Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

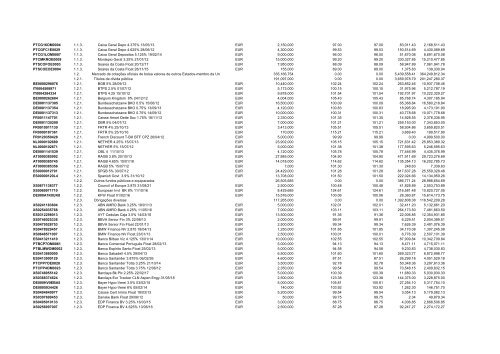

PTCG16OM0004 1.1.3. Caixa Geral Depo 4.375% 13/05/13 EUR 2,150,000 97.00 97.00 83,011.43 2,168,511.43<br />

PTCGFC1E0029 1.1.3. Caixa Geral Depo 4.625% 28/06/12 EUR 4,300,000 99.53 99.53 150,514.69 4,430,089.69<br />

PTCG1LOM0007 1.1.3. Caixa Geral Depositos 5.125% 19/02/14 EUR 9,000,000 96.00 96.00 51,670.08 8,691,670.08<br />

PTCMKROE0009 1.1.3. Montepio Geral 3.25% 27/07/12 EUR 15,000,000 99.20 99.20 330,327.85 15,210,477.85<br />

PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 7,950,000 88.09 88.09 58,947.89 7,061,941.78<br />

PTSCOEOE0004 1.1.3. Soares da Costa Float 28/11/15 EUR 155,000 89.00 89.00 1,375.83 139,330.04<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 335,166,754 0.00 0.00 5,439,558.41 364,249,812.34<br />

1.2.1. Títulos de dívida pública 191,097,000 0.00 0.00 3,659,978.79 201,247,280.37<br />

BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 10,440,000 102.24 102.24 263,852.46 10,937,708.46<br />

IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 5,173,000 100.15 100.15 <strong>31</strong>,975.96 5,212,787.19<br />

IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 9,878,000 101.54 101.54 192,701.97 10,222,329.27<br />

BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 4,004,000 105.43 105.43 85,768.74 4,307,185.94<br />

DE0001137305 1.2.1. Bundesschatzanw BKO 0.5% 15/06/12 EUR 16,500,000 100.09 100.09 65,368.84 16,580,218.84<br />

DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 4,120,000 100.83 100.83 18,995.90 4,173,191.90<br />

DE0001137<strong><strong>31</strong>3</strong> 1.2.1. Bundesschatzanw BKO 0.75% 14/09/12 EUR 10,000,000 100.<strong>31</strong> 100.<strong>31</strong> 40,778.68 10,071,778.68<br />

FR0011147701 1.2.1. Caisse Amort Dette Soc 1.75% 18/11/13 EUR 2,330,000 101.35 101.35 14,928.55 2,376,336.95<br />

DE0001135200 1.2.1. DBR 5% 04/07/12 EUR 7,000,000 101.21 101.21 259,153.00 7,343,853.00<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 3,413,000 105.51 105.51 58,934.86 3,659,820.51<br />

FR0000187361 1.2.1. FRTR 5% 25/10/16 EUR 170,000 115.21 115.21 3,669.40 199,517.90<br />

FR012<strong>03</strong>50428 1.2.1. French Discount T-Bill BTF CPZ 26/04/12 EUR 5,000,000 99.99 99.99 0.00 4,999,500.00<br />

NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 23,902,000 105.15 105.15 721,6<strong>31</strong>.42 25,853,389.32<br />

NL0000102671 1.2.1. NETHER 5% 15/07/12 EUR 5,000,000 101.38 101.38 177,595.63 5,246,595.63<br />

DE0001141539 1.2.1. OBL 4 11/10/13 EUR 4,120,000 105.78 105.78 77,446.99 4,435,376.99<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 27,885,000 104.90 104.90 471,911.69 29,723,276.69<br />

AT000<strong>03</strong>85745 1.2.1. RAGB 4.65% 15/01/18 EUR 14,018,000 114.62 114.62 135,354.13 16,202,785.73<br />

AT000<strong>03</strong>85356 1.2.1. RAGB 5% 15/07/12 EUR 7,000 101.30 101.30 248.63 7,339.63<br />

ES0000012791 1.2.1. SPGB 5% 30/07/12 EUR 24,429,000 101.28 101.28 817,637.28 25,559,328.48<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 13,708,000 101.50 101.50 222,024.66 14,134,959.26<br />

1.2.2. Outros fundos públicos e equiparados 26,505,685 0.00 0.00 386,771.24 28,988,654.69<br />

XS0671138377 1.2.2. Council of Europe 2.875 <strong>31</strong>/08/21 EUR 2,500,000 100.48 100.48 41,828.89 2,553,753.89<br />

XS0069971710 1.2.2. European Invt BK 8% 11/10/16 EUR 8,429,685 124.61 124.61 <strong>31</strong>6,581.48 10,820,727.05<br />

DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 15,576,000 100.06 100.06 28,360.87 15,614,173.75<br />

1.2.3. Obrigações diversas 117,265,000 0.00 0.00 1,392,808.38 116,542,209.28<br />

XS0241183804 1.2.3. ABN AMRO Bank 3.25% 18/01/13 EUR 5,000,000 102.01 102.01 32,411.20 5,132,661.20<br />

XS0254<strong>03</strong>5768 1.2.3. ABN AMRO Bank 4.25% 11/05/16 EUR 7,000,000 1<strong>03</strong>.11 1<strong>03</strong>.11 264,173.50 7,481,663.50<br />

ES0<strong>31</strong>2298013 1.2.3. AYT Cedulas Caja 3.5% 14/<strong>03</strong>/16 EUR 13,500,000 91.36 91.36 22,006.85 12,354,9<strong>31</strong>.85<br />

XS0746025336 1.2.3. BBVA Senior Fin 3% 22/08/13 EUR 2,000,000 99.91 99.91 6,229.51 2,004,389.51<br />

XS0479528753 1.2.3. BBVA Senior Fin Float 22/01/13 EUR 2,500,000 99.34 99.34 7,626.39 2,491,076.39<br />

XS0478929457 1.2.3. BMW Finance NV 2.875 18/04/13 EUR 1,250,000 101.85 101.85 34,170.08 1,307,245.08<br />

XS0648571007 1.2.3. BMW Finance NV Float 23/01/13 EUR 2,500,000 100.01 100.01 6,776.39 2,507,101.39<br />

ES0413211410 1.2.3. Banco Bilbao Viz 4.125% 13/01/14 EUR 10,000,000 102.55 102.55 87,909.84 10,342,709.84<br />

PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 5,000,000 94.13 94.13 8,471.11 4,715,071.11<br />

PTBLMWOM0002 1.2.3. Banco Espírito Santo Float 25/02/13 EUR 5,000,000 94.58 94.58 9,230.83 4,738,<strong>03</strong>0.83<br />

ES0413860000 1.2.3. Banco Sabadell 4.5% 29/04/13 EUR 6,500,000 101.60 101.60 269,323.77 6,872,998.77<br />

ES0413900129 1.2.3. Banco Santander 3.875% 06/02/26 EUR 4,600,000 87.51 87.51 26,299.18 4,051,529.18<br />

PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 3,500,000 92.78 92.78 50,348.36 3,297,613.36<br />

PTCPP4OM0023 1.2.3. Banco Santander Totta 3.75% 12/06/12 EUR 2,350,000 99.54 99.54 70,548.15 2,409,832.15<br />

XS0748955142 1.2.3. Barclays Bk Plc 2.25% 22/02/17 EUR 5,000,000 100.39 100.39 11,680.33 5,<strong>03</strong>0,930.33<br />

XS<strong>03</strong>68374624 1.2.3. Barclays Eur Tracker CLN Aspen Engy.<strong>31</strong>/05/18 EUR 2,500,000 123.38 123.38 144,375.00 3,228,875.00<br />

DE000HV0EBA5 1.2.3. Bayer Hypo-Verei 3.5% <strong>03</strong>/02/15 EUR 5,000,000 105.81 105.81 27,254.10 5,<strong>31</strong>7,754.10<br />

DE0005934426 1.2.3. Bayer Hypo-Verei 6% 05/02/14 EUR 140,000 1<strong>03</strong>.92 1<strong>03</strong>.92 1,262.30 146,751.70<br />

XS0494840977 1.2.3. Caisse Cent Immo Float 18/<strong>03</strong>/13 EUR 5,200,000 99.54 99.54 3,054.13 5,179,082.13<br />

XS<strong>03</strong>07699453 1.2.3. Danske Bank Float 29/06/12 EUR 50,000 99.75 99.75 2.34 49,879.34<br />

XS0495010133 1.2.3. EDP Finance BV 3.25% 16/<strong>03</strong>/15 EUR 3,000,000 88.75 88.75 4,006.85 2,666,506.85<br />

XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 2,500,000 87.28 87.28 92,247.27 2,274,172.27