Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

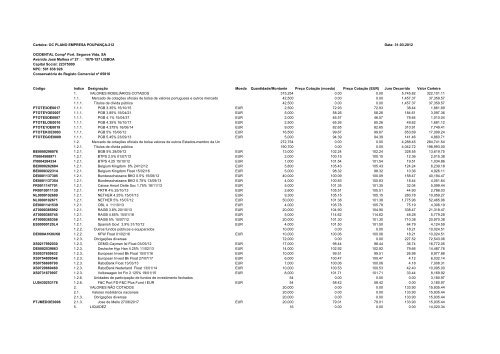

<strong>Carteira</strong>: <strong>OC</strong> PLANO EMPRESA POUPANÇA-212 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS <strong>31</strong>5,254 0.00 0.00 5,745.82 322,101.11<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 42,500 0.00 0.00 1,457.37 37,359.57<br />

1.1.1. Títulos de dívida pública 42,500 0.00 0.00 1,457.37 37,359.57<br />

PTOTE3OE0017 1.1.1. PGB 3.35% 15/10/15 EUR 2,500 72.93 72.93 38.44 1,861.69<br />

PTOTEYOE0007 1.1.1. PGB 3.85% 15/04/21 EUR 5,000 58.26 58.26 184.61 3,097.36<br />

PTOTE5OE0007 1.1.1. PGB 4.1% 15/04/37 EUR 2,000 46.57 46.57 78.64 1,010.04<br />

PTOTELOE0010 1.1.1. PGB 4.35% 16/10/17 EUR 2,500 65.26 65.26 49.62 1,681.12<br />

PTOTE1OE0019 1.1.1. PGB 4.375% 16/06/14 EUR 9,000 82.65 82.65 <strong>31</strong>0.91 7,749.41<br />

PTOTEKOE00<strong>03</strong> 1.1.1. PGB 5% 15/06/12 EUR 16,500 99.67 99.67 653.69 17,099.24<br />

PTOTEGOE0009 1.1.1. PGB 5.45% 23/09/13 EUR 5,000 94.39 94.39 141.46 4,860.71<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 272,754 0.00 0.00 4,288.45 284,741.54<br />

1.2.1. Títulos de dívida pública 190,700 0.00 0.00 4,042.72 198,993.00<br />

BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 13,000 102.24 102.24 328.55 13,619.75<br />

IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 2,000 100.15 100.15 12.36 2,015.38<br />

IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 1,000 101.54 101.54 19.51 1,<strong>03</strong>4.86<br />

BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 5,800 105.43 105.43 124.24 6,239.18<br />

BE000<strong>03</strong>22<strong>31</strong>4 1.2.1. Belgium Kingdom Float 15/02/16 EUR 5,000 98.32 98.32 10.36 4,926.11<br />

DE0001137305 1.2.1. Bundesschatzanw BKO 0.5% 15/06/12 EUR 40,000 100.09 100.09 158.47 40,194.47<br />

DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 4,000 100.83 100.83 18.44 4,051.64<br />

FR0011147701 1.2.1. Caisse Amort Dette Soc 1.75% 18/11/13 EUR 5,000 101.35 101.35 32.04 5,099.44<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 2,600 105.51 105.51 44.90 2,788.<strong>03</strong><br />

NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 9,300 105.15 105.15 280.78 10,059.27<br />

NL0000102671 1.2.1. NETHER 5% 15/07/12 EUR 50,000 101.38 101.38 1,775.96 52,465.96<br />

DE0001141539 1.2.1. OBL 4 11/10/13 EUR 4,000 105.78 105.78 75.19 4,306.19<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 20,000 104.90 104.90 338.47 21,<strong>31</strong>8.47<br />

AT000<strong>03</strong>85745 1.2.1. RAGB 4.65% 15/01/18 EUR 5,000 114.62 114.62 48.28 5,779.28<br />

AT000<strong>03</strong>85356 1.2.1. RAGB 5% 15/07/12 EUR 20,000 101.30 101.30 710.38 20,970.38<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 4,000 101.50 101.50 64.79 4,124.59<br />

1.2.2. Outros fundos públicos e equiparados 10,000 0.00 0.00 18.21 10,024.51<br />

DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 10,000 100.06 100.06 18.21 10,024.51<br />

1.2.3. Obrigações diversas 72,000 0.00 0.00 227.52 72,543.06<br />

XS0217992<strong>03</strong>0 1.2.3. CEMG-Cayman Isl Float <strong>03</strong>/05/12 EUR 17,000 98.44 98.44 36.74 16,772.05<br />

DE0002539863 1.2.3. Deutsche Hyp Han 4.25% 11/02/13 EUR 14,000 102.92 102.92 79.66 14,487.76<br />

XS0537659632 1.2.3. European Invest Bk Float 15/01/16 EUR 10,000 99.51 99.51 26.98 9,977.88<br />

XS0754809548 1.2.3. European Invest Bk Float 27/07/17 EUR 6,000 100.47 100.47 4.12 6,<strong>03</strong>2.14<br />

XS0756698790 1.2.3. RaboBank Float 13/<strong>03</strong>/13 EUR 7,000 100.06 100.06 4.18 7,008.<strong>31</strong><br />

XS0729869460 1.2.3. RaboBank Nederland Float 13/01/14 EUR 10,000 100.53 100.53 42.40 10,095.00<br />

XS07<strong>31</strong>679907 1.2.3. Volkswagen Int Fin 2.125% 19/01/15 EUR 8,000 101.71 101.71 33.44 8,169.92<br />

1.2.6. Unidades de participação de fundos de investimento fechados 54 0.00 0.00 0.00 3,180.97<br />

LU043025<strong>31</strong>78 1.2.6. F&C Port FD-F&C Plus Fund I EUR EUR 54 58.42 58.42 0.00 3,180.97<br />

2. VALORES NÃO COTADOS 20,000 0.00 0.00 133.90 15,935.44<br />

2.1. Valores mobiliários nacionais 20,000 0.00 0.00 133.90 15,935.44<br />

2.1.3. Obrigações diversas 20,000 0.00 0.00 133.90 15,935.44<br />

PTJMEDOE0006 2.1.3. Jose de Mello 27/06/2017 EUR 20,000 79.01 79.01 133.90 15,935.44<br />

5. LIQUIDEZ 16 0.00 0.00 0.00 14,020.34