Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

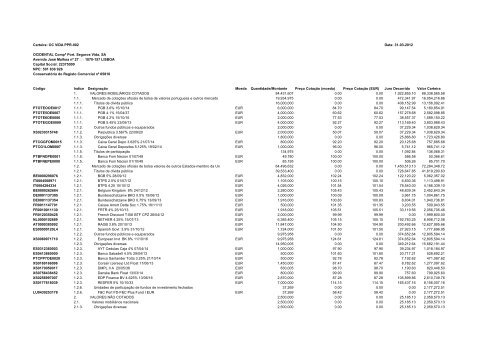

<strong>Carteira</strong>: <strong>OC</strong> VIDA PPR-002 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS 84,4<strong>31</strong>,607 0.00 0.00 1,922,855.10 88,338,565.58<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 19,934,975 0.00 0.00 472,341.97 16,054,216.86<br />

1.1.1. Títulos de dívida pública 16,000,000 0.00 0.00 408,152.99 13,156,092.41<br />

PTOTEOOE0017 1.1.1. PGB 3.6% 15/10/14 EUR 6,000,000 84.70 84.70 99,147.54 5,180,854.91<br />

PTOTE5OE0007 1.1.1. PGB 4.1% 15/04/37 EUR 4,000,000 60.62 60.62 157,278.68 2,582,098.85<br />

PTOTE6OE0006 1.1.1. PGB 4.2% 15/10/16 EUR 2,000,000 77.53 77.53 38,557.37 1,589,150.22<br />

PTOTEGOE0009 1.1.1. PGB 5.45% 23/09/13 EUR 4,000,000 92.27 92.27 113,169.40 3,8<strong>03</strong>,988.43<br />

1.1.2. Outros fundos públicos e equiparados 2,000,000 0.00 0.00 37,229.34 1,<strong>03</strong>8,629.34<br />

XS0230<strong>31</strong>5748 1.1.2. Parpublica 3.567% 22/09/20 EUR 2,000,000 50.07 50.07 37,229.34 1,<strong>03</strong>8,629.34<br />

1.1.3. Obrigações diversas 1,800,000 0.00 0.00 25,866.80 1,723,426.80<br />

PTCGGFOM0015 1.1.3. Caixa Geral Depo 3.625% 21/07/14 EUR 800,000 92.20 92.20 20,125.68 757,685.68<br />

PTCG1LOM0007 1.1.3. Caixa Geral Depositos 5.125% 19/02/14 EUR 1,000,000 96.00 96.00 5,741.12 965,741.12<br />

1.1.5. Títulos de participação 134,975 0.00 0.00 1,092.84 136,068.<strong>31</strong><br />

PTBFNDPE0001 1.1.5. Banco Fom Nacion 01/07/49 EUR 49,780 100.00 100.00 586.58 50,366.61<br />

PTBFNEPE0000 1.1.5. Banco Fom Nacion 01/10/49 EUR 85,195 100.00 100.00 506.26 85,701.70<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 64,496,632 0.00 0.00 1,450,513.13 72,284,348.72<br />

1.2.1. Títulos de dívida pública 39,533,400 0.00 0.00 726,647.85 41,619,290.63<br />

BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 4,832,000 102.24 102.24 122,120.22 5,062,357.02<br />

IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 1,105,000 100.15 100.15 6,830.36 1,113,498.91<br />

IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 4,026,000 101.54 101.54 78,540.00 4,166,339.10<br />

BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 2,280,000 105.43 105.43 48,839.34 2,452,643.34<br />

DE0001137305 1.2.1. Bundesschatzanw BKO 0.5% 15/06/12 EUR 1,000,000 100.09 100.09 3,961.75 1,004,861.75<br />

DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 1,916,000 100.83 100.83 8,834.01 1,940,736.81<br />

FR0011147701 1.2.1. Caisse Amort Dette Soc 1.75% 18/11/13 EUR 500,000 101.35 101.35 3,2<strong>03</strong>.55 509,943.55<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 1,918,000 105.51 105.51 33,119.56 2,056,705.46<br />

FR012<strong>03</strong>50428 1.2.1. French Discount T-Bill BTF CPZ 26/04/12 EUR 2,000,000 99.99 99.99 0.00 1,999,800.00<br />

NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 6,385,400 105.15 105.15 192,783.25 6,906,712.08<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 11,847,000 104.90 104.90 200,492.66 12,627,995.66<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 1,724,000 101.50 101.50 27,923.15 1,777,696.95<br />

1.2.2. Outros fundos públicos e equiparados 9,975,958 0.00 0.00 374,652.64 12,805,594.14<br />

XS0069971710 1.2.2. European Invt BK 8% 11/10/16 EUR 9,975,958 124.61 124.61 374,652.64 12,805,594.14<br />

1.2.3. Obrigações diversas 14,950,005 0.00 0.00 349,212.64 15,682,191.44<br />

ES0<strong>31</strong>23600<strong>03</strong> 1.2.3. AYT Cedulas Caja 4% 07/04/14 EUR 1,000,000 97.90 97.90 39,234.97 1,018,184.97<br />

ES0413860000 1.2.3. Banco Sabadell 4.5% 29/04/13 EUR 500,000 101.60 101.60 20,717.21 528,692.21<br />

PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 500,000 92.78 92.78 7,192.62 471,087.62<br />

XS0169166096 1.2.3. Corsair (Jersey) Ltd Float 17/06/13 EUR 1,450,000 87.47 87.47 8,782.62 1,277,097.62<br />

XS0170059017 1.2.3. DMPL II A 20/05/36 EUR 830,005 98.70 98.70 1,190.60 820,446.50<br />

XS0756438452 1.2.3. Danske Bank Float 13/<strong>03</strong>/14 EUR 800,000 99.90 99.90 757.60 799,925.60<br />

XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 2,870,000 87.28 87.28 105,899.86 2,610,749.76<br />

XS0177618<strong>03</strong>9 1.2.3. RESFER 5% 10/10/33 EUR 7,000,000 114.15 114.15 165,437.16 8,156,007.16<br />

1.2.6. Unidades de participação de fundos de investimento fechados 37,269 0.00 0.00 0.00 2,177,272.51<br />

LU043025<strong>31</strong>78 1.2.6. F&C Port FD-F&C Plus Fund I EUR EUR 37,269 58.42 58.42 0.00 2,177,272.51<br />

2. VALORES NÃO COTADOS 2,500,000 0.00 0.00 25,185.13 2,059,570.13<br />

2.1. Valores mobiliários nacionais 2,500,000 0.00 0.00 25,185.13 2,059,570.13<br />

2.1.3. Obrigações diversas 2,500,000 0.00 0.00 25,185.13 2,059,570.13