Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

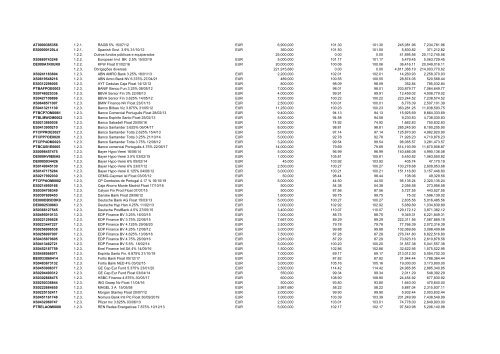

AT000<strong>03</strong>85356 1.2.1. RAGB 5% 15/07/12 EUR 6,900,000 101.30 101.30 245,081.96 7,234,781.96<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 360,000 101.50 101.50 5,830.82 371,212.82<br />

1.2.2. Outros fundos públicos e equiparados 25,000,000 0.00 0.00 41,895.56 25,112,745.56<br />

XS0669743246 1.2.2. European Invt BK 2.5% 15/<strong>03</strong>/19 EUR 5,000,000 101.17 101.17 5,479.45 5,063,729.45<br />

DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 20,000,000 100.06 100.06 36,416.11 20,049,016.11<br />

1.2.3. Obrigações diversas 221,915,680 0.00 0.00 4,811,366.19 214,0<strong>03</strong>,770.62<br />

XS0241183804 1.2.3. ABN AMRO Bank 3.25% 18/01/13 EUR 2,200,000 102.01 102.01 14,260.93 2,258,370.93<br />

XS0619548216 1.2.3. ABN Amro Bank NV 6.375% 27/04/21 EUR 489,000 100.55 100.55 28,874.05 520,568.44<br />

ES0<strong>31</strong>2298005 1.2.3. AYT Cedulas Caja Float 14/12/12 EUR 800,000 98.09 98.09 352.84 785,<strong>03</strong>2.84<br />

PTBAFPOE00<strong>03</strong> 1.2.3. BANIF Banco Fun 3.25% 08/05/12 EUR 7,000,000 98.01 98.01 2<strong>03</strong>,879.77 7,064,649.77<br />

XS0746025336 1.2.3. BBVA Senior Fin 3% 22/08/13 EUR 4,000,000 99.91 99.91 12,459.02 4,008,779.02<br />

XS0427109896 1.2.3. BBVA Senior Fin 3.625% 14/05/12 EUR 7,000,000 100.22 100.22 223,244.52 7,238,574.52<br />

XS0648571007 1.2.3. BMW Finance NV Float 23/01/13 EUR 2,500,000 100.01 100.01 6,776.39 2,507,101.39<br />

ES0413211139 1.2.3. Banco Bilbao Viz 3.875% <strong>31</strong>/05/12 EUR 11,250,000 100.23 100.23 363,281.25 11,638,593.75<br />

PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 9,400,000 94.13 94.13 15,925.69 8,864,333.69<br />

PTBLMWOM0002 1.2.3. Banco Espírito Santo Float 25/02/13 EUR 5,000,000 94.58 94.58 9,230.83 4,738,<strong>03</strong>0.83<br />

ES0213860<strong>03</strong>6 1.2.3. Banco Sabadell Float 25/05/16 EUR 1,000,000 74.92 74.92 1,662.83 750,832.83<br />

ES0413900210 1.2.3. Banco Santander 3.625% 06/04/17 EUR 8,000,000 98.81 98.81 285,245.90 8,190,205.90<br />

PTCPPROE0027 1.2.3. Banco Santander Totta 2.625% 15/4/13 EUR 5,000,000 97.14 97.14 125,870.90 4,982,920.90<br />

PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 5,000,000 92.78 92.78 71,926.23 4,710,876.23<br />

PTCPP4OM0023 1.2.3. Banco Santander Totta 3.75% 12/06/12 EUR 3,200,000 99.54 99.54 96,065.57 3,281,473.57<br />

PTBCUB1E0005 1.2.3. Banco comercial Português 4.75% 22/06/17 EUR 14,000,000 79.69 79.69 514,193.99 11,670,908.87<br />

XS0098457475 1.2.3. Bayer Hypo-Verei 16/06/14 EUR 5,000,000 96.99 96.99 140,486.08 4,990,136.08<br />

DE000HV0EBA5 1.2.3. Bayer Hypo-Verei 3.5% <strong>03</strong>/02/15 EUR 1,000,000 105.81 105.81 5,450.82 1,063,550.82<br />

DE0005934426 1.2.3. Bayer Hypo-Verei 6% 05/02/14 EUR 45,000 1<strong>03</strong>.92 1<strong>03</strong>.92 405.74 47,170.19<br />

XS0149945130 1.2.3. Bayer Hypo-Verei 6% 23/07/12 EUR 2,500,000 100.27 100.27 1<strong>03</strong>,278.68 2,609,953.68<br />

XS0147175284 1.2.3. Bayer Hypo-Verei 6.125% 04/06/12 EUR 3,000,000 100.21 100.21 151,116.80 3,157,446.80<br />

XS0217992<strong>03</strong>0 1.2.3. CEMG-Cayman Isl Float <strong>03</strong>/05/12 EUR 50,000 98.44 98.44 108.06 49,329.56<br />

PTCFPAOM0002 1.2.3. CP Comboios de Portugal 4.17 % 16/10/19 EUR 5,000,000 44.50 44.50 95,135.24 2,320,135.24<br />

ES0214950166 1.2.3. Caja Ahorro Monte Madrid Float 17/10/16 EUR 500,000 54.38 54.38 2,056.58 273,956.58<br />

XS<strong>03</strong>04708349 1.2.3. Calyon Fin Prod Float 07/07/15 EUR 500,000 87.56 87.56 5,727.55 443,527.55<br />

XS<strong>03</strong>07699453 1.2.3. Danske Bank Float 29/06/12 EUR 1,600,000 99.75 99.75 75.02 1,596,139.02<br />

DE000DB5DDK9 1.2.3. Deutsche Bank AG Float 15/<strong>03</strong>/13 EUR 5,000,000 100.27 100.27 2,835.56 5,016,485.56<br />

DE0002539863 1.2.3. Deutsche Hyp Han 4.25% 11/02/13 EUR 1,000,000 102.92 102.92 5,689.89 1,<strong>03</strong>4,839.89<br />

XS<strong>03</strong>66127545 1.2.3. Deutsche PostBank 4.5% 27/05/15 EUR 3,400,000 110.07 110.07 129,172.12 3,871,382.12<br />

XS0495010133 1.2.3. EDP Finance BV 3.25% 16/<strong>03</strong>/15 EUR 7,000,000 88.75 88.75 9,349.<strong>31</strong> 6,221,849.<strong>31</strong><br />

XS0221295628 1.2.3. EDP Finance BV 3.75% 22/06/15 EUR 7,667,000 89.29 89.29 222,<strong>31</strong>1.56 7,067,869.18<br />

XS0223447227 1.2.3. EDP Finance BV 4.125% 29/06/20 EUR 2,500,000 79.78 79.78 77,766.39 2,072,<strong>31</strong>6.39<br />

XS0256996538 1.2.3. EDP Finance BV 4.25% 12/06/12 EUR 3,000,000 99.88 99.88 102,069.66 3,098,409.66<br />

XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 7,500,000 87.28 87.28 276,741.80 6,822,516.80<br />

XS0435879605 1.2.3. EDP Finance BV 4.75% 26/09/16 EUR 2,910,000 87.29 87.29 70,623.16 2,610,878.56<br />

XS0413462721 1.2.3. EDP Finance BV 5.5% 18/02/14 EUR 5,000,000 100.20 100.20 <strong>31</strong>,557.38 5,041,557.38<br />

XS0452187759 1.2.3. Enel Finance Intl SA 4% 14/09/16 EUR 1,500,000 102.86 102.86 32,622.95 1,575,522.95<br />

XS0458566071 1.2.3. Espirito Santo Fin. 6.875% 21/10/19 EUR 7,000,000 69.17 69.17 213,012.30 5,054,702.30<br />

BE0933860414 1.2.3. Fortis Bank Float 05/12/17 EUR 2,000,000 87.82 87.82 <strong>31</strong>,944.44 1,788,364.44<br />

XS048367<strong><strong>31</strong>3</strong>2 1.2.3. Fortis Bank NED 4% <strong>03</strong>/02/15 EUR 3,000,000 105.16 105.16 19,000.00 3,173,800.00<br />

XS0453908377 1.2.3. GE Cap Eur Fund 5.375% 23/01/20 EUR 2,500,000 114.42 114.42 24,965.85 2,885,340.85<br />

XS0294490<strong>31</strong>2 1.2.3. GE Cap Eur Fund Float <strong>03</strong>/04/14 EUR 550,000 99.34 99.34 2,011.29 548,392.29<br />

XS<strong>03</strong>02868475 1.2.3. HSBC Finance 4.875% 30/05/17 EUR 600,000 108.90 108.90 24,454.92 677,830.92<br />

XS025<strong>03</strong>38844 1.2.3. ING Groep Nv Float 11/04/16 EUR 500,000 93.80 93.80 1,640.00 470,640.00<br />

XS0222684655 1.2.3. MAGEL 3 A 15/05/58 EUR 3,967,680 58.22 58.22 5,887.04 2,<strong>31</strong>5,937.11<br />

XS0225152411 1.2.3. Morgan Stanley Float 20/07/12 EUR 2,000,000 99.90 99.90 5,932.44 2,0<strong>03</strong>,832.44<br />

XS0451161748 1.2.3. Nomura Bank Intl Plc Float 30/09/2019 EUR 7,000,000 1<strong>03</strong>.39 1<strong>03</strong>.39 201,249.99 7,438,549.99<br />

XS0432069747 1.2.3. Pfizer Inc 3.625% <strong>03</strong>/06/13 EUR 2,500,000 1<strong>03</strong>.01 1<strong>03</strong>.01 74,778.00 2,649,9<strong>03</strong>.00<br />

PTRELAOM0000 1.2.3. REN Redes Energeticas 7.875% 10/12/13 EUR 5,000,000 102.17 102.17 97,540.98 5,206,140.98