Wiley & Sons.<br />

Cialet, P.G. (1998). Introduction à l’analyse numérique matricielle et à<br />

l’optimisation. Dunod.<br />

Raviart, P.A. & Thomas, J.M. (1992). Introduction à l’analyse numérique des<br />

équations aux dérivées partielles. Masson.<br />

Willmott, P., Howison, S. & Dewynne, J. (1997). The mathematics of financial<br />

derivatives. Cambridge University Press.<br />

Rogers, L.C.G. & Talay, D. (1997). Numerical Methods in Finance. Publications<br />

of the Newton Institute. Cambridge University Press.<br />

Talay, D. (1995). Simulation and numerical analysis of stochastic differ<strong>en</strong>tial systems<br />

: a review. in P. Krée and W. Wedig, editors, Probabilistic Methods in Applied<br />

Physics, volume 451 of Lecture Notes in Physics, chapter 3, pages 54-96. Springer-<br />

Verlag.<br />

Kloed<strong>en</strong>, P.E. & Plat<strong>en</strong>, E. (1995). Numerical Solution of Stochastic Differ<strong>en</strong>tial<br />

Equations. Springer-Verlag.<br />

Tavella, D. & Randall, K. (2000). Pricing Financial Instrum<strong>en</strong>ts: The Finite<br />

Differ<strong>en</strong>ce Method. John Wiley.<br />

Tavella, D. (2002). Quantitative Methods in Derivative Pricing: An Introduction<br />

to Computational Finance. John Wiley.<br />

Teman, E. (2004). Méthodes de Monte Carlo pour la <strong>finance</strong>. Notes de cours, DEA<br />

Paris 6.<br />

Lapeyra, B., Sulem, A. & Talay, D. (2000). Understanding Numerical Analysis<br />

for Option Pricing. Cambridge University Press.<br />

Jackel, P. (2002). Monte Carlo Methods in Finance. John Wiley.<br />

Cox, J. & Rubinstein, M. (1985). Options Markets. Englewood Cliffs, Pr<strong>en</strong>tice-<br />

Hall.<br />

Demange, G. & Rochet, J.C. (1992) Méthodes mathématiques de la Finance.<br />

Economica.<br />

Simon, Y. edt. (1997). Encyclopédie des marchés financiers. Economica.<br />

Karatzas, I. & Shreve, S. (1988).<br />

Springer.<br />

Brownian motion and stochastic calculs.<br />

Haug, E.G. (1997). The complete guide to option pricing formulas. Mc Graw Hill.<br />

Kunsher, H. (1977). Probabilistic methods for approximations in stochastic control<br />

and elliptic equation. Academic Press.<br />

Arthur CHARPENTIER - Méthodes numériques <strong>en</strong> Finance