Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

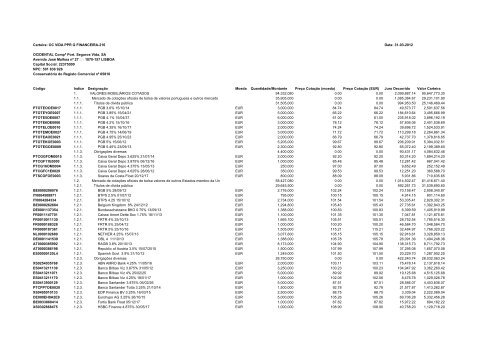

<strong>Carteira</strong>: <strong>OC</strong> VIDA PPR G FINANCEIRA-216 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS 94,332,080 0.00 0.00 2,099,887.14 90,647,773.30<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 35,905,000 0.00 0.00 1,085,384.67 29,2<strong>31</strong>,101.90<br />

1.1.1. Títulos de dívida pública <strong>31</strong>,505,000 0.00 0.00 994,953.50 25,146,469.44<br />

PTOTEOOE0017 1.1.1. PGB 3.6% 15/10/14 EUR 3,000,000 84.74 84.74 49,573.77 2,591,637.56<br />

PTOTEYOE0007 1.1.1. PGB 3.85% 15/04/21 EUR 5,000,000 66.22 66.22 184,610.64 3,495,666.99<br />

PTOTE5OE0007 1.1.1. PGB 4.1% 15/04/37 EUR 6,000,000 61.00 61.00 235,918.02 3,896,192.19<br />

PTOTE6OE0006 1.1.1. PGB 4.2% 15/10/16 EUR 3,000,000 78.12 78.12 57,836.06 2,401,538.69<br />

PTOTELOE0010 1.1.1. PGB 4.35% 16/10/17 EUR 2,000,000 74.24 74.24 39,696.72 1,524,533.91<br />

PTOTEMOE0027 1.1.1. PGB 4.75% 14/06/19 EUR 3,000,000 71.72 71.72 113,299.18 2,264,861.34<br />

PTOTEAOE0021 1.1.1. PGB 4.95% 25/10/23 EUR 2,000,000 66.79 66.79 42,737.70 1,378,616.65<br />

PTOTEKOE00<strong>03</strong> 1.1.1. PGB 5% 15/06/12 EUR 5,205,000 99.67 99.67 206,209.01 5,394,<strong>03</strong>2.51<br />

PTOTEGOE0009 1.1.1. PGB 5.45% 23/09/13 EUR 2,300,000 92.80 92.80 65,072.40 2,199,389.60<br />

1.1.3. Obrigações diversas 4,400,000 0.00 0.00 90,4<strong>31</strong>.17 4,084,632.46<br />

PTCGGFOM0015 1.1.3. Caixa Geral Depo 3.625% 21/07/14 EUR 2,000,000 92.20 92.20 50,<strong>31</strong>4.20 1,894,214.20<br />

PTCGF11E0000 1.1.3. Caixa Geral Depo 3.875% 06/12/16 EUR 1,000,000 85.48 85.48 12,281.42 867,041.42<br />

PTCG16OM0004 1.1.3. Caixa Geral Depo 4.375% 13/05/13 EUR 250,000 97.00 97.00 9,652.49 252,152.49<br />

PTCGFC1E0029 1.1.3. Caixa Geral Depo 4.625% 28/06/12 EUR 350,000 99.53 99.53 12,251.20 360,588.70<br />

PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 800,000 88.09 88.09 5,9<strong>31</strong>.86 710,635.65<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 58,427,080 0.00 0.00 1,014,502.47 61,416,671.40<br />

1.2.1. Títulos de dívida pública 29,645,500 0.00 0.00 592,261.73 <strong>31</strong>,539,690.60<br />

BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 2,776,000 102.24 102.24 70,158.47 2,908,340.87<br />

IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 795,000 100.15 100.15 4,914.15 801,114.60<br />

IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 2,734,000 101.54 101.54 53,335.41 2,829,302.<strong>31</strong><br />

BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 1,294,800 105.43 105.43 27,735.61 1,392,843.25<br />

DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 1,388,000 100.83 100.83 6,399.59 1,405,919.99<br />

FR0011147701 1.2.1. Caisse Amort Dette Soc 1.75% 18/11/13 EUR 1,100,000 101.35 101.35 7,047.81 1,121,875.81<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 1,665,100 105.51 105.51 28,752.54 1,785,516.30<br />

FR0000188328 1.2.1. FRTR 5% 25/04/12 EUR 1,000,000 100.20 100.20 46,584.70 1,048,584.70<br />

FR0000187361 1.2.1. FRTR 5% 25/10/16 EUR 1,505,000 115.21 115.21 32,484.97 1,766,320.22<br />

NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 3,077,600 105.15 105.15 92,916.61 3,328,859.13<br />

DE0001141539 1.2.1. OBL 4 11/10/13 EUR 1,388,000 105.78 105.78 26,091.36 1,494,248.36<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 8,173,000 104.90 104.90 138,<strong>31</strong>5.73 8,711,792.73<br />

AT000<strong>03</strong>86198 1.2.1. Republic of Austria 3.5% 15/07/2015 EUR 1,500,000 107.99 107.99 37,295.08 1,657,070.08<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 1,249,000 101.50 101.50 20,229.70 1,287,902.25<br />

1.2.3. Obrigações diversas 28,750,000 0.00 0.00 422,240.74 28,<strong>03</strong>2,063.24<br />

XS0254<strong>03</strong>5768 1.2.3. ABN AMRO Bank 4.25% 11/05/16 EUR 2,000,000 1<strong>03</strong>.11 1<strong>03</strong>.11 75,478.14 2,137,618.14<br />

ES0413211139 1.2.3. Banco Bilbao Viz 3.875% <strong>31</strong>/05/12 EUR 3,250,000 100.23 100.23 104,947.92 3,362,260.42<br />

ES0413211071 1.2.3. Banco Bilbao Viz 4% 25/02/25 EUR 5,000,000 89.92 89.92 19,125.68 4,515,125.68<br />

ES0413211170 1.2.3. Banco Bilbao Viz 4.25% 18/01/17 EUR 1,000,000 102.06 102.06 8,476.78 1,029,026.78<br />

ES0413900129 1.2.3. Banco Santander 3.875% 06/02/26 EUR 5,000,000 87.51 87.51 28,586.07 4,4<strong>03</strong>,836.07<br />

PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 1,500,000 92.78 92.78 21,577.87 1,413,262.87<br />

XS0495010133 1.2.3. EDP Finance BV 3.25% 16/<strong>03</strong>/15 EUR 2,500,000 88.75 88.75 3,339.04 2,222,089.04<br />

DE000EH0A2E9 1.2.3. Eurohypo AG 3.25% 26/10/15 EUR 5,000,000 105.26 105.26 69,706.28 5,332,456.28<br />

BE0933860414 1.2.3. Fortis Bank Float 05/12/17 EUR 1,000,000 87.82 87.82 15,972.22 894,182.22<br />

XS<strong>03</strong>02868475 1.2.3. HSBC Finance 4.875% 30/05/17 EUR 1,000,000 108.90 108.90 40,758.20 1,129,718.20