Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

Carteira: OC TESOURO GARANTIDO 1SR 313 Data: 31-03 ... - FEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

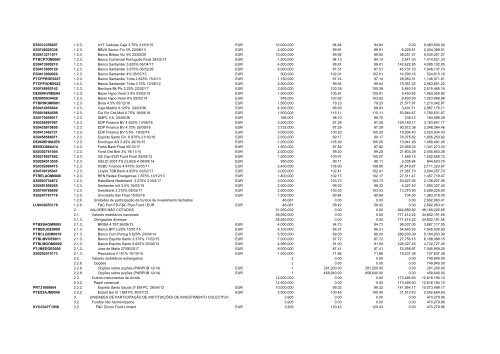

ES0<strong>31</strong>2358007 1.2.3. AYT Cedulas Caja 3.75% <strong>31</strong>/<strong>03</strong>/15 EUR 10,000,000 94.84 94.84 0.00 9,483,500.00<br />

XS0746025336 1.2.3. BBVA Senior Fin 3% 22/08/13 EUR 2,000,000 99.91 99.91 6,229.51 2,004,389.51<br />

ES0413211071 1.2.3. Banco Bilbao Viz 4% 25/02/25 EUR 10,000,000 89.92 89.92 38,251.37 9,<strong>03</strong>0,251.37<br />

PTBCP7OM0061 1.2.3. Banco Comercial Português Float 28/02/13 EUR 1,500,000 94.13 94.13 2,541.33 1,414,521.33<br />

ES0413900210 1.2.3. Banco Santander 3.625% 06/04/17 EUR 4,000,000 98.81 98.81 142,622.95 4,095,102.95<br />

ES0413900129 1.2.3. Banco Santander 3.875% 06/02/26 EUR 8,000,000 87.51 87.51 45,737.70 7,046,137.70<br />

ES0413900020 1.2.3. Banco Santander 4% 08/07/13 EUR 500,000 102.01 102.01 14,590.16 524,615.16<br />

PTCPPROE0027 1.2.3. Banco Santander Totta 2.625% 15/4/13 EUR 1,150,000 97.14 97.14 28,950.<strong>31</strong> 1,146,071.81<br />

PTCPP4OM0023 1.2.3. Banco Santander Totta 3.75% 12/06/12 EUR 2,500,000 99.54 99.54 75,051.22 2,563,651.22<br />

XS0748955142 1.2.3. Barclays Bk Plc 2.25% 22/02/17 EUR 2,500,000 100.39 100.39 5,840.16 2,515,465.16<br />

DE000HV0EBA5 1.2.3. Bayer Hypo-Verei 3.5% <strong>03</strong>/02/15 EUR 1,000,000 105.81 105.81 5,450.82 1,063,550.82<br />

DE0005934426 1.2.3. Bayer Hypo-Verei 6% 05/02/14 EUR 976,000 1<strong>03</strong>.92 1<strong>03</strong>.92 8,800.00 1,023,068.96<br />

PTBRIHOM0001 1.2.3. Brisa 4.5% 05/12/16 EUR 1,500,000 79.23 79.23 21,577.87 1,210,042.87<br />

ES0414950644 1.2.3. Caja Madrid 4.125% 24/<strong>03</strong>/36 EUR 4,300,000 68.93 68.93 3,401.71 2,967,176.71<br />

FR0010664599 1.2.3. Cie Fin Crd-Mutl 6.75% 18/09/18 EUR 1,500,000 115.11 115.11 53,944.67 1,780,5<strong>31</strong>.67<br />

XS0170059017 1.2.3. DMPL II A 20/05/36 EUR 166,001 98.70 98.70 238.12 164,089.29<br />

XS0256997007 1.2.3. EDP Finance BV 4.625% 13/06/16 EUR 3,500,000 87.28 87.28 129,146.17 3,183,841.17<br />

XS0435879605 1.2.3. EDP Finance BV 4.75% 26/09/16 EUR 3,732,000 87.29 87.29 90,572.38 3,348,384.46<br />

XS0413462721 1.2.3. EDP Finance BV 5.5% 18/02/14 EUR 3,000,000 100.20 100.20 18,934.43 3,024,934.43<br />

XS0458566071 1.2.3. Espirito Santo Fin. 6.875% 21/10/19 EUR 2,500,000 69.17 69.17 76,075.82 1,805,250.82<br />

DE000EH0A2E9 1.2.3. Eurohypo AG 3.25% 26/10/15 EUR 1,000,000 105.26 105.26 13,941.26 1,066,491.26<br />

BE0933860414 1.2.3. Fortis Bank Float 05/12/17 EUR 1,500,000 87.82 87.82 23,958.33 1,341,273.33<br />

ES<strong>03</strong>02761004 1.2.3. Fund Ord Bnk 3% 19/11/14 EUR 2,000,000 99.20 99.20 21,8<strong>03</strong>.28 2,005,8<strong>03</strong>.28<br />

XS0219927802 1.2.3. GE Cap EUR Fund Float 25/05/12 EUR 1,500,000 100.07 100.07 1,566.12 1,502,556.12<br />

XS0294513<strong>03</strong>0 1.2.3. GELDI 2007-TS CLASS A 08/09/14 EUR 950,000 99.11 99.11 3,<strong>03</strong>5.94 944,6<strong>03</strong>.70<br />

XS<strong>03</strong>02868475 1.2.3. HSBC Finance 4.875% 30/05/17 EUR 2,400,000 108.90 108.90 97,819.67 2,711,323.67<br />

XS0740795041 1.2.3. Lloyds TSB Bank 4.625% 02/02/17 EUR 3,000,000 102.41 102.41 21,987.70 3,094,257.70<br />

PTRELAOM0000 1.2.3. REN Redes Energeticas 7.875% 10/12/13 EUR 1,400,000 102.17 102.17 27,<strong>31</strong>1.47 1,457,719.47<br />

XS05<strong>03</strong>734872 1.2.3. RaboBank Nederland 3.375% 21/04/17 EUR 2,000,000 1<strong>03</strong>.73 1<strong>03</strong>.73 63,627.05 2,138,207.05<br />

XS0491856265 1.2.3. Santander Intl 3.5% 10/<strong>03</strong>/15 EUR 2,000,000 99.32 99.32 4,027.40 1,990,327.40<br />

XS0740788699 1.2.3. Swedbank 3.375% 09/02/17 EUR 2,500,000 1<strong>03</strong>.<strong>03</strong> 1<strong>03</strong>.<strong>03</strong> 13,370.90 2,589,220.90<br />

XS0247757718 1.2.3. Unicredito Itali Float 15/<strong>03</strong>/16 EUR 1,500,000 90.84 90.84 734.00 1,363,<strong>31</strong>9.00<br />

1.2.6. Unidades de participação de fundos de investimento fechados 46,081 0.00 0.00 0.00 2,692,063.41<br />

LU043025<strong>31</strong>78 1.2.6. F&C Port FD-F&C Plus Fund I EUR EUR 46,081 58.42 58.42 0.00 2,692,063.41<br />

2. VALORES NÃO COTADOS 51,050,002 0.00 0.00 944,880.82 48,168,225.65<br />

2.1. Valores mobiliários nacionais 38,550,000 0.00 0.00 771,414.22 34,802,191.55<br />

2.1.3. Obrigações diversas 38,550,000 0.00 0.00 771,414.22 34,802,191.55<br />

PTBSSAOM0005 2.1.3. BRISA 4.797 26/09/13 EUR 4,000,000 94.73 94.73 98,<strong>03</strong>7.05 3,887,117.05<br />

PTBB5JOE0000 2.1.3. Banco BPI 3.25% 15/01/15 EUR 8,100,000 86.<strong>31</strong> 86.<strong>31</strong> 54,663.93 7,045,530.93<br />

PTBCLQOM0010 2.1.3. Banco Com Portug 5.625% 23/04/14 EUR 5,500,000 89.00 89.00 289,933.39 5,184,933.39<br />

PTBLMVOE0011 2.1.3. Banco Espirito Santo 3.375% 17/02/15 EUR 7,000,000 87.72 87.72 27,756.15 6,168,086.15<br />

PTBLMGOM0002 2.1.3. Banco Espirito Santo 5.625% 05/06/14 EUR 4,950,000 91.00 91.00 228,227.45 4,732,727.45<br />

PTJMEDOE0006 2.1.3. Jose de Mello 27/06/2017 EUR 8,000,000 87.41 87.41 53,558.87 7,045,959.20<br />

XS0202475173 2.1.3. Parpublica 4.191% 15/10/14 EUR 1,000,000 71.86 71.86 19,237.38 737,837.38<br />

2.2. Valores mobiliários estrangeiros 2 0.00 0.00 0.00 749,840.00<br />

2.2.8. Opções 2 0.00 0.00 0.00 749,840.00<br />

2.2.8. Opções sobre acções (PARPUB 12/14) EUR 1 291,200.00 291,200.00 0.00 291,200.00<br />

2.2.8. Opções sobre acções (PARPUB 12/14) EUR 1 458,640.00 458,640.00 0.00 458,640.00<br />

2.3. Outros instrumentos de dívida 12,500,000 0.00 0.00 173,466.60 12,616,194.10<br />

2.3.2. Papel comercial 12,500,000 0.00 0.00 173,466.60 12,616,194.10<br />

PRT<strong>31</strong>000004 2.3.2. Espirito Santo Saude 3ª EM PC 26/04/12 EUR 10,000,000 99.32 99.32 141,954.17 10,073,499.17<br />

PTES3AJM0048 2.3.2. Estoril Sol III 1 EM PC 30/07/12 EUR 2,500,000 100.45 100.45 <strong>31</strong>,512.43 2,542,694.93<br />

3. UNIDADES DE PARTICIPAÇÃO DE INSTITUIÇÕES DE INVESTIMENTO COLECTIVO 3,905 0.00 0.00 0.00 470,279.96<br />

3.2. Fundos não harmonizados 3,905 0.00 0.00 0.00 470,279.96<br />

KYG3347T1058 3.2. F&C Zircon Fund Limited EUR 3,905 120.43 120.43 0.00 470,279.96