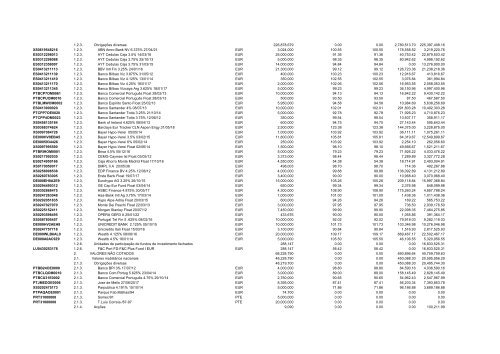

<strong>Carteira</strong>: <strong>OC</strong> GEST.CART.POUP.INV.2.4% 011 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012 <strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA Avenida José Malhoa nº 27 1070-157 LISBOA Capital Social: 22375000 NPC: 501 836 926 Conservatória do Registo Comercial nº 65816 Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong> 1. VALORES MOBILIÁRIOS COTADOS 797,957,845 0.00 0.00 15,628,323.34 794,146,973.65 1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 282,355,420 0.00 0.00 7,070,187.90 248,010,416.69 1.1.1. Títulos de dívida pública 221,418,000 0.00 0.00 6,108,135.02 188,607,810.41 PTOTE3OE0017 1.1.1. PGB 3.35% 15/10/15 EUR 39,300,000 77.84 77.84 604,<strong>31</strong>8.01 <strong>31</strong>,194,868.11 PTOTE6OE0006 1.1.1. PGB 4.2% 15/10/16 EUR 19,000,000 78.12 78.12 366,295.06 15,209,745.<strong>03</strong> PTOTELOE0010 1.1.1. PGB 4.35% 16/10/17 EUR <strong>31</strong>,000,000 74.24 74.24 615,299.13 23,630,275.57 PTOTE1OE0019 1.1.1. PGB 4.375% 16/06/14 EUR 38,079,000 82.65 82.65 1,<strong>31</strong>5,468.09 32,787,761.59 PTOTENOE0018 1.1.1. PGB 4.45% 15/06/18 EUR 5,000,000 72.87 72.87 176,297.80 3,819,962.12 PTOTEMOE0027 1.1.1. PGB 4.75% 14/06/19 EUR 20,000,000 71.72 71.72 755,327.87 15,099,075.59 PTOTECOE0029 1.1.1. PGB 4.8% 15/06/20 EUR 5,500,000 71.04 71.04 209,180.33 4,116,254.55 PTOTEKOE00<strong>03</strong> 1.1.1. PGB 5% 15/06/12 EUR 23,689,000 99.67 99.67 938,498.62 24,549,324.92 PTOTEGOE0009 1.1.1. PGB 5.45% 23/09/13 EUR 39,850,000 93.<strong>03</strong> 93.<strong>03</strong> 1,127,450.11 38,200,542.93 1.1.3. Obrigações diversas 60,650,000 0.00 0.00 962,052.88 56,007,112.63 PTCGGFOM0015 1.1.3. Caixa Geral Depo 3.625% 21/07/14 EUR 11,500,000 92.20 92.20 289,306.65 10,891,7<strong>31</strong>.65 PTCGF11E0000 1.1.3. Caixa Geral Depo 3.875% 06/12/16 EUR 15,550,000 85.48 85.48 190,976.08 13,482,494.08 PTCG16OM0004 1.1.3. Caixa Geral Depo 4.375% 13/05/13 EUR 1,000,000 97.00 97.00 38,609.97 1,008,609.97 PTCGFC1E0029 1.1.3. Caixa Geral Depo 4.625% 28/06/12 EUR 5,000,000 99.53 99.53 175,017.08 5,151,267.08 PTCG1LOM0007 1.1.3. Caixa Geral Depositos 5.125% 19/02/14 EUR 4,000,000 96.00 96.00 22,964.48 3,862,964.48 PTCG32OM0004 1.1.3. Caixa Geral Depositos 8% 28/09/15 EUR 650,000 98.99 98.99 26,284.15 669,706.15 PTCMKROE0009 1.1.3. Montepio Geral 3.25% 27/07/12 EUR 6,700,000 99.20 99.20 147,546.44 6,794,013.44 PTCMHXOM0006 1.1.3. Montepio Geral Float 29/05/13 EUR 7,750,000 85.00 85.00 8,321.99 6,595,821.99 PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 8,500,000 88.09 88.09 63,026.04 7,550,5<strong>03</strong>.79 1.1.6. Unidades de participação de fundos de investimento fechados 287,420 0.00 0.00 0.00 3,395,493.65 PTMXR0IM0008 1.1.6. Maxirent - Fundo Inv.Imob. EUR 287,420 11.81 11.81 0.00 3,395,493.65 1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 515,602,425 0.00 0.00 8,558,135.44 546,136,556.96 1.2.1. Títulos de dívida pública 274,435,600 0.00 0.00 5,752,130.46 289,871,<strong>31</strong>2.21 BE0000298076 1.2.1. BGB 5% 28/09/12 EUR 8,412,000 102.24 102.24 212,598.36 8,813,027.16 IT0004508971 1.2.1. BTPS 2.5% 01/07/12 EUR 23,588,000 100.15 100.15 145,804.95 23,769,422.83 IT0004284334 1.2.1. BTPS 4.25 15/10/12 EUR 39,<strong>03</strong>6,000 101.54 101.54 761,521.97 40,396,724.57 BE0000262684 1.2.1. Belgium Kingdom 8% 24/12/12 EUR 12,720,000 105.43 105.43 272,472.12 13,683,168.12 DE0001137305 1.2.1. Bundesschatzanw BKO 0.5% 15/06/12 EUR 11,000,000 100.09 100.09 43,579.23 11,053,479.23 DE0001137354 1.2.1. Bundesschatzanw BKO 0.75% 13/09/13 EUR 3,000,000 100.83 100.83 13,8<strong>31</strong>.97 3,<strong>03</strong>8,7<strong>31</strong>.97 FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 9,2<strong>31</strong>,000 105.51 105.51 159,398.68 9,898,565.23 FR0000187361 1.2.1. FRTR 5% 25/10/16 EUR 25,000 115.21 115.21 539.62 29,340.87 NL0000102242 1.2.1. NETHER 3.25% 15/07/15 EUR 5,000,000 107.68 107.68 115,437.16 5,499,437.16 NL0000102689 1.2.1. NETHER 4.25% 15/07/13 EUR 34,444,600 105.15 105.15 1,<strong>03</strong>9,925.77 37,256,700.44 NL0000102671 1.2.1. NETHER 5% 15/07/12 EUR 40,000,000 101.38 101.38 1,420,765.<strong>03</strong> 41,972,765.<strong>03</strong> DE0001141539 1.2.1. OBL 4 11/10/13 EUR 3,000,000 105.78 105.78 56,393.44 3,229,643.44 AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 46,104,000 104.90 104.90 780,240.87 49,143,336.87 AT0000A011T9 1.2.1. RAGB 4% 15/09/16 EUR 12,705,000 110.67 110.67 274,927.85 14,335,551.35 AT000<strong>03</strong>85745 1.2.1. RAGB 4.65% 15/01/18 EUR 2,800,000 114.62 114.62 27,<strong>03</strong>6.07 3,236,396.07 AT000<strong>03</strong>86198 1.2.1. Republic of Austria 3.5% 15/07/2015 EUR 5,670,000 107.99 107.99 140,975.40 6,263,724.90 ES00000120L4 1.2.1. Spanish Govt 3.9% <strong>31</strong>/10/12 EUR 17,700,000 101.50 101.50 286,681.97 18,251,296.97 1.2.2. Outros fundos públicos e equiparados 14,000,000 0.00 0.00 25,491.28 14,<strong>03</strong>4,<strong>31</strong>1.28 DE000A1K0UK8 1.2.2. KFW Float 01/02/16 EUR 14,000,000 100.06 100.06 25,491.28 14,<strong>03</strong>4,<strong>31</strong>1.28

1.2.3. Obrigações diversas 226,878,679 0.00 0.00 2,780,513.70 225,397,408.16 XS0619548216 1.2.3. ABN Amro Bank NV 6.375% 27/04/21 EUR 3,024,000 100.55 100.55 178,558.52 3,219,220.76 ES0<strong>31</strong>2298013 1.2.3. AYT Cedulas Caja 3.5% 14/<strong>03</strong>/16 EUR 25,000,000 91.36 91.36 40,753.42 22,879,5<strong>03</strong>.42 ES0<strong>31</strong>2298088 1.2.3. AYT Cedulas Caja 3.75% 25/10/13 EUR 5,000,000 98.35 98.35 80,942.62 4,998,192.62 ES0<strong>31</strong>2358007 1.2.3. AYT Cedulas Caja 3.75% <strong>31</strong>/<strong>03</strong>/15 EUR 14,000,000 94.84 94.84 0.00 13,276,900.00 ES0413211113 1.2.3. BBV Intl Fin 3.25% 24/01/16 EUR 21,300,000 99.12 99.12 126,723.36 21,238,218.36 ES0413211139 1.2.3. Banco Bilbao Viz 3.875% <strong>31</strong>/05/12 EUR 400,000 100.23 100.23 12,916.67 413,816.67 ES0413211410 1.2.3. Banco Bilbao Viz 4.125% 13/01/14 EUR 350,000 102.55 102.55 3,076.84 361,994.84 ES0413211170 1.2.3. Banco Bilbao Viz 4.25% 18/01/17 EUR 2,000,000 102.06 102.06 16,953.55 2,058,053.55 ES0413211345 1.2.3. Banco Bilbao Vizcaya Arg 3.625% 18/01/17 EUR 5,000,000 99.23 99.23 36,150.96 4,997,400.96 PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 10,000,000 94.13 94.13 16,942.22 9,430,142.22 PTBCPUOM0010 1.2.3. Banco Comercial Português Float 28/<strong>03</strong>/13 EUR 500,000 93.50 93.50 87.50 467,587.50 PTBLMWOM0002 1.2.3. Banco Espírito Santo Float 25/02/13 EUR 5,950,000 94.58 94.58 10,984.69 5,638,256.69 ES0413900020 1.2.3. Banco Santander 4% 08/07/13 EUR 10,000,000 102.01 102.01 291,8<strong>03</strong>.28 10,492,3<strong>03</strong>.28 PTCPP7OE0020 1.2.3. Banco Santander Totta 3.25% 21/10/14 EUR 5,000,000 92.78 92.78 71,926.23 4,710,876.23 PTCPP4OM0023 1.2.3. Banco Santander Totta 3.75% 12/06/12 EUR 350,000 99.54 99.54 10,507.17 358,911.17 XS0456135184 1.2.3. Bank of Ireland 4.625% 08/04/13 EUR 600,000 94.75 94.75 27,143.44 595,643.44 XS<strong>03</strong>68374624 1.2.3. Barclays Eur Tracker CLN Aspen Engy.<strong>31</strong>/05/18 EUR 2,500,000 123.38 123.38 144,375.00 3,228,875.00 XS0097084726 1.2.3. Bayer Hypo-Verei 05/05/14 EUR 1,000,000 1<strong>03</strong>.92 1<strong>03</strong>.92 36,111.11 1,075,261.11 DE000HV0EBA5 1.2.3. Bayer Hypo-Verei 3.5% <strong>03</strong>/02/15 EUR 11,800,000 105.81 105.81 64,<strong>31</strong>9.67 12,549,899.67 DE0005934426 1.2.3. Bayer Hypo-Verei 6% 05/02/14 EUR 250,000 1<strong>03</strong>.92 1<strong>03</strong>.92 2,254.10 262,056.60 XS0097995590 1.2.3. Bayer Hypo-Verei Float 02/06/14 EUR 1,500,000 98.10 98.10 49,666.67 1,521,211.67 PTBRIHOM0001 1.2.3. Brisa 4.5% 05/12/16 EUR 5,000,000 79.23 79.23 71,926.22 4,<strong>03</strong>3,476.22 XS0217992<strong>03</strong>0 1.2.3. CEMG-Cayman Isl Float <strong>03</strong>/05/12 EUR 3,373,000 98.44 98.44 7,289.89 3,327,772.28 ES0214950166 1.2.3. Caja Ahorro Monte Madrid Float 17/10/16 EUR 4,550,000 54.38 54.38 18,714.91 2,493,004.91 XS0170059017 1.2.3. DMPL II A 20/05/36 EUR 498,0<strong>03</strong> 98.70 98.70 714.36 492,267.88 XS0256996538 1.2.3. EDP Finance BV 4.25% 12/06/12 EUR 4,000,000 99.88 99.88 136,092.89 4,1<strong>31</strong>,212.89 XS0260783005 1.2.3. Erste Bank Float 19/07/17 EUR 3,400,000 90.00 90.00 10,968.40 3,070,968.40 DE000EH0A2E9 1.2.3. Eurohypo AG 3.25% 26/10/15 EUR 15,000,000 105.26 105.26 209,118.84 15,997,368.84 XS0294490<strong>31</strong>2 1.2.3. GE Cap Eur Fund Float <strong>03</strong>/04/14 EUR 650,000 99.34 99.34 2,376.98 648,099.98 XS<strong>03</strong>02868475 1.2.3. HSBC Finance 4.875% 30/05/17 EUR 4,300,000 108.90 108.90 175,260.24 4,857,788.24 XS0247263048 1.2.3. Haa-Bank Intl Ag 3.75% 17/<strong>03</strong>/14 EUR 1,000,000 101.00 101.00 1,438.36 1,011,438.36 XS0292051835 1.2.3. Hypo Alpe-Adria Float 20/<strong>03</strong>/15 EUR 600,000 94.26 94.26 169.22 565,753.22 XS0247027070 1.2.3. Monte Dei Paschi Float 22/<strong>03</strong>/13 EUR 3,000,000 97.95 97.95 736.50 2,939,176.50 XS0225152411 1.2.3. Morgan Stanley Float 20/07/12 EUR 7,450,000 99.90 99.90 22,098.35 7,464,275.85 XS0293598495 1.2.3. OPERA GER3 A 25/01/22 EUR 433,676 90.00 90.00 1,055.86 391,364.17 XS0587805457 1.2.3. Portugal Tel Fin 5 .625% 08/02/16 EUR 10,000,000 92.02 92.02 79,918.<strong>03</strong> 9,282,118.<strong>03</strong> DE000HV2AEH8 1.2.3. UNICREDIT BANK 2.125% 05/10/15 EUR 10,000,000 101.73 101.73 1<strong>03</strong>,346.98 10,276,046.98 XS0247757718 1.2.3. Unicredito Itali Float 15/<strong>03</strong>/16 EUR 3,100,000 90.84 90.84 1,516.93 2,817,525.93 DE000WLB6AL0 1.2.3. Westlb 4.125% 08/06/16 EUR 20,000,000 109.17 109.17 669,467.17 22,502,467.17 DE000A0AC9Z9 1.2.3. Westlb 4.5% 16/01/14 EUR 5,000,000 105.50 105.50 46,106.55 5,320,956.55 1.2.6. Unidades de participação de fundos de investimento fechados 288,147 0.00 0.00 0.00 16,833,525.<strong>31</strong> LU043025<strong>31</strong>78 1.2.6. F&C Port FD-F&C Plus Fund I EUR EUR 288,147 58.42 58.42 0.00 16,833,525.<strong>31</strong> 2. VALORES NÃO COTADOS 68,228,790 0.00 0.00 690,896.64 40,759,759.63 2.1. Valores mobiliários nacionais 48,228,790 0.00 0.00 450,088.30 20,595,956.29 2.1.3. Obrigações diversas 48,219,700 0.00 0.00 450,088.30 20,495,744.30 PTBB24OE0000 2.1.3. Banco BPI 3% 17/07/12 EUR 4,000,000 98.80 98.80 84,590.16 4,<strong>03</strong>6,590.16 PTBCLQOM0010 2.1.3. Banco Com Portug 5.625% 23/04/14 EUR 3,000,000 89.00 89.00 158,145.49 2,828,145.49 PTBCU<strong>31</strong>E0002 2.1.3. Banco Comercial Português 4.75% 29/10/14 EUR 2,750,000 90.65 90.65 54,962.43 2,547,967.99 PTJMEDOE0006 2.1.3. Jose de Mello 27/06/2017 EUR 8,395,000 87.41 87.41 56,2<strong>03</strong>.34 7,393,853.78 XS0202475173 2.1.3. Parpublica 4.191% 15/10/14 EUR 5,000,000 71.86 71.86 96,186.88 3,689,186.88 PTPAQAOE0001 2.1.3. Parque Fab.Malhas/94 EUR 74,700 0.00 0.00 0.00 0.00 PRT<strong>31</strong>000008 2.1.3. Somec/91 PTE 5,000,000 0.00 0.00 0.00 0.00 PRT<strong>31</strong>000008 2.1.3. T.Luís Correia /87-97 PTE 20,000,000 0.00 0.00 0.00 0.00 2.1.4. Acções 9,090 0.00 0.00 0.00 100,211.99

- Page 1 and 2: Carteira: OC TESOURO GARANTIDO 1SR

- Page 3 and 4: ES0413211139 1.2.3. Banco Bilbao Vi

- Page 5 and 6: Carteira: OC ATLANTICO REFORMA-209

- Page 7 and 8: Carteira: OC CAPITAL BPA-206 Data:

- Page 9 and 10: PTCPP7OE0020 1.2.3. Banco Santander

- Page 11 and 12: XS0260783005 1.2.3. Erste Bank Floa

- Page 13 and 14: Carteira: OC FUNDO POUPANCA 008 Dat

- Page 15 and 16: 5.1.9 IRS EUR 91,496 0.00 0.00 0.00

- Page 17: XS0746025336 1.2.3. BBVA Senior Fin

- Page 21 and 22: Carteira: OC INV.GARANTIDO FINANC-2

- Page 23 and 24: PTBCP7OM0061 1.2.3. Banco Comercial

- Page 25 and 26: 5.1.2. Depósitos à ordem 0 0.00 0

- Page 27 and 28: 5.1. À vista 16 0.00 0.00 0.00 14,

- Page 29 and 30: 5.1.2. Depósitos à ordem 0 0.00 0

- Page 31 and 32: Carteira: OC POUP. VERSÁTIL JOVEM-

- Page 33 and 34: FR0010011130 1.2.1. FRTR 4% 25/10/1

- Page 35 and 36: AT0000385356 1.2.1. RAGB 5% 15/07/1

- Page 37 and 38: Carteira: OC PPR CAPITAL GARANTIDO

- Page 39 and 40: XS0408285913 1.2.3. Vodafone Group

- Page 41 and 42: XS0446860826 1.2.3. Societe General

- Page 43 and 44: PTBLMWOM0002 1.2.3. Banco Espírito

- Page 45 and 46: 5.1.9 IRS EUR 68 0.00 0.00 0.00 0.0

- Page 47 and 48: Carteira: OC VERSÁTIL NOVE-204 Dat

- Page 49 and 50: Carteira: OC VIDA ATL.PER 2.4% FIN-

- Page 51 and 52: LU0430253178 1.2.6. F&C Port FD-F&C

- Page 53 and 54: Carteira: OC VIDA POUPANÇA VALOR-2

- Page 55 and 56: XS0446860826 1.2.3. Societe General

- Page 57 and 58: DE000EH0A2E9 1.2.3. Eurohypo AG 3.2

- Page 59 and 60: ES0312358007 1.2.3. AYT Cedulas Caj

- Page 61 and 62: Carteira: OC VIDA PPR-002 Data: 31-

- Page 63 and 64: Carteira: OC VIDA VALOR 2.4% FINAN-

- Page 65 and 66: Carteira: OC (UL) RENDA PRIVATE 200

- Page 67 and 68: Carteira: OC (UL) RENDA PRÉMIO 200

- Page 69 and 70:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 71 and 72:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 73 and 74:

Carteira: OC (UL) RENDA CRESC ESPEC

- Page 75 and 76:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 77 and 78:

Carteira: OC (UL) Renda Crescente T

- Page 79 and 80:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 81 and 82:

Carteira: OC (UL) RENDA VALOR 2010

- Page 83 and 84:

Carteira: OC (UL) RENDA PREMIO ESPE

- Page 85 and 86:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 87 and 88:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 89 and 90:

Carteira: ULA Capital Futuro (Estra

- Page 91 and 92:

Carteira: OC (UL) Renda Private 201

- Page 93 and 94:

Carteira: OC (UL) RENDA CERTA MAIS

- Page 95 and 96:

Carteira: OC (ULA) INVESTIM 75 FIN-

- Page 97 and 98:

Carteira: OC (UL) RENDA CERTA ESP 2

- Page 99 and 100:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 101 and 102:

PTS27AJM0048 2.3.2. Soc Francisco M

- Page 103 and 104:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 105 and 106:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 107 and 108:

Carteira: OC (UL) Renda Crescente T

- Page 109 and 110:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 111 and 112:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 113 and 114:

Carteira: OC (UL) Renda Crescente 2

- Page 115 and 116:

Carteira: OC (UL) RENDA PRESTIGE 20

- Page 117 and 118:

Carteira: OC (UL) RENDA EMPRESAS 20

- Page 119 and 120:

PRT11200001 5.1.2. EUR - Banco Come

- Page 121 and 122:

2.1. Valores mobiliários nacionais

- Page 123 and 124:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 125 and 126:

Carteira: OC (UL) RENDIMENTO VARIAV

- Page 127 and 128:

Carteira: OC (ULA) INVESTIM 20 FIN-

- Page 129 and 130:

Carteira: OC (ULA) NOVA POUP RENDIM

- Page 131 and 132:

Carteira: OC (ULA) SOLUÇÃO INVEST

- Page 133 and 134:

Carteira: OC (UL) RENDA CERTA PRIVA

- Page 135 and 136:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 137 and 138:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 139 and 140:

XS0458566071 1.2.3. Espirito Santo

- Page 141 and 142:

7.2.2. Swap (IRS-34835PA-5.29% 26/0

- Page 143 and 144:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 145 and 146:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 147 and 148:

Carteira: OC (UL) RENDA CERTA ESPEC

- Page 149 and 150:

Carteira: OC (UL) RENDA CRESC PRIVA

- Page 151 and 152:

Carteira: OC (UL) RENDA PRÉMIO 200

- Page 153 and 154:

Carteira: OC (UL) RENDA PRIVATE 200

- Page 155 and 156:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 157 and 158:

Carteira: OC (UL) RENDA CERTA 8A 1S

- Page 159 and 160:

Carteira: OC (UL) RENDA CRESCENTE M

- Page 161 and 162:

Carteira: OC (UL) RENDA PREMIO 2009

- Page 163 and 164:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 165 and 166:

PTBCQWOM0033 1.1.3. Banco Comercial

- Page 167 and 168:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 169 and 170:

Carteira: OC (UL) RENDA GLOBAL 2008

- Page 171 and 172:

Carteira: OC (UL) RENDA CERTA ESP 2

- Page 173 and 174:

5.1.2. Depósitos à ordem 0 0.00 0

- Page 175 and 176:

Carteira: OC (UL) RENDA CERTA 2004

- Page 177 and 178:

Carteira: OC (UL) RENDA CERTA 2005

- Page 179 and 180:

Carteira: OC (UL) RENDA CERTA 2005

- Page 181 and 182:

Carteira: OC (UL) RENDA CERTA 2005

- Page 183 and 184:

PTPTIBOE0009 2.1.3. Portucel Float

- Page 185 and 186:

PRT11200001 5.1.2. EUR - Banco Come

- Page 187 and 188:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 189 and 190:

Carteira: OC (UL) RENDA CRESC MAIS

- Page 191 and 192:

7.2.2. Swap (IRS-29111 PA Var 05/09

- Page 193 and 194:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 195 and 196:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 197 and 198:

Carteira: OC (UL) RENDA CRESCENTE 2

- Page 199 and 200:

Carteira: OC (UL) RENDA EURIBOR MAI

- Page 201 and 202:

Carteira: OC (UL) RENDA EURIBOR 200

- Page 203 and 204:

Carteira: OC (UL) RENDA EURIBOR 8 A

- Page 205 and 206:

2.2.3. Obrigações diversas 12,808

- Page 207 and 208:

5.1.9 Diferimento do juro das OPL's

- Page 209 and 210:

XS0257650019 1.2.3. Ageas Hybrid Va

- Page 211 and 212:

7.2.2. Swap (IRS/FB-DHU18248PA Floa

- Page 213 and 214:

Carteira: OC (UL) RENDA TRIMESTRAL

- Page 215 and 216:

Carteira: OC (ULA) GD Perfil Cresci

- Page 217 and 218:

Carteira: OC (ULA) GD Perfil Preser

- Page 219 and 220:

5.1.9 SEG-PRÉMIO-PV EUR 0 0.00 0.0

- Page 221 and 222:

5.1.9 SEG-PRÉMIO-PV EUR 0 0.00 0.0

- Page 223 and 224:

Carteira: OC ULA SIG - Equilibrada

- Page 225 and 226:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 227 and 228:

Carteira: OC (UL) SEGURO MILLENNIUM

- Page 229 and 230:

Carteira: OC (UL) SEGURO MILLENNIUM