Small Decentralized Hydropower Program National ... - Cd3wd.com

Small Decentralized Hydropower Program National ... - Cd3wd.com

Small Decentralized Hydropower Program National ... - Cd3wd.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

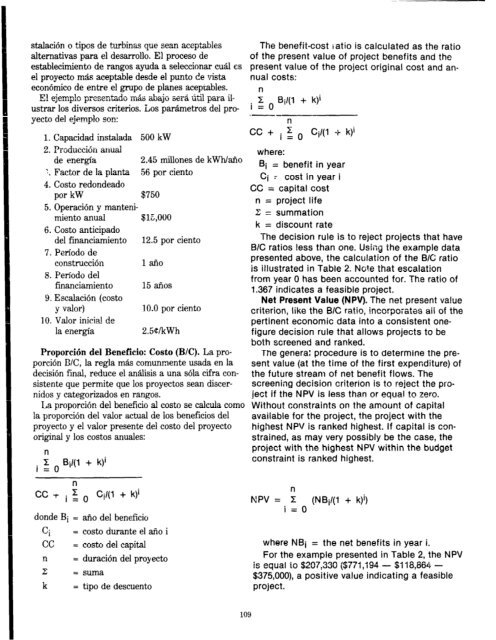

stalacion o tipos de turbinas que scan aceptables<br />

alternativas para el desarrollo. El proceso de<br />

establecimiento de ranges ayuda a seleccionar cual es<br />

el proyecto mas aceptable desde el punto de vista<br />

economico de entre el grupo de planes aceptables.<br />

E! ejepxplo pres~~r,f~&-j m&;i &jo ser& -&J pus Idi-<br />

ustrar 10s diversos criterios. Los par&metros de1 pro-<br />

ye&o de! ejemplo son:<br />

1. Capacidad instalada 500 kW<br />

2. pi-oJ-~cci&, all-uaj<br />

de energia 2.45 millones de kWh/aiio<br />

1. Factor de la planta 56 por ciento<br />

4. Costo redondeado<br />

por kW $750<br />

5. Operation y manteni-<br />

miento anual $lE,OOO<br />

6. Costo anticipado<br />

de1 financiamiento 12.5 por ciento<br />

7. Petiodo de<br />

construction 1 an0<br />

8. Periodo de1<br />

financiamiento 15 arias<br />

9. E scalacion (co&o<br />

y valor) 10.0 por ciento<br />

10. Valor initial de<br />

la energia 2.5UkWh<br />

Proporcih de1 Beneficio: Costo (B/C). La pro-<br />

portion G/C, la regla mas <strong>com</strong>unmente usada en la<br />

decision final, reduce el analisis a una sola cifra con-<br />

sistente que permite que 10s proyectos Sean discer-<br />

nidos y categorizados en rangos.<br />

La proportion de1 beneficio al costo se calcula <strong>com</strong>a<br />

la proporciom de1 valor actual de 10s beneficios de1<br />

proyecto y el valor presente de1 costo de1 proyecto<br />

original y 10s costos anuales:<br />

n<br />

i Z o Si/(l + k)i<br />

=<br />

n<br />

CC T i f 0 Ci/(l + k)t<br />

donde Bi = aiio de1 beneficio<br />

ci = cost0 durante el airo i<br />

cc = cost0 de1 capital<br />

n = duration de1 proy ecto<br />

z = suma<br />

k = tipo de descuento<br />

The benefit-cost ratio is calculated as the ratio<br />

of the present value of project benefits and the<br />

present value of the project original<br />

nual costs:<br />

n<br />

cost and anz<br />

i=O<br />

Bil(l + k)i<br />

.-<br />

n<br />

CC + i 2 0 Ci/(I + k)’<br />

where:<br />

R = benefit in year<br />

Ci : cost in year i<br />

cc = capital cost<br />

n = project life<br />

z = summation<br />

k = discount rate<br />

The decision rule is to reject projects that have<br />

B/C ratios less than one. Using the example data<br />

presented above, the calculation of the B/C ratio<br />

is illustrated in Table 2. Note that escalation<br />

from year 0 has been accounted for. The ratio of<br />

1.367 indicates a feasible project.<br />

Net Present Value (NPV). The net present va!ue<br />

criterion, like the B/C ratio, incorporates aii of the<br />

pertinent economic data into a consistent one-<br />

figure decision rule that allows projects to be<br />

both screened and ranked.<br />

The general procedure is to determine the pre-<br />

sent value (at the time of the first expenditure) of<br />

the future stream of net benefit flows. The<br />

screening decision criterion is to reject the pro-<br />

ject if the NFV is less than or equa! ?o zero.<br />

Without constraints on the amount of capital<br />

available for the project, the project with the<br />

highest NFV is ranked highest. If capital is con-<br />

strained, as may very possibly be the case, the<br />

project with the highest NFV within the budget<br />

constraint is ranked highest.<br />

n<br />

NFV= 1 (NBil(l + k)i)<br />

i=O<br />

109<br />

where NBi = the net benefits in year i.<br />

For the example presented in Table 2, the NFV<br />

is equal to $207,330 ($77;,;94 - $ii6,864 -<br />

$375,000), a positive value indicating a feasible<br />

project.

![Mum, int. [man] - Cd3wd.com](https://img.yumpu.com/51564724/1/190x134/mum-int-man-cd3wdcom.jpg?quality=85)