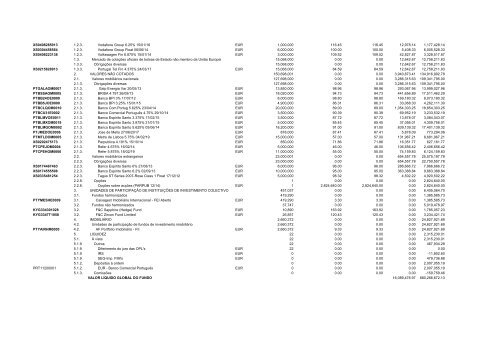

PTCPP4OM0023 1.2.3. Banco Santander Totta 3.75% 12/06/12 EUR 3,500,000 99.54 99.54 105,071.71 3,589,111.71 DE0005934426 1.2.3. Bayer Hypo-Verei 6% 05/02/14 EUR 5,000,000 1<strong>03</strong>.92 1<strong>03</strong>.92 45,081.97 5,241,1<strong>31</strong>.97 XS0495145657 1.2.3. Boligkreditt 3.25% 17/<strong>03</strong>/17 EUR 7,000,000 105.58 105.58 8,726.<strong>03</strong> 7,399,116.<strong>03</strong> PTBRIHOM0001 1.2.3. Brisa 4.5% 05/12/16 EUR 6,400,000 79.23 79.23 92,065.57 5,162,849.57 XS0217992<strong>03</strong>0 1.2.3. CEMG-Cayman Isl Float <strong>03</strong>/05/12 EUR 1,300,000 98.44 98.44 2,809.62 1,282,568.62 XS0250907218 1.2.3. CEMG-Cayman Island Float 18/04/16 EUR 3,000,000 53.88 53.88 13,213.00 1,629,715.00 PTCFPAOM0002 1.2.3. CP Comboios de Portugal 4.17 % 16/10/19 EUR 5,000,000 44.50 44.50 95,135.24 2,320,135.24 XS<strong>03</strong>04708349 1.2.3. Calyon Fin Prod Float 07/07/15 EUR 500,000 87.56 87.56 5,727.55 443,527.55 FR0010664599 1.2.3. Cie Fin Crd-Mutl 6.75% 18/09/18 EUR 2,500,000 115.11 115.11 89,907.78 2,967,552.78 FR0010749598 1.2.3. Cie Financiere Du Cred 5.375% 04/22/14 EUR 4,500,000 106.45 106.45 227,336.06 5,017,586.06 XS0226062981 1.2.3. Citigroup Inc 3.5% 05/08/15 EUR 5,000,000 101.77 101.77 114,275.95 5,202,725.95 DE000A0T5SE6 1.2.3. Daimler Intl Fin 7.875% 16/01/14 EUR 7,000,000 111.25 111.25 112,961.06 7,900,461.06 XS<strong>03</strong>66127545 1.2.3. Deutsche PostBank 4.5% 27/05/15 EUR 1,500,000 110.07 110.07 56,987.70 1,707,962.70 XS0525787874 1.2.3. Deutsche Tel Int Fin 4.25% 07/13/22 EUR 5,000,000 110.10 110.10 152,117.48 5,657,117.48 XS0495010133 1.2.3. EDP Finance BV 3.25% 16/<strong>03</strong>/15 EUR 6,000,000 88.75 88.75 8,013.70 5,333,013.70 XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 5,000,000 87.28 87.28 184,494.54 4,548,344.54 XS0435879605 1.2.3. EDP Finance BV 4.75% 26/09/16 EUR 17,000,000 87.29 87.29 412,575.13 15,252,555.13 XS0413462721 1.2.3. EDP Finance BV 5.5% 18/02/14 EUR 6,000,000 100.20 100.20 37,868.85 6,049,868.85 XS0586598350 1.2.3. EDP Finance BV 5.875% 01/02/16 EUR 9,200,000 91.71 91.71 87,129.78 8,524,449.78 XS0451457435 1.2.3. ENI SPA 4.125% 16/09/19 EUR 5,000,000 105.21 105.21 111,014.34 5,371,414.34 XS0411044653 1.2.3. ENI SPA 5% 28/01/16 EUR 1,500,000 109.52 109.52 12,909.84 1,655,724.84 XS0260783005 1.2.3. Erste Bank Float 19/07/17 EUR 1,000,000 90.00 90.00 3,226.00 9<strong>03</strong>,226.00 XS0458566071 1.2.3. Espirito Santo Fin. 6.875% 21/10/19 EUR 9,000,000 69.17 69.17 273,872.95 6,498,902.95 BE0933860414 1.2.3. Fortis Bank Float 05/12/17 EUR 500,000 87.82 87.82 7,986.11 447,091.11 XS048367<strong><strong>31</strong>3</strong>2 1.2.3. Fortis Bank NED 4% <strong>03</strong>/02/15 EUR 3,000,000 105.16 105.16 19,000.00 3,173,800.00 XS0219927802 1.2.3. GE Cap EUR Fund Float 25/05/12 EUR 1,900,000 100.07 100.07 1,983.76 1,9<strong>03</strong>,237.76 XS0453908377 1.2.3. GE Cap Eur Fund 5.375% 23/01/20 EUR 2,500,000 114.42 114.42 24,965.85 2,885,340.85 XS<strong>03</strong>02868475 1.2.3. HSBC Finance 4.875% 30/05/17 EUR 1,000,000 108.90 108.90 40,758.20 1,129,718.20 XS0272672113 1.2.3. Hsbc Bank Plc Float 28/10/13 EUR 1,000,000 98.70 98.70 2,341.72 989,371.72 XS0218080082 1.2.3. Hypo Alpe-Adria Float 19/06/15 EUR 5,000,000 17.87 17.87 2,053.33 895,3<strong>03</strong>.33 XS0497141142 1.2.3. ING Bank NV 3.375% 23/<strong>03</strong>/17 EUR 8,000,000 106.54 106.54 5,917.81 8,529,197.81 XS025<strong>03</strong>38844 1.2.3. ING Groep Nv Float 11/04/16 EUR 1,000,000 93.80 93.80 3,280.00 941,280.00 XS0275896933 1.2.3. KION 2006-1 A 15/07/51 EUR 467,860 57.50 57.50 1,359.72 270,379.38 XS0275897<strong>31</strong>1 1.2.3. KION 2006-1 B 15/07/51 EUR 544,829 12.50 12.50 1,719.62 69,823.20 XS0422705128 1.2.3. Lloyds TSB Bank Float 04/15/14 EUR 600,000 104.11 104.11 5,9<strong>31</strong>.25 630,591.25 XS0222684655 1.2.3. MAGEL 3 A 15/05/58 EUR 4,761,216 58.22 58.22 7,064.45 2,779,124.54 XS0222691510 1.2.3. MAGEL 3 B 15/05/58 EUR 499,198 41.09 41.09 778.12 205,922.53 XS0260784821 1.2.3. MAGEL 4 B 20/07/59 EUR 1,466,208 36.46 36.46 4,0<strong>31</strong>.01 538,610.25 XS0260787840 1.2.3. MAGEL 4 C 20/07/59 EUR 1,466,208 <strong>31</strong>.69 <strong>31</strong>.69 4,262.35 468,9<strong>03</strong>.52 XS<strong>03</strong>0263<strong>31</strong>68 1.2.3. Merrill Lynch 4.875% 30/05/14 EUR 10,000,000 1<strong>03</strong>.69 1<strong>03</strong>.69 407,581.96 10,776,281.96 XS0451161748 1.2.3. Nomura Bank Intl Plc Float 30/09/2019 EUR 5,000,000 1<strong>03</strong>.39 1<strong>03</strong>.39 143,750.00 5,<strong><strong>31</strong>3</strong>,250.00 XS0296761785 1.2.3. PEARL 22 B1 12/30/14 EUR 1,000,000 0.00 0.00 46.86 46.86 XS0173793216 1.2.3. Polo III - CP Fin 4.7% 29/07/15 EUR 1,000,000 66.50 66.50 <strong>31</strong>,590.16 696,638.16 XS0462994343 1.2.3. Portugal Tel Fin 5 11/04/19 EUR 5,000,000 77.50 77.50 101,092.89 3,976,142.89 XS0426126180 1.2.3. Portugal Tel Fin 6% 30/04/13 EUR 15,000,000 101.57 101.57 826,229.48 16,061,129.48 PTRELAOM0000 1.2.3. REN Redes Energeticas 7.875% 10/12/13 EUR 8,600,000 102.17 102.17 167,770.48 8,954,562.48 XS05<strong>03</strong>734872 1.2.3. RaboBank Nederland 3.375% 21/04/17 EUR 5,000,000 1<strong>03</strong>.73 1<strong>03</strong>.73 159,067.62 5,345,517.62 XS0426090485 1.2.3. RaboBank Nederland 4.375% 05/05/16 EUR 15,000,000 107.84 107.84 593,493.85 16,769,193.85 XS0429484891 1.2.3. RaboBank Nederland 5.875% 20/05/19 EUR 4,000,000 111.57 111.57 202,896.17 4,665,496.17 XS0214446188 1.2.3. Refer 4% 16/<strong>03</strong>/15 EUR 5,500,000 59.50 59.50 9,041.10 3,281,541.10 XS0491856265 1.2.3. Santander Intl 3.5% 10/<strong>03</strong>/15 EUR 1,400,000 99.32 99.32 2,819.18 1,393,229.18 XS0477243843 1.2.3. Santander Intl Float 18/01/13 EUR 1,500,000 99.27 99.27 5,085.67 1,494,165.67 XS0410258833 1.2.3. Telefonica 5.4<strong>31</strong>% <strong>03</strong>/02/14 EUR 1,500,000 104.86 104.86 12,687.17 1,585,617.17 XS050<strong>03</strong><strong>31</strong>557 1.2.3. UBS AG London 4% 08/04/22 EUR 10,000,000 109.79 109.79 391,256.80 11,369,756.80 XS0497362748 1.2.3. Vale SA 4.375% 24/<strong>03</strong>/18 EUR 1,000,000 107.34 107.34 839.04 1,074,219.04

XS0408285913 1.2.3. Vodafone Group 6.25% 15/01/16 EUR 1,000,000 116.45 116.45 12,978.14 1,177,428.14 XS<strong>03</strong>04458564 1.2.3. Vodafone Group Float 06/06/14 EUR 6,000,000 100.00 100.00 5,408.33 6,005,528.33 XS040822<strong><strong>31</strong>3</strong>8 1.2.3. Volkswagen Fin 6.875% 15/01/14 EUR 3,000,000 109.52 109.52 42,827.87 3,328,517.87 1.3. Mercado de cotações oficiais de bolsas de Estado não membro da União Europei 15,068,000 0.00 0.00 12,642.67 12,758,211.83 1.3.3. Obrigações diversas 15,068,000 0.00 0.00 12,642.67 12,758,211.83 XS0215828913 1.3.3. Portugal Tel Fin 4.375% 24/<strong>03</strong>/17 EUR 15,068,000 84.59 84.59 12,642.67 12,758,211.83 2. VALORES NÃO COTADOS 150,698,001 0.00 0.00 3,940,873.41 134,916,992.78 2.1. Valores mobiliários nacionais 127,698,000 0.00 0.00 3,286,<strong>31</strong>5.63 109,341,795.00 2.1.3. Obrigações diversas 127,698,000 0.00 0.00 3,286,<strong>31</strong>5.63 109,341,795.00 PTGALAOM0007 2.1.3. Galp Energia Var 20/05/13 EUR 13,850,000 98.96 98.96 293,067.96 13,999,027.96 PTBSSAOM0005 2.1.3. BRISA 4.797 26/09/13 EUR 18,020,000 94.73 94.73 441,656.89 17,511,462.29 PTBB24OE0000 2.1.3. Banco BPI 3% 17/07/12 EUR 8,000,000 98.80 98.80 169,180.32 8,073,180.32 PTBB5JOE0000 2.1.3. Banco BPI 3.25% 15/01/15 EUR 4,900,000 86.<strong>31</strong> 86.<strong>31</strong> 33,068.30 4,262,111.30 PTBCLQOM0010 2.1.3. Banco Com Portug 5.625% 23/04/14 EUR 20,000,000 89.00 89.00 1,054,3<strong>03</strong>.25 18,854,3<strong>03</strong>.25 PTBCU<strong>31</strong>E0002 2.1.3. Banco Comercial Português 4.75% 29/10/14 EUR 3,500,000 90.39 90.39 69,952.19 3,233,532.19 PTBLMVOE0011 2.1.3. Banco Espirito Santo 3.375% 17/02/15 EUR 3,500,000 87.72 87.72 13,878.07 3,084,043.07 PTBLMXOM0019 2.1.3. Banco Espirito Santo 3.875% 21/01/15 EUR 5,000,000 85.45 85.45 37,056.01 4,309,756.01 PTBLMGOM0002 2.1.3. Banco Espirito Santo 5.625% 05/06/14 EUR 18,200,000 91.00 91.00 839,139.32 17,401,139.32 PTJMEDOE0006 2.1.3. Jose de Mello 27/06/2017 EUR 878,000 87.41 87.41 5,878.09 773,294.06 PTMTLDOM0005 2.1.3. Metro de Lisboa 5.75% 04/02/19 EUR 15,000,000 57.00 57.00 1<strong>31</strong>,967.21 8,681,967.21 XS0202475173 2.1.3. Parpublica 4.191% 15/10/14 EUR 850,000 71.86 71.86 16,351.77 627,161.77 PTCPEJOM0004 2.1.3. Refer 4.675% 16/02/14 EUR 5,000,000 46.00 46.00 106,656.42 2,406,656.42 PTCPEHOM0006 2.1.3. Refer 5.875% 18/02/19 EUR 11,000,000 55.00 55.00 74,159.83 6,124,159.83 2.2. Valores mobiliários estrangeiros 23,000,001 0.00 0.00 654,557.78 25,575,197.78 2.2.3. Obrigações diversas 23,000,000 0.00 0.00 654,557.78 22,750,557.78 XS0174467463 2.2.3. Banco Espirito Santo 6% 27/08/13 EUR 8,000,000 96.00 96.00 286,666.72 7,966,666.72 XS0174555598 2.2.3. Banco Espirito Santo 6.2% 02/09/13 EUR 10,000,000 95.00 95.00 363,388.84 9,863,388.84 XS<strong>03</strong>35481254 2.2.3. Tagus ST Series 2007-Rose Class 1 Float 17/12/12 EUR 5,000,000 98.32 98.32 4,502.22 4,920,502.22 2.2.8. Opções 1 0.00 0.00 0.00 2,824,640.00 2.2.8. Opções sobre acções (PARPUB 12/14) EUR 1 2,824,640.00 2,824,640.00 0.00 2,824,640.00 3. UNIDADES DE PARTICIPAÇÃO DE INSTITUIÇÕES DE INVESTIMENTO COLECTIVO 457,<strong>03</strong>7 0.00 0.00 0.00 6,405,064.70 3.1. Fundos harmonizados 419,290 0.00 0.00 0.00 1,385,585.73 PTYMESHE0009 3.1. Caixagest Imobiliário Internacional - FEI Aberto EUR 419,290 3.30 3.30 0.00 1,385,585.73 3.2. Fundos não harmonizados 37,747 0.00 0.00 0.00 5,019,478.97 KYG334301028 3.2. F&C Sapphire (Hedge) Fund EUR 10,890 163.92 163.92 0.00 1,785,057.23 KYG3347T1058 3.2. F&C Zircon Fund Limited EUR 26,857 120.43 120.43 0.00 3,234,421.74 4. IMOBILIÁRIO 2,660,372 0.00 0.00 0.00 24,827,921.69 4.2. Unidades de participação de fundos de investimento imobiliário 2,660,372 0.00 0.00 0.00 24,827,921.69 PTYAIRHM0000 4.2. AF Portfólio Imobiliário - FII EUR 2,660,372 9.33 9.33 0.00 24,827,921.69 5. LIQUIDEZ 22 0.00 0.00 0.00 2,<strong>31</strong>5,230.01 5.1. À vista 22 0.00 0.00 0.00 2,<strong>31</strong>5,230.01 5.1.9 Outros 22 0.00 0.00 0.00 467,934.28 5.1.9 Diferimento do juro das OPL's EUR 22 0.00 0.00 0.00 0.00 5.1.9 IRS EUR 0 0.00 0.00 0.00 -11,802.60 5.1.9 SEG-Imp. FIM's EUR 0 0.00 0.00 0.00 479,736.88 5.1.2. Depósitos à ordem 0 0.00 0.00 0.00 2,007,055.19 PRT11200001 5.1.2. EUR - Banco Comercial Português EUR 0 0.00 0.00 0.00 2,007,055.19 5.1.3. Comissões 0 0.00 0.00 0.00 -159,759.46 VALOR LÍQUIDO GLOBAL DO FUNDO 16,089,476.97 680,266,672.13