Small Decentralized Hydropower Program National ... - Cd3wd.com

Small Decentralized Hydropower Program National ... - Cd3wd.com

Small Decentralized Hydropower Program National ... - Cd3wd.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

todos sus <strong>com</strong>promises financieros. Si este fuere el<br />

case, el analisis financier0 indicarb la extension de1<br />

deficit de1 proyecto, permitiendc la elaboraci6n de<br />

planes para satisfacer dicho deficit.<br />

Se ejecuta el antiisis financier0 media&e la <strong>com</strong>-<br />

paracion de ios recibos dei proyecto con 10s desem-<br />

bolsos en base anual o m&s frecuente. El an$i.lisis da<br />

cuenta de ios servicios de deuda pero ignora 10s<br />

articulos que no implican gastos, tales corn0 la<br />

depreciacibn. Dependiendo de1 pak y el tipo de<br />

organizaci6n, 10s efectos de las tasas pod&n ser im-<br />

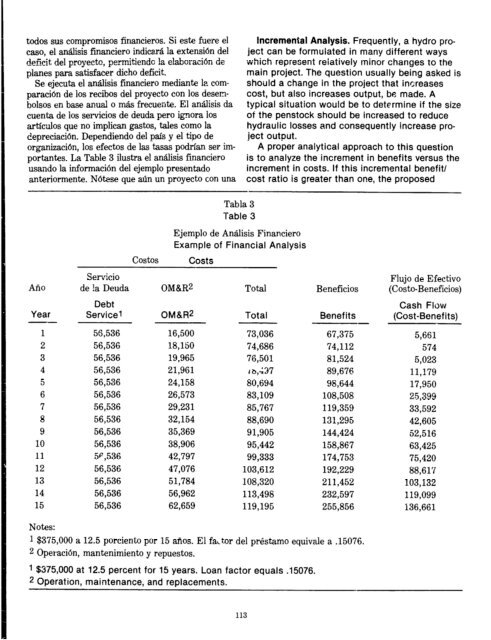

portantes. La Table 3 ilustra el analisis financier0<br />

usando la information de1 ejemplo presentado<br />

anteriormente. N6tese que atin un proyecto con una<br />

Ario<br />

Year<br />

costos costs<br />

Tabla 3<br />

Table 3<br />

Ejemplo de Analisis Financier0<br />

Example of Financial Analysis<br />

Incremental Analysis. Frequently, a hydro pro-<br />

ject can be formuiated in many different ways<br />

which represent reiatively minor changes to the<br />

main project. The question usually being asked is<br />

should a change in the project that increases<br />

cost, but also increases output, be made. A<br />

typical situation would be to determine if the size<br />

of the penstock should be increased to reduce<br />

hydraulic losses and consequently increase pro-<br />

ject output.<br />

A proper anaiytical approach to this question<br />

is to analyze the increment in benefits versus the<br />

increment in costs. If this incremental benefit/<br />

cost ratio is greater than one, the proposed<br />

Servicio<br />

de !a Deuda OM&R2 Total Beneficios<br />

Debt<br />

Service1 OM&R2 Total Benefits<br />

Flujo de Efectivo<br />

(Costo-Beneficios)<br />

Cash Flow<br />

(Cost-Benefits)<br />

1 56,536 16,500 73,036 67,375 5,661<br />

2 56,536 18,150 74,686 74,112 574<br />

3 56,536 19,965 76,501 81,524 5,023<br />

4 56,536 21,961 1 a,-;37 89,676 11,179<br />

5 56,536 24,158 80,694 98,644 17,950<br />

6 56,536 26,573 83,109 108,508 25,399<br />

7 56,536 29,231 85,767 119,359 33,592<br />

8 56,536 32,154 88,690 131,295 42,605<br />

9 56,536 35,369 91,905 144,424 52,516<br />

10 56,536 38,906 95,442 158,867 63,425<br />

11 5c,536 42,797 99,333 174,753 75,420<br />

12 56,536 47,076 103,612 192,229 88,617<br />

13 56,536 51,784 108,320 211,452 103,132<br />

14 56,536 56,962 113,498 232,597 119,099<br />

15 56,536 62,659 119,195 255,856 136,661<br />

Notes:<br />

1 $375,000 a 12.5 porciento por 15 adios. El faLtor de1 prestamo equivale a .15076.<br />

2 Operaci6n, manknimiento y repuestos.<br />

1 $375,000 at 12.5 percent for 15 years. Loan factor equals .15076.<br />

2 Operation, maintenance, and replacements.<br />

113

![Mum, int. [man] - Cd3wd.com](https://img.yumpu.com/51564724/1/190x134/mum-int-man-cd3wdcom.jpg?quality=85)