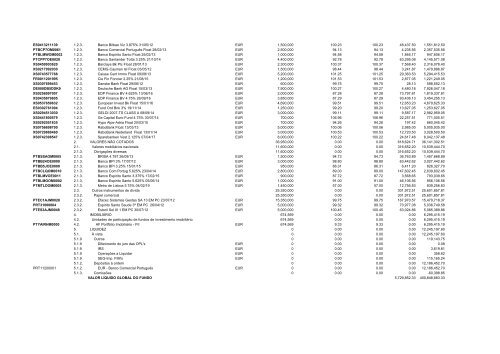

<strong>Carteira</strong>: <strong>OC</strong> VIDA COBERTURA OSCILAÇÕES MERCADO 302 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012 <strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA Avenida José Malhoa nº 27 1070-157 LISBOA Capital Social: 22375000 NPC: 501 836 926 Conservatória do Registo Comercial nº 65816 Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong> 1. VALORES MOBILIÁRIOS COTADOS 348,767,600 0.00 0.00 5,111,227.62 346,166,768.<strong>03</strong> 1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 34,521,000 0.00 0.00 839,372.35 29,468,762.94 1.1.1. Títulos de dívida pública 22,721,000 0.00 0.00 652,213.10 18,513,<strong>03</strong>3.80 PTOTE3OE0017 1.1.1. PGB 3.35% 15/10/15 EUR 1,000,000 72.93 72.93 15,377.05 744,677.05 PTOTEOOE0017 1.1.1. PGB 3.6% 15/10/14 EUR 4,000,000 81.00 81.00 66,098.36 3,306,098.36 PTOTEYOE0007 1.1.1. PGB 3.85% 15/04/21 EUR 2,000,000 58.26 58.26 73,844.26 1,238,944.26 PTOTELOE0010 1.1.1. PGB 4.35% 16/10/17 EUR 5,000,000 65.26 65.26 99,241.80 3,362,241.80 PTOTECOE0029 1.1.1. PGB 4.8% 15/06/20 EUR 2,800,000 59.80 59.80 106,491.80 1,780,751.80 PTOTEKOE00<strong>03</strong> 1.1.1. PGB 5% 15/06/12 EUR 5,921,000 99.67 99.67 234,575.13 6,136,<strong>03</strong>5.83 PTOTEGOE0009 1.1.1. PGB 5.45% 23/09/13 EUR 2,000,000 94.39 94.39 56,584.70 1,944,284.70 1.1.2. Outros fundos públicos e equiparados 950,000 0.00 0.00 24,256.15 869,756.15 PTPETQOM0006 1.1.2. Parpublica 3.5% 08/07/13 EUR 950,000 89.00 89.00 24,256.15 869,756.15 1.1.3. Obrigações diversas 10,850,000 0.00 0.00 162,9<strong>03</strong>.10 10,085,972.99 PTCGGFOM0015 1.1.3. Caixa Geral Depo 3.625% 21/07/14 EUR 3,000,000 92.20 92.20 75,471.30 2,841,321.30 PTCMKROE0009 1.1.3. Montepio Geral 3.25% 27/07/12 EUR 2,500,000 99.20 99.20 55,054.64 2,535,079.64 PTCMHXOM0006 1.1.3. Montepio Geral Float 29/05/13 EUR 1,150,000 85.00 85.00 1,234.88 978,734.88 PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 4,200,000 88.09 88.09 <strong>31</strong>,142.28 3,730,837.17 1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un <strong>31</strong>4,246,600 0.00 0.00 4,271,855.27 <strong>31</strong>6,698,005.09 1.2.1. Títulos de dívida pública 228,201,600 0.00 0.00 3,646,423.96 233,555,043.68 BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 988,000 102.24 102.24 24,969.95 1,<strong>03</strong>5,101.15 FR0113087466 1.2.1. BTAN 3.75% 12/01/13 EUR 6,000,000 102.75 102.75 48,565.57 6,213,265.57 IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 795,000 100.15 100.15 4,914.15 801,114.60 IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 1,430,000 101.54 101.54 27,896.72 1,479,847.22 BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 424,000 105.43 105.43 9,082.40 456,105.60 DE0001137305 1.2.1. Bundesschatzanw BKO 0.5% 15/06/12 EUR 58,000,000 100.09 100.09 229,781.38 58,281,981.38 DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 494,000 100.83 100.83 2,277.66 500,377.86 NL0009979855 1.2.1. Dutch Treasury Cert. CPZ 28/02/12 EUR 50,000,000 99.96 99.96 0.00 49,977,500.00 FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 565,000 105.51 105.51 9,756.28 605,859.53 FR0000188690 1.2.1. FRTR 4.75% 25/10/12 EUR 11,800,000 102.49 102.49 241,964.48 12,335,784.48 FR0000188328 1.2.1. FRTR 5% 25/04/12 EUR 6,000,000 100.20 100.20 279,508.19 6,291,508.19 FR012<strong>03</strong>50477 1.2.1. French Discount T-Bill BTF CPZ 12/07/12 EUR 10,000,000 99.97 99.97 0.00 9,996,500.00 NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 1,944,600 105.15 105.15 58,709.92 2,1<strong>03</strong>,359.59 NL0000102671 1.2.1. NETHER 5% 15/07/12 EUR 15,000,000 101.38 101.38 532,786.89 15,739,786.89 DE0001141539 1.2.1. OBL 4 11/10/13 EUR 494,000 105.78 105.78 9,286.12 5<strong>31</strong>,814.62 DE0001141505 1.2.1. OBL 4 13/04/12 EUR 50,000,000 100.09 100.09 1,928,961.62 51,973,961.62 AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 13,387,000 104.90 104.90 226,554.84 14,269,517.84 AT000<strong>03</strong>85745 1.2.1. RAGB 4.65% 15/01/18 EUR 435,000 114.62 114.62 4,200.25 502,797.25 ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 445,000 101.50 101.50 7,207.54 458,860.29 1.2.2. Outros fundos públicos e equiparados 19,740,000 0.00 0.00 23,687.50 17,<strong>31</strong>4,219.62 XS0669743246 1.2.2. European Invt BK 2.5% 15/<strong>03</strong>/19 EUR 5,000,000 101.17 101.17 5,479.45 5,063,729.45 XS0070560288 1.2.2. Int Bk Recon&Dev Cpz 08/11/16 DEM 4,740,000 91.85 46.96 0.00 2,225,982.12 DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 10,000,000 100.06 100.06 18,208.05 10,024,508.05 1.2.3. Obrigações diversas 66,305,000 0.00 0.00 601,743.81 65,828,741.79 XS0241183804 1.2.3. ABN AMRO Bank 3.25% 18/01/13 EUR 2,500,000 102.01 102.01 16,205.60 2,566,330.60 XS0408730157 1.2.3. BMW US Cap LLC 6.375% 23/07/12 EUR 3,515,000 101.62 101.62 154,285.44 3,726,228.44

ES0413211139 1.2.3. Banco Bilbao Viz 3.875% <strong>31</strong>/05/12 EUR 1,500,000 100.23 100.23 48,437.50 1,551,812.50 PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 2,500,000 94.13 94.13 4,235.56 2,357,535.56 PTBLMWOM0002 1.2.3. Banco Espírito Santo Float 25/02/13 EUR 1,000,000 94.58 94.58 1,846.17 947,606.17 PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 4,400,000 92.78 92.78 63,295.08 4,145,571.08 XS04599<strong>03</strong>620 1.2.3. Barclays Bk Plc Float 28/01/13 EUR 2,300,000 100.37 100.37 7,568.40 2,<strong>31</strong>6,078.40 XS0217992<strong>03</strong>0 1.2.3. CEMG-Cayman Isl Float <strong>03</strong>/05/12 EUR 1,500,000 98.44 98.44 3,241.87 1,479,886.87 XS0743577768 1.2.3. Caisse Cent Immo Float 09/08/13 EUR 5,200,000 101.25 101.25 29,363.53 5,294,415.53 FR0011201995 1.2.3. Cie Fin Foncier 2.25% 21/08/15 EUR 1,200,000 101.53 101.53 2,877.05 1,221,249.05 XS<strong>03</strong>07699453 1.2.3. Danske Bank Float 29/06/12 EUR 600,000 99.75 99.75 28.13 598,552.13 DE000DB5DDK9 1.2.3. Deutsche Bank AG Float 15/<strong>03</strong>/13 EUR 7,900,000 100.27 100.27 4,480.18 7,926,047.18 XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 2,000,000 87.28 87.28 73,797.81 1,819,337.81 XS0435879605 1.2.3. EDP Finance BV 4.75% 26/09/16 EUR 3,850,000 87.29 87.29 93,436.13 3,454,255.13 XS0537659632 1.2.3. European Invest Bk Float 15/01/16 EUR 4,690,000 99.51 99.51 12,653.23 4,679,625.33 ES<strong>03</strong>02761004 1.2.3. Fund Ord Bnk 3% 19/11/14 EUR 1,250,000 99.20 99.20 13,627.05 1,253,627.05 XS0294513<strong>03</strong>0 1.2.3. GELDI 2007-TS CLASS A 08/09/14 EUR 3,000,000 99.11 99.11 9,587.17 2,982,959.05 XS0441800579 1.2.3. Ge Capital Euro Fund 4.75% 30/07/14 EUR 700,000 106.96 106.96 22,257.51 771,005.51 XS0292051835 1.2.3. Hypo Alpe-Adria Float 20/<strong>03</strong>/15 EUR 700,000 94.26 94.26 197.42 660,045.42 XS0756698790 1.2.3. RaboBank Float 13/<strong>03</strong>/13 EUR 5,000,000 100.06 100.06 2,985.00 5,005,935.00 XS0729869460 1.2.3. RaboBank Nederland Float 13/01/14 EUR 3,000,000 100.53 100.53 12,720.50 3,028,500.50 XS0742398547 1.2.3. Sparebanken Vest 2.125% 07/04/17 EUR 8,000,000 100.22 100.22 24,617.48 8,042,137.48 2. VALORES NÃO COTADOS 36,950,000 0.00 0.00 618,624.71 36,141,302.51 2.1. Valores mobiliários nacionais 11,600,000 0.00 0.00 <strong>31</strong>6,652.20 10,539,444.70 2.1.3. Obrigações diversas 11,600,000 0.00 0.00 <strong>31</strong>6,652.20 10,539,444.70 PTBSSAOM0005 2.1.3. BRISA 4.797 26/09/13 EUR 1,500,000 94.73 94.73 36,763.89 1,457,668.89 PTBB24OE0000 2.1.3. Banco BPI 3% 17/07/12 EUR 3,000,000 98.80 98.80 63,442.62 3,027,442.62 PTBB5JOE0000 2.1.3. Banco BPI 3.25% 15/01/15 EUR 950,000 86.<strong>31</strong> 86.<strong>31</strong> 6,411.20 826,327.70 PTBCLQOM0010 2.1.3. Banco Com Portug 5.625% 23/04/14 EUR 2,800,000 89.00 89.00 147,602.45 2,639,602.45 PTBLMVOE0011 2.1.3. Banco Espirito Santo 3.375% 17/02/15 EUR 900,000 87.72 87.72 3,568.65 793,<strong>03</strong>9.65 PTBLMGOM0002 2.1.3. Banco Espirito Santo 5.625% 05/06/14 EUR 1,000,000 91.00 91.00 46,106.56 956,106.56 PTMTLDOM0005 2.1.3. Metro de Lisboa 5.75% 04/02/19 EUR 1,450,000 57.00 57.00 12,756.83 839,256.83 2.3. Outros instrumentos de dívida 25,350,000 0.00 0.00 301,972.51 25,601,857.81 2.3.2. Papel comercial 25,350,000 0.00 0.00 301,972.51 25,601,857.81 PTEC1AJM0028 2.3.2. Efacec Sistemas Gestao SA 13 EM PC 23/07/12 EUR 15,350,000 99.75 99.75 167,970.57 15,479,718.37 PRT<strong>31</strong>000004 2.3.2. Espirito Santo Saude 3ª EM PC 26/04/12 EUR 5,000,000 99.32 99.32 70,977.08 5,<strong>03</strong>6,749.58 PTES3AJM0048 2.3.2. Estoril Sol III 1 EM PC 30/07/12 EUR 5,000,000 100.45 100.45 63,024.86 5,085,389.86 4. IMOBILIÁRIO 674,569 0.00 0.00 0.00 6,295,415.19 4.2. Unidades de participação de fundos de investimento imobiliário 674,569 0.00 0.00 0.00 6,295,415.19 PTYAIRHM0000 4.2. AF Portfólio Imobiliário - FII EUR 674,569 9.33 9.33 0.00 6,295,415.19 5. LIQUIDEZ 0 0.00 0.00 0.00 12,245,197.60 5.1. À vista 0 0.00 0.00 0.00 12,245,197.60 5.1.9 Outros 0 0.00 0.00 0.00 119,143.75 5.1.9 Diferimento do juro das OPL's EUR 0 0.00 0.00 0.00 0.08 5.1.9 IRS EUR 0 0.00 0.00 0.00 3,619.81 5.1.9 Operações a Liquidar EUR 0 0.00 0.00 0.00 358.62 5.1.9 SEG-Imp. FIM's EUR 0 0.00 0.00 0.00 115,165.24 5.1.2. Depósitos à ordem 0 0.00 0.00 0.00 12,186,452.70 PRT11200001 5.1.2. EUR - Banco Comercial Português EUR 0 0.00 0.00 0.00 12,186,452.70 5.1.3. Comissões 0 0.00 0.00 0.00 -60,398.85 VALOR LÍQUIDO GLOBAL DO FUNDO 5,729,852.33 400,848,683.33

- Page 1: Carteira: OC TESOURO GARANTIDO 1SR

- Page 5 and 6: Carteira: OC ATLANTICO REFORMA-209

- Page 7 and 8: Carteira: OC CAPITAL BPA-206 Data:

- Page 9 and 10: PTCPP7OE0020 1.2.3. Banco Santander

- Page 11 and 12: XS0260783005 1.2.3. Erste Bank Floa

- Page 13 and 14: Carteira: OC FUNDO POUPANCA 008 Dat

- Page 15 and 16: 5.1.9 IRS EUR 91,496 0.00 0.00 0.00

- Page 17 and 18: XS0746025336 1.2.3. BBVA Senior Fin

- Page 19 and 20: 1.2.3. Obrigações diversas 226,87

- Page 21 and 22: Carteira: OC INV.GARANTIDO FINANC-2

- Page 23 and 24: PTBCP7OM0061 1.2.3. Banco Comercial

- Page 25 and 26: 5.1.2. Depósitos à ordem 0 0.00 0

- Page 27 and 28: 5.1. À vista 16 0.00 0.00 0.00 14,

- Page 29 and 30: 5.1.2. Depósitos à ordem 0 0.00 0

- Page 31 and 32: Carteira: OC POUP. VERSÁTIL JOVEM-

- Page 33 and 34: FR0010011130 1.2.1. FRTR 4% 25/10/1

- Page 35 and 36: AT0000385356 1.2.1. RAGB 5% 15/07/1

- Page 37 and 38: Carteira: OC PPR CAPITAL GARANTIDO

- Page 39 and 40: XS0408285913 1.2.3. Vodafone Group

- Page 41 and 42: XS0446860826 1.2.3. Societe General

- Page 43 and 44: PTBLMWOM0002 1.2.3. Banco Espírito

- Page 45 and 46: 5.1.9 IRS EUR 68 0.00 0.00 0.00 0.0

- Page 47 and 48: Carteira: OC VERSÁTIL NOVE-204 Dat

- Page 49 and 50: Carteira: OC VIDA ATL.PER 2.4% FIN-

- Page 51 and 52: LU0430253178 1.2.6. F&C Port FD-F&C

- Page 53 and 54:

Carteira: OC VIDA POUPANÇA VALOR-2

- Page 55 and 56:

XS0446860826 1.2.3. Societe General

- Page 57 and 58:

DE000EH0A2E9 1.2.3. Eurohypo AG 3.2

- Page 59 and 60:

ES0312358007 1.2.3. AYT Cedulas Caj

- Page 61 and 62:

Carteira: OC VIDA PPR-002 Data: 31-

- Page 63 and 64:

Carteira: OC VIDA VALOR 2.4% FINAN-

- Page 65 and 66:

Carteira: OC (UL) RENDA PRIVATE 200

- Page 67 and 68:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 69 and 70:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 71 and 72:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 73 and 74:

Carteira: OC (UL) RENDA CRESC ESPEC

- Page 75 and 76:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 77 and 78:

Carteira: OC (UL) Renda Crescente T

- Page 79 and 80:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 81 and 82:

Carteira: OC (UL) RENDA VALOR 2010

- Page 83 and 84:

Carteira: OC (UL) RENDA PREMIO ESPE

- Page 85 and 86:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 87 and 88:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 89 and 90:

Carteira: ULA Capital Futuro (Estra

- Page 91 and 92:

Carteira: OC (UL) Renda Private 201

- Page 93 and 94:

Carteira: OC (UL) RENDA CERTA MAIS

- Page 95 and 96:

Carteira: OC (ULA) INVESTIM 75 FIN-

- Page 97 and 98:

Carteira: OC (UL) RENDA CERTA ESP 2

- Page 99 and 100:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 101 and 102:

PTS27AJM0048 2.3.2. Soc Francisco M

- Page 103 and 104:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 105 and 106:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 107 and 108:

Carteira: OC (UL) Renda Crescente T

- Page 109 and 110:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 111 and 112:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 113 and 114:

Carteira: OC (UL) Renda Crescente 2

- Page 115 and 116:

Carteira: OC (UL) RENDA PRESTIGE 20

- Page 117 and 118:

Carteira: OC (UL) RENDA EMPRESAS 20

- Page 119 and 120:

PRT11200001 5.1.2. EUR - Banco Come

- Page 121 and 122:

2.1. Valores mobiliários nacionais

- Page 123 and 124:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 125 and 126:

Carteira: OC (UL) RENDIMENTO VARIAV

- Page 127 and 128:

Carteira: OC (ULA) INVESTIM 20 FIN-

- Page 129 and 130:

Carteira: OC (ULA) NOVA POUP RENDIM

- Page 131 and 132:

Carteira: OC (ULA) SOLUÇÃO INVEST

- Page 133 and 134:

Carteira: OC (UL) RENDA CERTA PRIVA

- Page 135 and 136:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 137 and 138:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 139 and 140:

XS0458566071 1.2.3. Espirito Santo

- Page 141 and 142:

7.2.2. Swap (IRS-34835PA-5.29% 26/0

- Page 143 and 144:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 145 and 146:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 147 and 148:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 149 and 150:

Carteira: OC (UL) RENDA CRESC PRIVA

- Page 151 and 152:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 153 and 154:

Carteira: OC (UL) RENDA PRIVATE 200

- Page 155 and 156:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 157 and 158:

Carteira: OC (UL) RENDA CERTA 8A 1S

- Page 159 and 160:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 161 and 162:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 163 and 164:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 165 and 166:

PTBCQWOM0033 1.1.3. Banco Comercial

- Page 167 and 168:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 169 and 170:

Carteira: OC (UL) RENDA GLOBAL 2008

- Page 171 and 172:

Carteira: OC (UL) RENDA CERTA ESP 2

- Page 173 and 174:

5.1.2. Depósitos à ordem 0 0.00 0

- Page 175 and 176:

Carteira: OC (UL) RENDA CERTA 2004

- Page 177 and 178:

Carteira: OC (UL) RENDA CERTA 2005

- Page 179 and 180:

Carteira: OC (UL) RENDA CERTA 2005

- Page 181 and 182:

Carteira: OC (UL) RENDA CERTA 2005

- Page 183 and 184:

PTPTIBOE0009 2.1.3. Portucel Float

- Page 185 and 186:

PRT11200001 5.1.2. EUR - Banco Come

- Page 187 and 188:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 189 and 190:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 191 and 192:

7.2.2. Swap (IRS-29111 PA Var 05/09

- Page 193 and 194:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 195 and 196:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 197 and 198:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 199 and 200:

Carteira: OC (UL) RENDA EURIBOR MAI

- Page 201 and 202:

Carteira: OC (UL) RENDA EURIBOR 200

- Page 203 and 204:

Carteira: OC (UL) RENDA EURIBOR 8 A

- Page 205 and 206:

2.2.3. Obrigações diversas 12,808

- Page 207 and 208:

5.1.9 Diferimento do juro das OPL's

- Page 209 and 210:

XS0257650019 1.2.3. Ageas Hybrid Va

- Page 211 and 212:

7.2.2. Swap (IRS/FB-DHU18248PA Floa

- Page 213 and 214:

Carteira: OC (UL) RENDA TRIMESTRAL

- Page 215 and 216:

Carteira: OC (ULA) GD Perfil Cresci

- Page 217 and 218:

Carteira: OC (ULA) GD Perfil Preser

- Page 219 and 220:

5.1.9 SEG-PRÉMIO-PV EUR 0 0.00 0.0

- Page 221 and 222:

5.1.9 SEG-PRÉMIO-PV EUR 0 0.00 0.0

- Page 223 and 224:

Carteira: OC ULA SIG - Equilibrada

- Page 225 and 226:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 227 and 228:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 229 and 230:

Carteira: OC (UL) SEGURO MILLENNIUM