Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

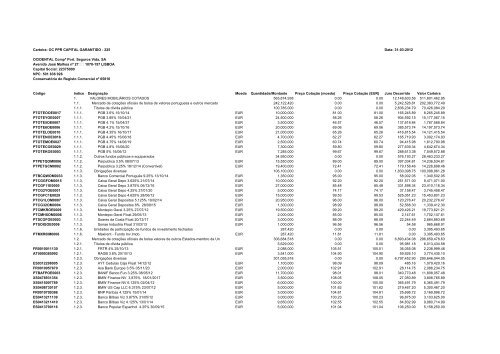

<strong>Carteira</strong>: <strong>OC</strong> PPR CAPITAL <strong>GARANTIDO</strong> - 225 <strong>Data</strong>: <strong>31</strong>-<strong>03</strong>-2012<br />

<strong>OC</strong>IDENTAL Compª Port. Seguros Vida, SA<br />

Avenida José Malhoa nº 27 1070-157 LISBOA<br />

Capital Social: 22375000<br />

NPC: 501 836 926<br />

Conservatória do Registo Comercial nº 65816<br />

Código Indice Designação Moeda Quantidade/Montante Preço Cotação (moeda) Preço Cotação (EUR) Juro Decorrido Valor <strong>Carteira</strong><br />

1. VALORES MOBILIÁRIOS COTADOS 563,874,938 0.00 0.00 12,148,6<strong>03</strong>.56 511,801,462.95<br />

1.1. Mercado de cotações oficiais de bolsa de valores portuguesa e outros mercado 242,122,420 0.00 0.00 5,242,526.81 202,383,772.49<br />

1.1.1. Títulos de dívida pública 100,785,000 0.00 0.00 2,836,234.79 70,426,084.29<br />

PTOTEOOE0017 1.1.1. PGB 3.6% 15/10/14 EUR 10,000,000 81.00 81.00 165,245.89 8,265,245.89<br />

PTOTEYOE0007 1.1.1. PGB 3.85% 15/04/21 EUR 24,500,000 58.26 58.26 904,592.15 15,177,067.15<br />

PTOTE5OE0007 1.1.1. PGB 4.1% 15/04/37 EUR 3,500,000 46.57 46.57 137,618.84 1,767,568.84<br />

PTOTE6OE0006 1.1.1. PGB 4.2% 15/10/16 EUR 20,000,000 69.06 69.06 385,573.74 14,197,573.74<br />

PTOTELOE0010 1.1.1. PGB 4.35% 16/10/17 EUR 21,000,000 65.26 65.26 416,815.54 14,121,415.54<br />

PTOTENOE0018 1.1.1. PGB 4.45% 15/06/18 EUR 4,700,000 62.27 62.27 165,719.93 3,092,174.93<br />

PTOTEMOE0027 1.1.1. PGB 4.75% 14/06/19 EUR 2,500,000 60.74 60.74 94,415.98 1,612,790.98<br />

PTOTECOE0029 1.1.1. PGB 4.8% 15/06/20 EUR 7,300,000 59.80 59.80 277,639.34 4,642,674.34<br />

PTOTEKOE00<strong>03</strong> 1.1.1. PGB 5% 15/06/12 EUR 7,285,000 99.67 99.67 288,613.38 7,549,572.88<br />

1.1.2. Outros fundos públicos e equiparados 34,950,000 0.00 0.00 576,193.27 28,463,233.27<br />

PTPETQOM0006 1.1.2. Parpublica 3.5% 08/07/13 EUR 15,550,000 89.00 89.00 397,<strong>03</strong>4.81 14,236,534.81<br />

PTPETGCM0002 1.1.2. Parpública 3.25% 18/12/14 (Convertível) EUR 19,400,000 72.41 72.41 179,158.46 14,226,698.46<br />

1.1.3. Obrigações diversas 106,100,000 0.00 0.00 1,830,098.75 100,098,961.28<br />

PTBCQWOM0<strong>03</strong>3 1.1.3. Banco Comercial Português 9.25% 13/10/14 EUR 1,350,000 95.00 95.00 58,002.05 1,340,502.05<br />

PTCGGFOM0015 1.1.3. Caixa Geral Depo 3.625% 21/07/14 EUR 10,000,000 92.20 92.20 251,571.00 9,471,071.00<br />

PTCGF11E0000 1.1.3. Caixa Geral Depo 3.875% 06/12/16 EUR 27,000,000 85.48 85.48 3<strong>31</strong>,598.34 23,410,118.34<br />

PTCG2YOE0001 1.1.3. Caixa Geral Depo 4.25% 27/01/20 EUR 5,000,000 74.17 74.17 37,158.47 3,745,458.47<br />

PTCGFC1E0029 1.1.3. Caixa Geral Depo 4.625% 28/06/12 EUR 15,000,000 99.53 99.53 525,051.23 15,453,801.23<br />

PTCG1LOM0007 1.1.3. Caixa Geral Depositos 5.125% 19/02/14 EUR 20,950,000 96.00 96.00 120,276.47 20,232,276.47<br />

PTCG32OM0004 1.1.3. Caixa Geral Depositos 8% 28/09/15 EUR 1,300,000 98.99 98.99 52,568.30 1,339,412.30<br />

PTCMKROE0009 1.1.3. Montepio Geral 3.25% 27/07/12 EUR 19,500,000 99.20 99.20 429,426.21 19,773,621.21<br />

PTCMHXOM0006 1.1.3. Montepio Geral Float 29/05/13 EUR 2,000,000 85.00 85.00 2,147.61 1,702,147.61<br />

PTSCOFOE00<strong>03</strong> 1.1.3. Soares da Costa Float 20/12/17 EUR 3,000,000 88.09 88.09 22,244.49 2,664,883.69<br />

PTSOIGOE0006 1.1.3. Sonae Industria Float <strong>31</strong>/<strong>03</strong>/13 EUR 1,000,000 96.56 96.56 54.58 965,668.91<br />

1.1.6. Unidades de participação de fundos de investimento fechados 287,420 0.00 0.00 0.00 3,395,493.65<br />

PTMXR0IM0008 1.1.6. Maxirent - Fundo Inv.Imob. EUR 287,420 11.81 11.81 0.00 3,395,493.65<br />

1.2. Mercado de cotações oficiais de bolsa valores de outros Estados-membro da Un 306,684,518 0.00 0.00 6,893,434.08 296,659,478.63<br />

1.2.1. Títulos de dívida pública 5,629,000 0.00 0.00 95,981.18 6,013,434.58<br />

FR0010011130 1.2.1. FRTR 4% 25/10/13 EUR 2,088,000 105.51 105.51 36,055.08 2,238,999.48<br />

AT000<strong>03</strong>85992 1.2.1. RAGB 3.8% 20/10/13 EUR 3,541,000 104.90 104.90 59,926.10 3,774,435.10<br />

1.2.3. Obrigações diversas 301,055,518 0.00 0.00 6,797,452.90 290,646,044.05<br />

ES0<strong>31</strong>2298005 1.2.3. AYT Cedulas Caja Float 14/12/12 EUR 1,100,000 98.09 98.09 485.16 1,079,420.16<br />

FR0010957670 1.2.3. Axa Bank Europe 3.5% 05/11/20 EUR 2,000,000 102.91 102.91 28,114.75 2,086,234.75<br />

PTBAFPOE00<strong>03</strong> 1.2.3. BANIF Banco Fun 3.25% 08/05/12 EUR 11,700,000 98.01 98.01 340,770.48 11,808,057.48<br />

XS04789<strong><strong>31</strong>3</strong>54 1.2.3. BMW Finance NV 3,875% 18/01/2017 EUR 3,500,000 108.05 108.05 27,050.89 3,808,765.89<br />

XS0415007789 1.2.3. BMW Finance NV 6.125% 02/04/12 EUR 6,000,000 100.00 100.00 365,491.79 6,365,491.79<br />

XS0408730157 1.2.3. BMW US Cap LLC 6.375% 23/07/12 EUR 5,000,000 101.62 101.62 219,467.20 5,300,467.20<br />

FR0010709386 1.2.3. BNP Paribas 4.125% 15/01/14 EUR 3,000,000 104.81 104.81 25,696.72 3,169,996.72<br />

ES0413211139 1.2.3. Banco Bilbao Viz 3.875% <strong>31</strong>/05/12 EUR 3,000,000 100.23 100.23 96,875.00 3,1<strong>03</strong>,625.00<br />

ES0413211410 1.2.3. Banco Bilbao Viz 4.125% 13/01/14 EUR 9,650,000 102.55 102.55 84,832.99 9,980,714.99<br />

ES0413790116 1.2.3. Banco Popular Espanhol 4.25% 30/09/15 EUR 5,000,000 101.04 101.04 106,250.00 5,158,250.00