Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

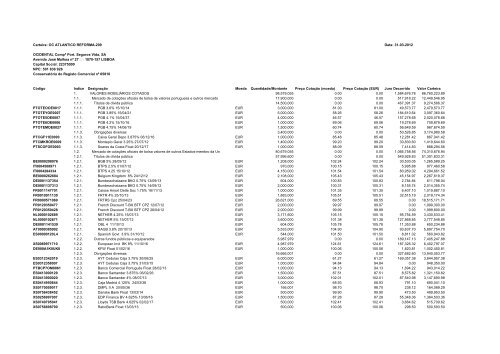

<strong>Carteira</strong>: <strong>OC</strong> ATLANTICO REFORMA-209 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS 98,579,055 0.00 0.00 1,584,676.78 86,760,223.89<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 17,900,000 0.00 0.00 517,918.22 12,449,546.95<br />

1.1.1. Títulos de dívida pública 14,500,000 0.00 0.00 467,391.37 9,274,566.37<br />

PTOTEOOE0017 1.1.1. PGB 3.6% 15/10/14 EUR 3,000,000 81.00 81.00 49,573.77 2,479,573.77<br />

PTOTEYOE0007 1.1.1. PGB 3.85% 15/04/21 EUR 5,000,000 58.26 58.26 184,610.64 3,097,360.64<br />

PTOTE5OE0007 1.1.1. PGB 4.1% 15/04/37 EUR 4,000,000 46.57 46.57 157,278.68 2,020,078.68<br />

PTOTE6OE0006 1.1.1. PGB 4.2% 15/10/16 EUR 1,000,000 69.06 69.06 19,278.69 709,878.69<br />

PTOTEMOE0027 1.1.1. PGB 4.75% 14/06/19 EUR 1,500,000 60.74 60.74 56,649.59 967,674.59<br />

1.1.3. Obrigações diversas 3,400,000 0.00 0.00 50,526.85 3,174,980.58<br />

PTCGF11E0000 1.1.3. Caixa Geral Depo 3.875% 06/12/16 EUR 1,000,000 85.48 85.48 12,281.42 867,041.42<br />

PTCMKROE0009 1.1.3. Montepio Geral 3.25% 27/07/12 EUR 1,400,000 99.20 99.20 30,830.60 1,419,644.60<br />

PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 1,000,000 88.09 88.09 7,414.83 888,294.56<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 80,679,055 0.00 0.00 1,066,758.56 74,<strong>31</strong>0,676.94<br />

1.2.1. Títulos de dívida pública 57,996,600 0.00 0.00 549,928.83 51,301,833.<strong>31</strong><br />

BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 1,208,000 102.24 102.24 30,530.05 1,265,589.25<br />

IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 970,000 100.15 100.15 5,995.88 977,460.58<br />

IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 4,150,000 101.54 101.54 80,959.02 4,294,661.52<br />

BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 2,108,000 105.43 105.43 45,154.97 2,267,619.37<br />

DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 604,000 100.83 100.83 2,784.84 611,798.04<br />

DE0001137<strong><strong>31</strong>3</strong> 1.2.1. Bundesschatzanw BKO 0.75% 14/09/12 EUR 2,000,000 100.<strong>31</strong> 100.<strong>31</strong> 8,155.74 2,014,355.74<br />

FR0011147701 1.2.1. Caisse Amort Dette Soc 1.75% 18/11/13 EUR 1,000,000 101.35 101.35 6,407.10 1,019,887.10<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 1,883,000 105.51 105.51 32,515.19 2,019,174.34<br />

FR0000571069 1.2.1. FRTRS Cpz 25/04/23 EUR 26,621,000 69.55 69.55 0.00 18,515,171.71<br />

FR012<strong>03</strong>50477 1.2.1. French Discount T-Bill BTF CPZ 12/07/12 EUR 2,000,000 99.97 99.97 0.00 1,999,300.00<br />

FR012<strong>03</strong>50428 1.2.1. French Discount T-Bill BTF CPZ 26/04/12 EUR 2,000,000 99.99 99.99 0.00 1,999,800.00<br />

NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 3,171,600 105.15 105.15 95,754.59 3,430,533.41<br />

NL0000102671 1.2.1. NETHER 5% 15/07/12 EUR 3,600,000 101.38 101.38 127,868.85 3,777,548.85<br />

DE0001141539 1.2.1. OBL 4 11/10/13 EUR 604,000 105.78 105.78 11,353.88 650,234.88<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 5,533,000 104.90 104.90 93,637.70 5,897,754.70<br />

ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 544,000 101.50 101.50 8,811.02 560,943.82<br />

1.2.2. Outros fundos públicos e equiparados 5,987,979 0.00 0.00 189,147.13 7,405,247.88<br />

XS0069971710 1.2.2. European Invt BK 8% 11/10/16 EUR 4,987,979 124.61 124.61 187,326.32 6,402,797.07<br />

DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 1,000,000 100.06 100.06 1,820.81 1,002,450.81<br />

1.2.3. Obrigações diversas 16,666,001 0.00 0.00 327,682.60 13,940,053.77<br />

ES0<strong>31</strong>2342019 1.2.3. AYT Cedulas Caja 3.75% 30/06/25 EUR 6,000,000 61.27 61.27 169,057.38 3,844,957.38<br />

ES0<strong>31</strong>2358007 1.2.3. AYT Cedulas Caja 3.75% <strong>31</strong>/<strong>03</strong>/15 EUR 1,000,000 94.84 94.84 0.00 948,350.00<br />

PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 1,000,000 94.13 94.13 1,694.22 943,014.22<br />

ES0413900129 1.2.3. Banco Santander 3.875% 06/02/26 EUR 1,500,000 87.51 87.51 8,575.82 1,321,150.82<br />

ES0413900020 1.2.3. Banco Santander 4% 08/07/13 EUR 3,000,000 102.01 102.01 87,540.98 3,147,690.98<br />

ES0414950644 1.2.3. Caja Madrid 4.125% 24/<strong>03</strong>/36 EUR 1,000,000 68.93 68.93 791.10 690,041.10<br />

XS0170059017 1.2.3. DMPL II A 20/05/36 EUR 166,001 98.70 98.70 238.12 164,089.29<br />

XS0756438452 1.2.3. Danske Bank Float 13/<strong>03</strong>/14 EUR 500,000 99.90 99.90 473.50 499,953.50<br />

XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 1,500,000 87.28 87.28 55,348.36 1,364,5<strong>03</strong>.36<br />

XS0740795041 1.2.3. Lloyds TSB Bank 4.625% 02/02/17 EUR 500,000 102.41 102.41 3,664.62 515,709.62<br />

XS0756698790 1.2.3. RaboBank Float 13/<strong>03</strong>/13 EUR 500,000 100.06 100.06 298.50 500,593.50