Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

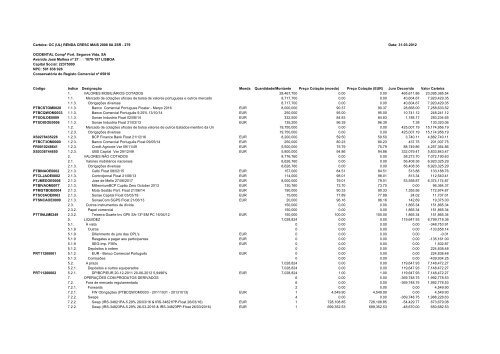

<strong>Carteira</strong>: <strong>OC</strong> (UL) RENDA CRESC MAIS 2008 8A 2SR - 279 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS 28,467,700 0.00 0.00 465,611.86 23,095,385.54<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 8,717,700 0.00 0.00 40,604.67 7,920,429.35<br />

1.1.3. Obrigações diversas 8,717,700 0.00 0.00 40,604.67 7,920,429.35<br />

PTBCSTOM0028 1.1.3. Banco Comercial Portugues Floater - Março 2016 EUR 8,000,000 90.37 90.37 28,668.00 7,258,633.52<br />

PTBCQWOM0<strong>03</strong>3 1.1.3. Banco Comercial Português 9.25% 13/10/14 EUR 250,000 95.00 95.00 10,741.12 248,241.12<br />

PTSOILOE0009 1.1.3. Sonae Industria Float 02/08/14 EUR 332,500 84.83 84.83 1,188.17 283,234.65<br />

PTSOIGOE0006 1.1.3. Sonae Industria Float <strong>31</strong>/<strong>03</strong>/13 EUR 135,200 96.39 96.39 7.38 130,320.06<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 19,750,000 0.00 0.00 425,007.19 15,174,956.19<br />

1.2.3. Obrigações diversas 19,750,000 0.00 0.00 425,007.19 15,174,956.19<br />

XS0278435226 1.2.3. BCP Finance Bank Float 21/12/16 EUR 8,200,000 59.50 59.50 3,740.11 4,882,740.11<br />

PTBCT3OM0000 1.2.3. Banco Comercial Português Float 09/05/14 EUR 250,000 80.23 80.23 437.75 201,007.75<br />

FR0010248641 1.2.3. Credit Agricole Var 09/11/49 EUR 5,500,000 75.79 75.79 88,749.86 4,257,364.86<br />

XS<strong>03</strong>36744650 1.2.3. UBS Capital Var 29/12/49 EUR 5,800,000 94.86 94.86 332,079.47 5,833,843.47<br />

2. VALORES NÃO COTADOS 8,776,760 0.00 0.00 58,273.70 7,072,190.63<br />

2.1. Valores mobiliários nacionais 8,626,760 0.00 0.00 56,408.36 6,920,325.29<br />

2.1.3. Obrigações diversas 8,626,760 0.00 0.00 56,408.36 6,920,325.29<br />

PTBINAOE0002 2.1.3. Celbi Float 08/02/15 EUR 157,000 84.51 84.51 513.88 133,188.76<br />

PTCLJAOE0002 2.1.3. Controljornal Float 21/06/13 EUR 114,000 98.01 98.01 813.34 112,540.41<br />

PTJMEDOE0006 2.1.3. Jose de Mello 27/06/2017 EUR 8,000,000 79.01 79.01 53,558.87 6,374,174.87<br />

PTBIVAOM0077 2.1.3. MillenniumBCP Cupão Zero October 2013 EUR 130,760 73.70 73.70 0.00 96,364.37<br />

PTMGTBOE0004 2.1.3. Mota Gestão Part. Float 21/06/14 EUR 190,000 90.33 90.33 1,355.56 172,974.87<br />

PTSC0AOE0063 2.1.3. Sonae Capital Float <strong>03</strong>/<strong>03</strong>/18 EUR 15,000 77.89 77.89 24.02 11,707.01<br />

PTSNCAOE0009 2.1.3. SonaeCom SGPS Float 21/06/13 EUR 20,000 96.16 96.16 142.69 19,375.00<br />

2.3. Outros instrumentos de dívida 150,000 0.00 0.00 1,865.34 151,865.34<br />

2.3.2. Papel comercial 150,000 0.00 0.00 1,865.34 151,865.34<br />

PTTI9AJM0249 2.3.2. Teixeira Duarte Inv GPII SA-13ª EM PC 16/04/12 EUR 150,000 100.00 100.00 1,865.34 151,865.34<br />

5. LIQUIDEZ 7,028,824 0.00 0.00 119,647.93 6,799,718.36<br />

5.1. À vista 0 0.00 0.00 0.00 -348,753.91<br />

5.1.9 Outros 0 0.00 0.00 0.00 -133,658.14<br />

5.1.9 Diferimento do juro das OPL's EUR 0 0.00 0.00 0.00 -0.01<br />

5.1.9 Resgates a pagar aos participantes EUR 0 0.00 0.00 0.00 -135,161.00<br />

5.1.9 SEG-Imp. FIM's EUR 0 0.00 0.00 0.00 1,502.87<br />

5.1.2. Depósitos à ordem 0 0.00 0.00 0.00 224,838.48<br />

PRT11200001 5.1.2. EUR - Banco Comercial Português EUR 0 0.00 0.00 0.00 224,838.48<br />

5.1.3. Comissões 0 0.00 0.00 0.00 -439,934.25<br />

5.2. A prazo 7,028,824 0.00 0.00 119,647.93 7,148,472.27<br />

5.2.1. Depósitos e outros equiparados 7,028,824 0.00 0.00 119,647.93 7,148,472.27<br />

PRT11200002 5.2.1. DP/BCP/EUR 20-12-2011 20-06-2012 5,9496% EUR 7,028,824 1.00 1.00 119,647.93 7,148,472.27<br />

7. OPERAÇÕES COM PRODUTOS DERIVADOS 6 0.00 0.00 -369,748.75 1,992,778.53<br />

7.2. Fora de mercado regulamentado 6 0.00 0.00 -369,748.75 1,992,778.53<br />

7.2.1. Forwards 2 0.00 0.00 0.00 4,549.90<br />

7.2.1. FW Obrigações (PTBCQWOM0<strong>03</strong>3 - 201110<strong>31</strong> - 201<strong>31</strong>013) EUR 1 4,549.90 4,549.90 0.00 4,549.90<br />

7.2.2. Swaps 4 0.00 0.00 -369,748.75 1,988,228.63<br />

7.2.2. Swap (IRS-34821PA-5.29% 26/<strong>03</strong>/16 & IRS-34821PP-Float 26/<strong>03</strong>/16) EUR 1 728,108.85 728,108.85 -54,429.77 673,679.08<br />

7.2.2. Swap (IRS-34823PA-5.29% 26-<strong>03</strong>-2016 & IRS-34823PP-Float 26/<strong>03</strong>/2016) EUR 1 699,352.53 699,352.53 -48,670.00 650,682.53