Attention! Your ePaper is waiting for publication!

By publishing your document, the content will be optimally indexed by Google via AI and sorted into the right category for over 500 million ePaper readers on YUMPU.

This will ensure high visibility and many readers!

Your ePaper is now published and live on YUMPU!

You can find your publication here:

Share your interactive ePaper on all platforms and on your website with our embed function

Nevada_Executive_Budget_2013-2015

Nevada_Executive_Budget_2013-2015

Nevada_Executive_Budget_2013-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

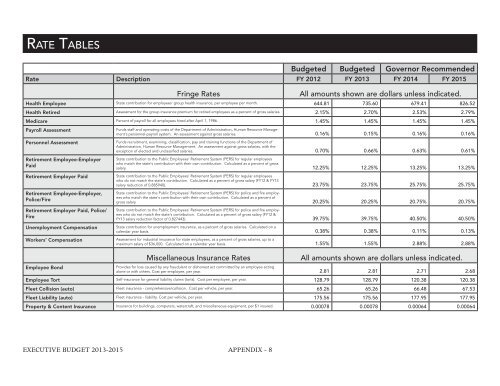

RATE TABLES<br />

<strong>Budget</strong>ed <strong>Budget</strong>ed Governor Recommended<br />

Rate Description FY 2012 FY <strong>2013</strong> FY 2014 FY <strong>2015</strong><br />

Fringe Rates All amounts shown are dollars unless indicated.<br />

Health Employee State contribution for employees' group health insurance, per employee per month. 644.81 735.60 679.41 826.52<br />

Health Retired Assessment for the group insurance premium for retired employees as a percent of gross salaries. 2.15% 2.70% 2.53% 2.79%<br />

Medicare Percent of payroll for all employees hired after April 1, 1986. 1.45% 1.45% 1.45% 1.45%<br />

Payroll Assessment<br />

Funds staff and operating costs of the Department of Administration, Human Resource Management's<br />

personnel-payroll system. An assessment against gross salaries. 0.16% 0.15% 0.16% 0.16%<br />

Personnel Assessment<br />

Funds recruitment, examining, classifi cation, pay and training functions of the Department of<br />

Administration, Human Resource Management. An assessment against gross salaries, with the<br />

exception of elected and unclassifi ed salaries. 0.70% 0.66% 0.63% 0.61%<br />

Retirement Employee-Employer State contribution to the Public Employees' Retirement System (PERS) for regular employees<br />

Paid<br />

who match the state's contribution with their own contribution. Calculated as a percent of gross<br />

salary. 12.25% 12.25% 13.25% 13.25%<br />

Retirement Employer Paid<br />

State contribution to the Public Employees' Retirement System (PERS) for regular employees<br />

who do not match the state's contribution. Calculated as a percent of gross salary (FY12 & FY13<br />

salary reduction of 0.885940). 23.75% 23.75% 25.75% 25.75%<br />

Retirement Employee-Employer, State contribution to the Public Employees' Retirement System (PERS) for police and fi re employ-<br />

Police/Fire<br />

ees who match the state's contribution with their own contribution. Calculated as a percent of<br />

gross salary. 20.25% 20.25% 20.75% 20.75%<br />

Retirement Employer Paid, Police/ State contribution to the Public Employees' Retirement System (PERS) for police and fi re employ-<br />

Fire<br />

ees who do not match the state's contribution. Calculated as a percent of gross salary (FY12 &<br />

FY13 salary reduction factor of 0.827443). 39.75% 39.75% 40.50% 40.50%<br />

Unemployment Compensation State contribution for unemployment insurance, as a percent of gross salaries. Calculated on a<br />

calendar year basis. 0.38% 0.38% 0.11% 0.13%<br />

Workers’ Compensation<br />

Assessment for industrial insurance for state employees, as a percent of gross salaries, up to a<br />

maximum salary of $36,000. Calculated on a calendar year basis. 1.55% 1.55% 2.88% 2.88%<br />

Miscellaneous Insurance Rates All amounts shown are dollars unless indicated.<br />

Employee Bond<br />

Provides for loss caused by any fraudulent or dishonest act committed by an employee acting<br />

alone or with others. Cost per employee, per year. 2.81 2.81 2.71 2.68<br />

Employee Tort Self-insurance for general liability claims (torts). Cost per employee, per year. 128.79 128.79 120.38 120.38<br />

Fleet Collision (auto) Fleet insurance - comprehensive/collision. Cost per vehicle, per year. 65.26 65.26 66.48 67.53<br />

Fleet Liability (auto) Fleet insurance - liability. Cost per vehicle, per year. 175.56 175.56 177.95 177.95<br />

Property & Content Insurance Insurance for buildings, computers, watercraft, and miscellaneous equipment, per $1 insured. 0.00078 0.00078 0.00064 0.00064<br />

EXECUTIVE BUDGET <strong>2013</strong>-<strong>2015</strong><br />

APPENDIX - 8

RATE TABLES <strong>Budget</strong>ed <strong>Budget</strong>ed Governor Recommended Rate Description FY 2012 FY <strong>2013</strong> FY 2014 FY <strong>2015</strong> Fringe Rates All amounts shown are dollars unless indicated. Health Employee State contribution for employees' group health insurance, per employee per month. 644.81 735.60 679.41 826.52 Health Retired Assessment for the group insurance premium for retired employees as a percent of gross salaries. 2.15% 2.70% 2.53% 2.79% Medicare Percent of payroll for all employees hired after April 1, 1986. 1.45% 1.45% 1.45% 1.45% Payroll Assessment Funds staff and operating costs of the Department of Administration, Human Resource Management's personnel-payroll system. An assessment against gross salaries. 0.16% 0.15% 0.16% 0.16% Personnel Assessment Funds recruitment, examining, classifi cation, pay and training functions of the Department of Administration, Human Resource Management. An assessment against gross salaries, with the exception of elected and unclassifi ed salaries. 0.70% 0.66% 0.63% 0.61% Retirement Employee-Employer State contribution to the Public Employees' Retirement System (PERS) for regular employees Paid who match the state's contribution with their own contribution. Calculated as a percent of gross salary. 12.25% 12.25% 13.25% 13.25% Retirement Employer Paid State contribution to the Public Employees' Retirement System (PERS) for regular employees who do not match the state's contribution. Calculated as a percent of gross salary (FY12 & FY13 salary reduction of 0.885940). 23.75% 23.75% 25.75% 25.75% Retirement Employee-Employer, State contribution to the Public Employees' Retirement System (PERS) for police and fi re employ- Police/Fire ees who match the state's contribution with their own contribution. Calculated as a percent of gross salary. 20.25% 20.25% 20.75% 20.75% Retirement Employer Paid, Police/ State contribution to the Public Employees' Retirement System (PERS) for police and fi re employ- Fire ees who do not match the state's contribution. Calculated as a percent of gross salary (FY12 & FY13 salary reduction factor of 0.827443). 39.75% 39.75% 40.50% 40.50% Unemployment Compensation State contribution for unemployment insurance, as a percent of gross salaries. Calculated on a calendar year basis. 0.38% 0.38% 0.11% 0.13% Workers’ Compensation Assessment for industrial insurance for state employees, as a percent of gross salaries, up to a maximum salary of $36,000. Calculated on a calendar year basis. 1.55% 1.55% 2.88% 2.88% Miscellaneous Insurance Rates All amounts shown are dollars unless indicated. Employee Bond Provides for loss caused by any fraudulent or dishonest act committed by an employee acting alone or with others. Cost per employee, per year. 2.81 2.81 2.71 2.68 Employee Tort Self-insurance for general liability claims (torts). Cost per employee, per year. 128.79 128.79 120.38 120.38 Fleet Collision (auto) Fleet insurance - comprehensive/collision. Cost per vehicle, per year. 65.26 65.26 66.48 67.53 Fleet Liability (auto) Fleet insurance - liability. Cost per vehicle, per year. 175.56 175.56 177.95 177.95 Property & Content Insurance Insurance for buildings, computers, watercraft, and miscellaneous equipment, per $1 insured. 0.00078 0.00078 0.00064 0.00064 EXECUTIVE BUDGET <strong>2013</strong>-<strong>2015</strong> APPENDIX - 8

<strong>Budget</strong>ed <strong>Budget</strong>ed Governor Recommended Rate Description FY 2012 FY <strong>2013</strong> FY 2014 FY <strong>2015</strong> State Rent All amounts shown are dollars unless indicated. State Owned Building Rent Offi ce space rent - State facilities per square foot per month. 0.96 0.96 1.00 1.00 State Owned Building Rent Storage space rent - State facilities, per square foot per month. 0.35 0.35 0.37 0.37 DCNR Lease/Purchase Building Department of Conservation and Natural Resources Lease/Purchase Building payment to Buildings and Grounds, per square foot per month. 0.54 0.54 0.56 0.56 Enterprise IT Services Rates All amounts shown are dollars unless indicated. Infrastructure Assessment Per FTE Per Year 113.91 118.01 123.59 108.24 Security Assessment Per FTE Per Year 50.44 46.72 81.95 62.00 Programmer/Developer Per Hour 79.39 74.09 89.01 91.68 Data Base Administrator Per Hour 89.14 82.90 96.52 95.96 Batch Per CPU Minute 25.56 22.58 22.15 22.23 TSO Per CPU Minute 14.18 12.33 16.68 16.05 CICS Per CPU Minute 7.56 6.36 5.65 5.77 DB2 (DBMS) Per CPU Minute 108.75 90.76 80.32 82.30 ADABAS Per CPU Minute 84.75 81.63 252.63 210.71 Tape I/O Per I/O Transaction 0.07 0.06 0.02 0.02 Tape Storage Per Tape Per Day 0.0016 0.0015 0.0027 0.0026 Disk I/O Per Disk I/O’ Transaction 0.00067 0.00062 0.00075 0.00073 Disk Storage Per Megabyte Per Day 0.000010 0.000004 0.000017 0.000014 Print Management Per 1000 Lines 1.12 1.04 0.68 0.68 UNIX Support Per Processor Per Year 40,656.87 16,881.76 1,193.65 1,138.20 Non Server Hosting Per Server Per Month 21.30 20.52 21.59 20.37 Server Hosting - Basic Per Server Per Month 35.49 34.21 35.98 33.95 Server Hosting - Managed Per Server Per Month 70.99 68.42 71.97 67.90 Server Hosting - Full Per Server Per Month 141.97 136.83 143.93 135.80 Email Service Per Account Per Month 3.04 1.40 4.24 3.62 Dial-Up Access Per Connection Account Per Month 12.27 12.80 Discontinued Discontinued VPN Secure Link Per Connection Account Per Month 4.36 5.61 5.97 6.06 State Phone Line Per Line Per Month 8.63 7.79 5.51 5.43 Voice Mail Per Account Per Month 2.69 2.54 2.31 2.25 EXECUTIVE BUDGET <strong>2013</strong>-<strong>2015</strong> APPENDIX - 9

- Page 4 and 5:

ELECTED OFFICIALS ELECTED OFFICIALS

- Page 6 and 7:

FINANCE & ADMINISTRATION CONTINUED

- Page 8 and 9:

COMMERCE & INDUSTRY CONTINUED GAMIN

- Page 10 and 11:

HUMAN SERVICES CONTINUED AGING AND

- Page 12 and 13:

PUBLIC SAFETY CONTINUED DEPARTMENT

- Page 14 and 15:

INFRASTRUCTURE CONTINUED CONSERVATI

- Page 16 and 17:

GOVERNOR’S EXECUTIVE BUDGET OVERV

- Page 18 and 19:

ECONOMIC OVERVIEW A Long and Prolon

- Page 20 and 21:

they have improved, indicating cons

- Page 22 and 23:

SOURCE (MILLIONS) or before May 1,

- Page 24 and 25:

SPENDING SUMMARY Expenditures for t

- Page 26 and 27:

FUND BALANCES The Governor’s Exec

- Page 28 and 29:

EXECUTIVE BUDGET 2013-2015 Statemen

- Page 30 and 31:

APPROPRIATIONS AND AUTHORIZATIONS E

- Page 32 and 33:

EXECUTIVE BUDGET 2013-2015 2013 - 2

- Page 34 and 35:

CONSERVATION & NATURAL RESOURCES FO

- Page 36 and 37:

RESTORATION OF FUND BALANCES Approp

- Page 38 and 39:

12. Health Care Financing and Polic

- Page 40 and 41:

transferred among the various budge

- Page 42 and 43:

Legislative Counsel Bureau of the a

- Page 44 and 45:

PPBB Objectives link to Core Functi

- Page 46 and 47:

CORE FUNCTIONS, OBJECTIVES AND BENC

- Page 48 and 49:

EXECUTIVE BUDGET 2013-2015 Core Fun

- Page 50 and 51:

Core Function: Infrastructure and C

- Page 52 and 53:

EXECUTIVE BUDGET 2013-2015 Core Fun

- Page 54 and 55:

GOVERNOR'S OFFICE - The Governor's

- Page 56 and 57:

Activity: Policy and Administration

- Page 58 and 59:

Activity: Policy Support The Nevada

- Page 60 and 61:

OFFICE OF THE GOVERNOR 101-1000 PRO

- Page 62 and 63:

OFFICE OF THE GOVERNOR 101-1000 201

- Page 64 and 65:

OFFICE OF THE GOVERNOR 101-1000 E80

- Page 66 and 67:

GOVERNOR'S MANSION MAINTENANCE 101-

- Page 68 and 69:

GOVERNOR'S MANSION MAINTENANCE 101-

- Page 70 and 71:

GOVERNOR'S WASHINGTON OFFICE 101-10

- Page 72 and 73:

GOVERNOR'S OFFICE STATE FISCAL STAB

- Page 74 and 75:

Activity: Promote Energy Efficiency

- Page 76 and 77:

GOVERNOR'S OFFICE ENERGY CONSERVATI

- Page 78 and 79:

GOVERNOR'S OFFICE ENERGY CONSERVATI

- Page 80 and 81:

GOVERNOR'S OFFICE ENERGY CONSERVATI

- Page 82 and 83:

GOVERNOR'S OFFICE ENERGY CONSERVATI

- Page 84 and 85:

GOVERNOR'S OFFICE ENERGY CONSERVATI

- Page 86 and 87:

RENEWABLE ENERGY FUND 101-4869 PROG

- Page 88 and 89:

RENEWABLE ENERGY, EFFICIENCY AND CO

- Page 90 and 91:

NUCLEAR PROJECTS OFFICE - The missi

- Page 92 and 93:

Activity: Policy Oversight for Othe

- Page 94 and 95:

Activity: Pass Through - DPS - Neva

- Page 96 and 97:

Activity: Pass Through - Health Div

- Page 98 and 99:

GOVERNOR'S OFFICE HIGH LEVEL NUCLEA

- Page 100 and 101:

GOVERNOR'S OFFICE HIGH LEVEL NUCLEA

- Page 102 and 103:

GOVERNOR'S OFFICE HIGH LEVEL NUCLEA

- Page 104 and 105:

Activity: Veterans Services Marshal

- Page 106 and 107:

GOVERNOR'S OFFICE VETERAN'S POLICY

- Page 108 and 109:

Activity: Duties of Lieutenant Gove

- Page 110 and 111:

LIEUTENANT GOVERNOR 101-1020 PROGRA

- Page 112 and 113:

LIEUTENANT GOVERNOR 101-1020 E671 F

- Page 114 and 115:

ATTORNEY GENERAL'S OFFICE - The Att

- Page 116 and 117:

Activity: Consumer Protection Consu

- Page 118 and 119:

Activity: Litigation Litigation def

- Page 120 and 121:

AG - EXTRADITION COORDINATOR 101-10

- Page 122 and 123:

AG - EXTRADITION COORDINATOR 101-10

- Page 124 and 125:

AG - EXTRADITION COORDINATOR 101-10

- Page 126 and 127:

AG - ADMINISTRATIVE FUND 101-1030 2

- Page 128 and 129:

AG - ADMINISTRATIVE FUND 101-1030 2

- Page 130 and 131:

AG - ADMINISTRATIVE FUND 101-1030 E

- Page 132 and 133:

AG - ADMINISTRATIVE FUND 101-1030 2

- Page 134 and 135:

AG - ADMINISTRATIVE FUND 101-1030 E

- Page 136 and 137:

AG - SPECIAL FUND 101-1031 PROGRAM

- Page 138 and 139:

AG - SPECIAL FUND 101-1031 ENHANCEM

- Page 140 and 141:

AG - SPECIAL FUND 101-1031 2012-201

- Page 142 and 143:

AG - WORKERS' COMP FRAUD 101-1033 2

- Page 144 and 145:

AG - WORKERS' COMP FRAUD 101-1033 E

- Page 146 and 147:

AG - CRIME PREVENTION 101-1036 PROG

- Page 148 and 149:

AG - CRIME PREVENTION 101-1036 E671

- Page 150 and 151:

AG - MEDICAID FRAUD 101-1037 PROGRA

- Page 152 and 153:

AG - MEDICAID FRAUD 101-1037 2011-2

- Page 154 and 155:

AG - MEDICAID FRAUD 101-1037 2011-2

- Page 156 and 157:

AG - CONSUMER ADVOCATE 330-1038 PRO

- Page 158 and 159:

AG - CONSUMER ADVOCATE 330-1038 ENH

- Page 160 and 161:

AG - CONSUMER ADVOCATE 330-1038 201

- Page 162 and 163:

AG - VIOLENCE AGAINST WOMEN GRANTS

- Page 164 and 165:

AG - VIOLENCE AGAINST WOMEN GRANTS

- Page 166 and 167:

AG - VIOLENCE AGAINST WOMEN GRANTS

- Page 168 and 169:

AG - COUNCIL FOR PROSECUTING ATTORN

- Page 170 and 171:

AG - COUNCIL FOR PROSECUTING ATTORN

- Page 172 and 173:

AG - VICTIMS OF DOMESTIC VIOLENCE 1

- Page 174 and 175:

AG - VICTIMS OF DOMESTIC VIOLENCE 1

- Page 176 and 177:

AG - VICTIMS OF DOMESTIC VIOLENCE 1

- Page 178 and 179:

AG - NATIONAL SETTLEMENT ADMINISTRA

- Page 180 and 181:

AG - NATIONAL SETTLEMENT ADMINISTRA

- Page 182 and 183:

AG - ATTORNEY GENERAL TORT CLAIM FU

- Page 184 and 185:

AG - ATTORNEY GENERAL TORT CLAIM FU

- Page 186 and 187:

AG - ATTORNEY GENERAL TORT CLAIM FU

- Page 188 and 189:

Activity: Commercial Recordings / P

- Page 190 and 191:

Activity: Domestic Partnership Regi

- Page 192 and 193:

Activity: Confidential Address Prog

- Page 194 and 195:

Activity: Notary Licensing and Trai

- Page 196 and 197:

Activity: General Administration Ge

- Page 198 and 199:

Activity: Personnel / Payroll Perso

- Page 200 and 201:

SOS - SECRETARY OF STATE 101-1050 2

- Page 202 and 203:

SOS - SECRETARY OF STATE 101-1050 E

- Page 204 and 205:

SOS - SECRETARY OF STATE 101-1050 E

- Page 206 and 207:

SOS - SECRETARY OF STATE 101-1050 E

- Page 208 and 209:

SOS - SECRETARY OF STATE 101-1050 2

- Page 210 and 211:

SOS - SECRETARY OF STATE 101-1050 2

- Page 212 and 213:

SOS - HAVA ELECTION REFORM 101-1051

- Page 214 and 215:

SOS - HAVA ELECTION REFORM 101-1051

- Page 216 and 217:

SOS - HAVA ELECTION REFORM 101-1051

- Page 218 and 219:

SOS - STATE BUSINESS PORTAL 101-105

- Page 220 and 221:

SOS - STATE BUSINESS PORTAL 101-105

- Page 222 and 223:

SOS - STATE BUSINESS PORTAL 101-105

- Page 224 and 225:

SOS - STATE BUSINESS PORTAL 101-105

- Page 226 and 227:

SOS - STATE BUSINESS PORTAL 101-105

- Page 228 and 229:

TREASURER - TREASURER'S OFFICE - Th

- Page 230 and 231:

Activity: Debt Issuance and Debt Se

- Page 232 and 233:

TREASURER - STATE TREASURER 101-108

- Page 234 and 235:

TREASURER - STATE TREASURER 101-108

- Page 236 and 237:

TREASURER - STATE TREASURER 101-108

- Page 238 and 239:

TREASURER - BOND INTEREST & REDEMPT

- Page 240 and 241:

TREASURER - BOND INTEREST & REDEMPT

- Page 242 and 243:

TREASURER - MUNICIPAL BOND BANK REV

- Page 244 and 245:

TREASURER - MUNICIPAL BOND BANK DEB

- Page 246 and 247:

TREASURER - COLLEGE SAVINGS TRUST -

- Page 248 and 249:

Activity: General Administration Th

- Page 250 and 251:

TREASURER - NEVADA COLLEGE SAVINGS

- Page 252 and 253:

TREASURER - NEVADA COLLEGE SAVINGS

- Page 254 and 255:

TREASURER - ENDOWMENT ACCOUNT 101-1

- Page 256 and 257:

TREASURER - ENDOWMENT ACCOUNT 101-1

- Page 258 and 259:

Activity: Outreach and Awareness Ca

- Page 260 and 261:

TREASURER - HIGHER EDUCATION TUITIO

- Page 262 and 263:

TREASURER - HIGHER EDUCATION TUITIO

- Page 264 and 265:

TREASURER - HIGHER EDUCATION TUITIO

- Page 266 and 267:

Activity: General Administration, I

- Page 268 and 269:

TREASURER - MILLENNIUM SCHOLARSHIP

- Page 270 and 271:

TREASURER - MILLENNIUM SCHOLARSHIP

- Page 272 and 273:

TREASURER - UNCLAIMED PROPERTY - To

- Page 274 and 275:

Activity: Revenue Collection/Compli

- Page 276 and 277:

TREASURER - UNCLAIMED PROPERTY 101-

- Page 278 and 279:

TREASURER - UNCLAIMED PROPERTY 101-

- Page 280 and 281:

CONTROLLER'S OFFICE - The Controlle

- Page 282 and 283:

Activity: Financial Operations The

- Page 284 and 285:

Activity: General Administration Th

- Page 286 and 287:

Activity: Vendor Services Vendor Se

- Page 288 and 289:

CONTROLLER - CONTROLLER'S OFFICE 10

- Page 290 and 291:

CONTROLLER - CONTROLLER'S OFFICE 10

- Page 292 and 293:

CONTROLLER - CONTROLLER'S OFFICE 10

- Page 294 and 295:

CONTROLLER - CONTROLLER'S OFFICE 10

- Page 296 and 297:

CONTROLLER - CONTROLLER'S OFFICE 10

- Page 298 and 299:

CONTROLLER - DEBT RECOVERY ACCOUNT

- Page 300 and 301:

COMMISSION ON ETHICS - The Nevada C

- Page 302 and 303:

COMMISSION ON ETHICS 101-1343 PROGR

- Page 304 and 305:

COMMISSION ON ETHICS 101-1343 M801

- Page 306 and 307:

COMMISSION ON ETHICS 101-1343 E670

- Page 308 and 309:

COMMISSION ON ETHICS 101-1343 2011-

- Page 310 and 311:

LEG - LEGISLATIVE COUNSEL BUREAU -

- Page 312 and 313:

Activity: Audit Division The Audit

- Page 314 and 315:

Activity: Interim Legislature The I

- Page 316 and 317:

Activity: Research Division The div

- Page 318 and 319:

LEG - LEGISLATIVE COUNSEL BUREAU 32

- Page 320 and 321:

LEG - LEGISLATIVE COUNSEL BUREAU 32

- Page 322 and 323:

LEG - NEVADA LEGISLATURE INTERIM 32

- Page 324 and 325:

PROGRAM DESCRIPTION LEG - INTERIM F

- Page 326 and 327:

LEG - PRINTING OFFICE - The Legisla

- Page 328 and 329:

LEG - PRINTING OFFICE 741-1330 PROG

- Page 330 and 331:

LEG - PRINTING OFFICE 741-1330 E672

- Page 332 and 333:

JUDICIAL BRANCH - This section of t

- Page 334 and 335:

Activity: District Courts The State

- Page 336 and 337:

Activity: Recall to Active Service

- Page 338 and 339:

Activity: Legal Resources and Resea

- Page 340 and 341:

Activity: Special Problem-Solving C

- Page 342 and 343:

Activity: Trial Court Technological

- Page 344 and 345:

SUPREME COURT 101-1494 MAINTENANCE

- Page 346 and 347:

SUPREME COURT 101-1494 E710 EQUIPME

- Page 348 and 349:

STATE JUDICIAL ELECTED OFFICIALS 10

- Page 350 and 351:

JUDICIAL RETIREMENT SYSTEM STATE SH

- Page 352 and 353:

JUDICIAL SELECTION 101-1498 SUMMARY

- Page 354 and 355:

SENIOR JUSTICE & SENIOR JUDGE PROGR

- Page 356 and 357:

LAW LIBRARY 101-2889 2012-2013 WORK

- Page 358 and 359:

ADMINISTRATIVE OFFICE OF THE COURTS

- Page 360 and 361:

ADMINISTRATIVE OFFICE OF THE COURTS

- Page 362 and 363:

JUDICIAL PROGRAMS AND SERVICES DIVI

- Page 364 and 365:

JUDICIAL PROGRAMS AND SERVICES DIVI

- Page 366 and 367:

UNIFORM SYSTEM OF JUDICIAL RECORDS

- Page 368 and 369:

UNIFORM SYSTEM OF JUDICIAL RECORDS

- Page 370 and 371:

JUDICIAL EDUCATION 101-1487 PROGRAM

- Page 372 and 373:

JUDICIAL EDUCATION 101-1487 ENHANCE

- Page 374 and 375:

SPECIALTY COURT 101-1495 PROGRAM DE

- Page 376 and 377:

JUDICIAL SUPPORT, GOVERNANCE AND SP

- Page 378 and 379:

JUDICIAL BRANCH - FORECLOSURE MEDIA

- Page 380 and 381:

FORECLOSURE MEDIATION PROGRAM 101-1

- Page 382 and 383:

FORECLOSURE MEDIATION PROGRAM 101-1

- Page 384 and 385:

JUDICIAL DISCIPLINE COMMISSION - Th

- Page 386 and 387:

Activity: Issue Judicial Ethics Adv

- Page 388 and 389:

JUDICIAL DISCIPLINE 101-1497 MAINTE

- Page 390 and 391:

JUDICIAL DISCIPLINE 101-1497 SUMMAR

- Page 392 and 393:

Department Budget Highlights (conti

- Page 394 and 395:

Activity: Executive Leadership and

- Page 396 and 397:

Activity: Grants Management The gra

- Page 398 and 399:

Activity: General Administrative Se

- Page 400 and 401:

ADMINISTRATION - BUDGET AND PLANNIN

- Page 402 and 403:

ADMINISTRATION - BUDGET AND PLANNIN

- Page 404 and 405:

ADMINISTRATION - BUDGET AND PLANNIN

- Page 406 and 407:

ADMINISTRATION - BUDGET AND PLANNIN

- Page 408 and 409:

ADMINISTRATION - SPECIAL APPROPRIAT

- Page 410 and 411:

JUDICIAL COLL & COLL OF JUVENILE &

- Page 412 and 413:

ADMIN - DIVISION OF HUMAN RESOURCE

- Page 414 and 415:

Activity: Statewide Employee Relati

- Page 416 and 417:

Activity: Centralized Agency Human

- Page 418 and 419:

Activity: Support - Statewide Human

- Page 420 and 421:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 422 and 423:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 424 and 425:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 426 and 427:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 428 and 429:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 430 and 431:

ADMINISTRATION - HRM - HUMAN RESOUR

- Page 432 and 433:

ADMINISTRATION - HRM - UNEMPLOYMENT

- Page 434 and 435:

Division Budget Highlights (continu

- Page 436 and 437:

Activity: Communications Communicat

- Page 438 and 439:

Activity: Computing Computing servi

- Page 440 and 441:

Activity: Service Planning Service

- Page 442 and 443:

Activity: Information Security Info

- Page 444 and 445:

ADMINISTRATION - IT - OFFICE OF CIO

- Page 446 and 447:

ADMINISTRATION - IT - OFFICE OF CIO

- Page 448 and 449:

ADMINISTRATION - IT - OFFICE OF CIO

- Page 450 and 451:

ADMINISTRATION - IT - OFFICE OF CIO

- Page 452 and 453:

ADMINISTRATION - IT - OFFICE OF CIO

- Page 454 and 455:

ADMINISTRATION - IT - APPLICATION S

- Page 456 and 457:

ADMINISTRATION - IT - APPLICATION S

- Page 458 and 459:

ADMINISTRATION - IT - APPLICATION S

- Page 460 and 461:

ADMINISTRATION - IT - APPLICATION S

- Page 462 and 463:

ADMINISTRATION - IT - APPLICATION S

- Page 464 and 465:

ADMINISTRATION - IT - APPLICATION S

- Page 466 and 467:

ADMINISTRATION - IT - COMPUTER FACI

- Page 468 and 469:

ADMINISTRATION - IT - COMPUTER FACI

- Page 470 and 471:

ADMINISTRATION - IT - COMPUTER FACI

- Page 472 and 473:

ADMINISTRATION - IT - COMPUTER FACI

- Page 474 and 475:

ADMINISTRATION - IT - COMPUTER FACI

- Page 476 and 477:

ADMINISTRATION - IT - COMPUTER FACI

- Page 478 and 479:

ADMINISTRATION - IT - COMPUTER FACI

- Page 480 and 481:

ADMINISTRATION - IT - DATA COMM & N

- Page 482 and 483:

ADMINISTRATION - IT - DATA COMM & N

- Page 484 and 485:

ADMINISTRATION - IT - DATA COMM & N

- Page 486 and 487:

ADMINISTRATION - IT - DATA COMM & N

- Page 488 and 489:

ADMINISTRATION - IT - DATA COMM & N

- Page 490 and 491:

ADMINISTRATION - IT - DATA COMM & N

- Page 492 and 493:

ADMINISTRATION - IT - TELECOMMUNICA

- Page 494 and 495:

ADMINISTRATION - IT - TELECOMMUNICA

- Page 496 and 497:

ADMINISTRATION - IT - TELECOMMUNICA

- Page 498 and 499:

ADMINISTRATION - IT - TELECOMMUNICA

- Page 500 and 501:

ADMINISTRATION - IT - NETWORK TRANS

- Page 502 and 503:

ADMINISTRATION - IT - NETWORK TRANS

- Page 504 and 505:

ADMINISTRATION - IT - NETWORK TRANS

- Page 506 and 507:

ADMINISTRATION - IT - NETWORK TRANS

- Page 508 and 509:

ADMINISTRATION - IT - NETWORK TRANS

- Page 510 and 511:

ADMINISTRATION - IT - SECURITY 721-

- Page 512 and 513:

ADMINISTRATION - IT - SECURITY 721-

- Page 514 and 515:

ADMINISTRATION - IT - SECURITY 721-

- Page 516 and 517:

ADMINISTRATION - IT - SECURITY 721-

- Page 518 and 519:

ADMINISTRATION - IT - SECURITY 721-

- Page 520 and 521:

ADMINISTRATION - IT - INFO TECH CON

- Page 522 and 523:

ADMINISTRATION - IT - INFO TECH CON

- Page 524 and 525:

ADMINISTRATION - IT - INFO TECH CON

- Page 526 and 527:

ADMINISTRATION - IT - INFO TECH CON

- Page 528 and 529:

Activity: Financial Planning and Ma

- Page 530 and 531:

ADMINISTRATION - ADMINISTRATIVE SER

- Page 532 and 533:

ADMINISTRATION - ADMINISTRATIVE SER

- Page 534 and 535:

ADMINISTRATION - ADMINISTRATIVE SER

- Page 536 and 537:

ADMIN - INTERNAL AUDITS DIVISION -

- Page 538 and 539:

Activity: Financial Management The

- Page 540 and 541:

ADMINISTRATION - DIVISION OF INTERN

- Page 542 and 543:

ADMINISTRATION - DIVISION OF INTERN

- Page 544 and 545:

ADMINISTRATION - DIVISION OF INTERN

- Page 546 and 547:

Activity: Capital Improvement Progr

- Page 548 and 549:

Activity: Facility Condition Analys

- Page 550 and 551:

Activity: Provision of Office Space

- Page 552 and 553:

Activity: Water Delivery from the M

- Page 554 and 555:

Activity: Pass Through - Other Stat

- Page 556 and 557:

ADMINISTRATION - SPWD - ADMINISTRAT

- Page 558 and 559:

ADMINISTRATION - SPWD - ADMINISTRAT

- Page 560 and 561:

ADMINISTRATION - SPWD - ENGINEERING

- Page 562 and 563:

ADMINISTRATION - SPWD - ENGINEERING

- Page 564 and 565:

ADMINISTRATION - SPWD - ENGINEERING

- Page 566 and 567:

ADMINISTRATION - SPWD - ENGINEERING

- Page 568 and 569:

ADMINISTRATION - SPWD - ENGINEERING

- Page 570 and 571:

ADMINISTRATION - SPWD - FACILITY CO

- Page 572 and 573:

ADMINISTRATION - SPWD - FACILITY CO

- Page 574 and 575:

ADMINISTRATION - SPWD - FACILITY CO

- Page 576 and 577:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 578 and 579:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 580 and 581:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 582 and 583:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 584 and 585:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 586 and 587:

ADMINISTRATION - SPWD - BUILDINGS &

- Page 588 and 589:

ADMINISTRATION - SPWD - MARLETTE LA

- Page 590 and 591:

ADMINISTRATION - SPWD - MARLETTE LA

- Page 592 and 593:

ADMINISTRATION - SPWD - MARLETTE LA

- Page 594 and 595:

ADMINISTRATION - SPWD - MARLETTE LA

- Page 596 and 597:

ADMIN - PURCHASING DIVISION - Nevad

- Page 598 and 599:

Activity: Food Supply and Distribut

- Page 600 and 601:

ADMINISTRATION - PURCHASING 718-135

- Page 602 and 603:

ADMINISTRATION - PURCHASING 718-135

- Page 604 and 605:

ADMINISTRATION - PURCHASING 718-135

- Page 606 and 607:

ADMIN - RISK MANAGEMENT DIVISION -

- Page 608 and 609:

Activity: Manage Property and Casua

- Page 610 and 611:

ADMINISTRATION - INSURANCE & LOSS P

- Page 612 and 613:

ADMINISTRATION - INSURANCE & LOSS P

- Page 614 and 615:

ADMINISTRATION - INSURANCE & LOSS P

- Page 616 and 617:

ADMINISTRATION - INSURANCE & LOSS P

- Page 618 and 619:

ADMIN - MOTOR POOL DIVISION - To pr

- Page 620 and 621:

Activity: Short-term Assigned Vehic

- Page 622 and 623:

ADMINISTRATION - MOTOR POOL 711-135

- Page 624 and 625:

ADMINISTRATION - MOTOR POOL 711-135

- Page 626 and 627:

ADMINISTRATION - MOTOR POOL 711-135

- Page 628 and 629:

ADMINISTRATION - MOTOR POOL 711-135

- Page 630 and 631:

ADMINISTRATION - MOTOR POOL 711-135

- Page 632 and 633:

ADMINISTRATION - MOTOR POOL CAPITAL

- Page 634 and 635:

ADMINISTRATION - MOTOR POOL CAPITAL

- Page 636 and 637:

Activity: Reference/Resource Access

- Page 638 and 639:

Activity: Library Development Servi

- Page 640 and 641:

Activity: Cooperative Libraries Aut

- Page 642 and 643:

Activity: Support - General Adminis

- Page 644 and 645:

ADMINISTRATION - NSLA - NEVADA STAT

- Page 646 and 647:

ADMINISTRATION - NSLA - NEVADA STAT

- Page 648 and 649:

ADMINISTRATION - NSLA - NEVADA STAT

- Page 650 and 651:

ADMINISTRATION - NSLA - NEVADA STAT

- Page 652 and 653:

ADMINISTRATION - NSLA - ARCHIVES AN

- Page 654 and 655:

ADMINISTRATION - NSLA - ARCHIVES AN

- Page 656 and 657:

ADMINISTRATION - NSLA - ARCHIVES AN

- Page 658 and 659:

ADMINISTRATION - NSLA - ARCHIVES AN

- Page 660 and 661:

ADMINISTRATION - NSLA - IPS EQUIPME

- Page 662 and 663:

ADMINISTRATION - NSLA - CLAN 101-28

- Page 664 and 665:

ADMINISTRATION - NSLA - CLAN 101-28

- Page 666 and 667:

ADMINISTRATION - NSLA - CLAN 101-28

- Page 668 and 669:

ADMINISTRATION - NSLA - MAIL SERVIC

- Page 670 and 671:

ADMINISTRATION - NSLA - MAIL SERVIC

- Page 672 and 673:

ADMINISTRATION - NSLA - MAIL SERVIC

- Page 674 and 675:

ADMINISTRATION - NSLA - MAIL SERVIC

- Page 676 and 677:

ADMIN - VICTIMS OF CRIME - The Vict

- Page 678 and 679:

ADMINISTRATION - VICTIMS OF CRIME 2

- Page 680 and 681:

ADMINISTRATION - VICTIMS OF CRIME 2

- Page 682 and 683:

ADMINISTRATION - VICTIMS OF CRIME 2

- Page 684 and 685:

ADMINISTRATION - VICTIMS OF CRIME 2

- Page 686 and 687:

ADMIN - HEARINGS AND APPEALS DIVISI

- Page 688 and 689:

ADMINISTRATION - HEARINGS DIVISION

- Page 690 and 691:

ADMINISTRATION - HEARINGS DIVISION

- Page 692 and 693:

ADMINISTRATION - HEARINGS DIVISION

- Page 694 and 695:

ADMIN - BOARD OF EXAMINERS - The De

- Page 696 and 697:

BOE - GENERAL FUND SALARY ADJUSTMEN

- Page 698 and 699:

DEPARTMENT OF TAXATION - Taxation f

- Page 700 and 701:

Activity: Tax Audits Taxation condu

- Page 702 and 703:

Activity: Accounting and Processing

- Page 704 and 705:

Activity: Information Technology In

- Page 706 and 707:

DEPARTMENT OF TAXATION 101-2361 PRO

- Page 708 and 709:

DEPARTMENT OF TAXATION 101-2361 201

- Page 710 and 711:

DEPARTMENT OF TAXATION 101-2361 E22

- Page 712 and 713:

DEPARTMENT OF TAXATION 101-2361 E71

- Page 714 and 715:

DEPARTMENT OF TAXATION 101-2361 201

- Page 716 and 717:

Department Budget Highlights (conti

- Page 718 and 719:

Activity: Educator Effectiveness Th

- Page 720 and 721:

Activity: Equal Educational Opportu

- Page 722 and 723:

Activity: Longitudinal Data System

- Page 724 and 725:

Activity: Student Nutrition This ac

- Page 726 and 727:

Activity: SUPPORT - General Adminis

- Page 728 and 729:

Activity: SUPPORT - Information Tec

- Page 730 and 731:

Activity: Pass Through Records subg

- Page 732 and 733:

NDE - DISTRIBUTIVE SCHOOL ACCOUNT 1

- Page 734 and 735:

NDE - DISTRIBUTIVE SCHOOL ACCOUNT 1

- Page 736 and 737:

NDE - OTHER STATE EDUCATION PROGRAM

- Page 738 and 739:

NDE - OTHER STATE EDUCATION PROGRAM

- Page 740 and 741:

NDE - OTHER STATE EDUCATION PROGRAM

- Page 742 and 743:

NDE - SCHOOL REMEDIATION TRUST FUND

- Page 744 and 745:

NDE - STATE SUPPLEMENTAL SCHOOL SUP

- Page 746 and 747:

NDE - INCENTIVES FOR LICENSED EDUCA

- Page 748 and 749:

NDE - EDUCATOR EFFECTIVENESS 101-26

- Page 750 and 751:

NDE - EDUCATION STATE PROGRAMS 101-

- Page 752 and 753:

NDE - EDUCATION STATE PROGRAMS 101-

- Page 754 and 755:

NDE - EDUCATION STATE PROGRAMS 101-

- Page 756 and 757:

NDE - EDUCATION STATE PROGRAMS 101-

- Page 758 and 759:

NDE - EDUCATION STAFFING SERVICES 1

- Page 760 and 761:

NDE - EDUCATION STAFFING SERVICES 1

- Page 762 and 763:

NDE - EDUCATION STAFFING SERVICES 1

- Page 764 and 765:

NDE - EDUCATION SUPPORT SERVICES 10

- Page 766 and 767:

NDE - EDUCATION SUPPORT SERVICES 10

- Page 768 and 769:

NDE - EDUCATION SUPPORT SERVICES 10

- Page 770 and 771:

NDE - EDUCATION SUPPORT SERVICES 10

- Page 772 and 773:

NDE - PROFICIENCY TESTING 101-2697

- Page 774 and 775:

NDE - PROFICIENCY TESTING 101-2697

- Page 776 and 777:

NDE - PROFICIENCY TESTING 101-2697

- Page 778 and 779:

NDE - TEACHER EDUCATION AND LICENSI

- Page 780 and 781:

NDE - TEACHER EDUCATION AND LICENSI

- Page 782 and 783:

NDE - TEACHER EDUCATION AND LICENSI

- Page 784 and 785:

NDE - DRUG ABUSE EDUCATION 101-2605

- Page 786 and 787:

NDE - SCHOOL HEALTH EDUCATION - AID

- Page 788 and 789:

NDE - SCHOOL HEALTH EDUCATION - AID

- Page 790 and 791:

NDE - GEAR UP 101-2678 MAINTENANCE

- Page 792 and 793:

NDE - GEAR UP 101-2678 TOTAL RESOUR

- Page 794 and 795:

NDE - OTHER UNRESTRICTED ACCOUNTS 1

- Page 796 and 797:

NDE - OTHER UNRESTRICTED ACCOUNTS 1

- Page 798 and 799:

NDE - DISCRETIONARY GRANTS - RESTRI

- Page 800 and 801:

NDE - DISCRETIONARY GRANTS - RESTRI

- Page 802 and 803:

NDE - DISCRETIONARY GRANTS - RESTRI

- Page 804 and 805:

NDE - ELEMENTARY & SECONDARY ED - T

- Page 806 and 807:

NDE - ELEMENTARY & SECONDARY ED - T

- Page 808 and 809:

NDE - ELEMENTARY & SECONDARY ED - T

- Page 810 and 811:

NDE - ELEMENTARY & SECONDARY ED TIT

- Page 812 and 813:

NDE - ELEMENTARY & SECONDARY ED TIT

- Page 814 and 815:

NDE - ELEMENTARY & SECONDARY ED TIT

- Page 816 and 817:

NDE - ELEMENTARY & SECONDARY ED TIT

- Page 818 and 819:

NDE - CAREER AND TECHNICAL EDUCATIO

- Page 820 and 821:

NDE - CAREER AND TECHNICAL EDUCATIO

- Page 822 and 823:

NDE - CAREER AND TECHNICAL EDUCATIO

- Page 824 and 825:

NDE - CONTINUING EDUCATION 101-2680

- Page 826 and 827:

NDE - CONTINUING EDUCATION 101-2680

- Page 828 and 829:

NDE - INDIVIDUALS WITH DISABILITIES

- Page 830 and 831:

NDE - INDIVIDUALS WITH DISABILITIES

- Page 832 and 833:

NDE - INDIVIDUALS WITH DISABILITIES

- Page 834 and 835:

Activity: Quality Charter School Au

- Page 836 and 837:

Activity: Pass Through Transfer fed

- Page 838 and 839:

STATE PUBLIC CHARTER SCHOOL AUTHORI

- Page 840 and 841:

STATE PUBLIC CHARTER SCHOOL AUTHORI

- Page 842 and 843:

STATE PUBLIC CHARTER SCHOOL AUTHORI

- Page 844 and 845:

PUBLIC CHARTER SCHOOL LOAN PROGRAM

- Page 846 and 847:

Activity: License and Regulate Priv

- Page 848 and 849:

COMMISSION ON POSTSECONDARY EDUCATI

- Page 850 and 851:

COMMISSION ON POSTSECONDARY EDUCATI

- Page 852 and 853:

Department Budget Highlights (conti

- Page 854 and 855:

Activity: Instruction Instruction p

- Page 856 and 857:

Activity: Public Service The public

- Page 858 and 859:

Activity: Student Services The stud

- Page 860 and 861:

Activity: Operations and Maintenanc

- Page 862 and 863:

Activity: Nevada WICHE Health Workf

- Page 864 and 865:

NSHE - SYSTEM ADMINISTRATION 101-29

- Page 866 and 867:

NSHE - SYSTEM ADMINISTRATION 101-29

- Page 868 and 869:

NSHE - SPECIAL PROJECTS 101-2977 M3

- Page 870 and 871:

NSHE - UNIVERSITY PRESS 101-2996 PR

- Page 872 and 873:

NSHE - UNIVERSITY PRESS 101-2996 E6

- Page 874 and 875:

NSHE - SYSTEM COMPUTING CENTER 101-

- Page 876 and 877:

NSHE - STATE-FUNDED PERKINS LOAN 10

- Page 878 and 879:

NSHE - UNIVERSITY OF NEVADA - RENO

- Page 880 and 881:

NSHE - UNIVERSITY OF NEVADA - RENO

- Page 882 and 883:

NSHE - INTERCOLLEGIATE ATHLETICS -

- Page 884 and 885:

NSHE - INTERCOLLEGIATE ATHLETICS -

- Page 886 and 887:

NSHE - STATEWIDE PROGRAMS - UNR 101

- Page 888 and 889:

NSHE - SCHOOL OF MEDICAL SCIENCES 1

- Page 890 and 891:

NSHE - SCHOOL OF MEDICAL SCIENCES 1

- Page 892 and 893:

NSHE - HEALTH LABORATORY AND RESEAR

- Page 894 and 895:

NSHE - HEALTH LABORATORY AND RESEAR

- Page 896 and 897:

NSHE - AGRICULTURAL EXPERIMENT STAT

- Page 898 and 899:

NSHE - AGRICULTURAL EXPERIMENT STAT

- Page 900 and 901:

NSHE - COOPERATIVE EXTENSION SERVIC

- Page 902 and 903:

NSHE - COOPERATIVE EXTENSION SERVIC

- Page 904 and 905:

NSHE - BUSINESS CENTER NORTH 101-30

- Page 906 and 907:

NSHE - UNIVERSITY OF NEVADA - LAS V

- Page 908 and 909:

NSHE - UNIVERSITY OF NEVADA - LAS V

- Page 910 and 911:

NSHE - UNIVERSITY OF NEVADA - LAS V

- Page 912 and 913:

NSHE - INTERCOLLEGIATE ATHLETICS -

- Page 914 and 915:

NSHE - STATEWIDE PROGRAMS - UNLV 10

- Page 916 and 917:

NSHE - STATEWIDE PROGRAMS - UNLV 10

- Page 918 and 919:

NSHE - UNLV LAW SCHOOL 101-2992 M20

- Page 920 and 921:

NSHE - UNLV LAW SCHOOL 101-2992 201

- Page 922 and 923:

NSHE - DENTAL SCHOOL - UNLV 101-300

- Page 924 and 925:

NSHE - DENTAL SCHOOL - UNLV 101-300

- Page 926 and 927:

NSHE - BUSINESS CENTER SOUTH 101-30

- Page 928 and 929:

NSHE - DESERT RESEARCH INSTITUTE 10

- Page 930 and 931:

NSHE - DESERT RESEARCH INSTITUTE 10

- Page 932 and 933:

NSHE - GREAT BASIN COLLEGE 101-2994

- Page 934 and 935:

NSHE - GREAT BASIN COLLEGE 101-2994

- Page 936 and 937:

NSHE - WESTERN NEVADA COLLEGE 101-3

- Page 938 and 939:

NSHE - WESTERN NEVADA COLLEGE 101-3

- Page 940 and 941:

NSHE - WESTERN NEVADA COLLEGE 101-3

- Page 942 and 943:

NSHE - COLLEGE OF SOUTHERN NEVADA 1

- Page 944 and 945:

NSHE - COLLEGE OF SOUTHERN NEVADA 1

- Page 946 and 947:

NSHE - TRUCKEE MEADOWS COMMUNITY CO

- Page 948 and 949:

NSHE - TRUCKEE MEADOWS COMMUNITY CO

- Page 950 and 951:

NSHE - NEVADA STATE COLLEGE AT HEND

- Page 952 and 953:

NSHE - NEVADA STATE COLLEGE AT HEND

- Page 954 and 955:

NSHE - NEVADA STATE COLLEGE AT HEND

- Page 956 and 957:

NSHE - W.I.C.H.E. ADMINISTRATION 10

- Page 958 and 959:

NSHE - W.I.C.H.E. LOAN & STIPEND 10

- Page 960 and 961:

DEPARTMENT OF AGRICULTURE - The Nev

- Page 962 and 963:

Activity: Administration The Admini

- Page 964 and 965:

Activity: Licensing/Permitting/Cert

- Page 966 and 967:

Activity: Resource Management This

- Page 968 and 969:

AGRI - NUTRITION EDUCATION PROGRAMS

- Page 970 and 971:

AGRI - NUTRITION EDUCATION PROGRAMS

- Page 972 and 973:

AGRI - NUTRITION EDUCATION PROGRAMS

- Page 974 and 975:

AGRI - NUTRITION EDUCATION PROGRAMS

- Page 976 and 977:

AGRI - NUTRITION EDUCATION PROGRAMS

- Page 978 and 979:

AGRI - COMMODITY FOOD PROG 101-1362

- Page 980 and 981:

AGRI - COMMODITY FOOD PROG 101-1362

- Page 982 and 983:

AGRI - COMMODITY FOOD PROG 101-1362

- Page 984 and 985:

AGRI - COMMODITY FOOD PROG 101-1362

- Page 986 and 987:

AGRI - COMMODITY FOOD PROG 101-1362

- Page 988 and 989:

AGRI - DAIRY COMMISSION 233-4470 PR

- Page 990 and 991:

AGRI - DAIRY COMMISSION 233-4470 M8

- Page 992 and 993:

AGRI - DAIRY COMMISSION 233-4470 E6

- Page 994 and 995:

AGRI - DAIRY COMMISSION 233-4470 SU

- Page 996 and 997:

AGRI - ADMINISTRATION 101-4554 MAIN

- Page 998 and 999:

AGRI - ADMINISTRATION 101-4554 TOTA

- Page 1000 and 1001:

AGRI - ADMINISTRATION 101-4554 2012

- Page 1002 and 1003:

AGRI - ADMINISTRATION 101-4554 E672

- Page 1004 and 1005:

AGRI - ADMINISTRATION 101-4554 E806

- Page 1006 and 1007:

AGRI - ADMINISTRATION 101-4554 2012

- Page 1008 and 1009:

AGRI - GAS POLLUTION STANDARDS 101-

- Page 1010 and 1011:

AGRI - GAS POLLUTION STANDARDS 101-

- Page 1012 and 1013:

AGRI - GAS POLLUTION STANDARDS 101-

- Page 1014 and 1015:

AGRI - GAS POLLUTION STANDARDS 101-

- Page 1016 and 1017:

AGRI - GAS POLLUTION STANDARDS 101-

- Page 1018 and 1019:

AGRI - PLANT HEALTH & QUARANTINE SE

- Page 1020 and 1021:

AGRI - PLANT HEALTH & QUARANTINE SE

- Page 1022 and 1023:

AGRI - PLANT HEALTH & QUARANTINE SE

- Page 1024 and 1025:

AGRI - GRADE & CERTIFICATION OF AG

- Page 1026 and 1027:

AGRI - GRADE & CERTIFICATION OF AG

- Page 1028 and 1029:

AGRI - GRADE & CERTIFICATION OF AG

- Page 1030 and 1031:

AGRI - GRADE & CERTIFICATION OF AG

- Page 1032 and 1033:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1034 and 1035:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1036 and 1037:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1038 and 1039:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1040 and 1041:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1042 and 1043:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1044 and 1045:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1046 and 1047:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1048 and 1049:

AGRI - AGRICULTURE REGISTRATION/ENF

- Page 1050 and 1051:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1052 and 1053:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1054 and 1055:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1056 and 1057:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1058 and 1059:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1060 and 1061:

AGRI - WEIGHTS, MEASURES AND STANDA

- Page 1062 and 1063:

AGRI - PEST, PLANT DISEASE NOXIOUS

- Page 1064 and 1065:

AGRI - PEST, PLANT DISEASE NOXIOUS

- Page 1066 and 1067:

AGRI - PEST, PLANT DISEASE NOXIOUS

- Page 1068 and 1069:

AGRI - PEST, PLANT DISEASE NOXIOUS

- Page 1070 and 1071:

AGRI - PEST, PLANT DISEASE NOXIOUS

- Page 1072 and 1073:

AGRI - MORMON CRICKET & GRASSHOPPER

- Page 1074 and 1075:

AGRI - MORMON CRICKET & GRASSHOPPER

- Page 1076 and 1077:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1078 and 1079:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1080 and 1081:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1082 and 1083:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1084 and 1085:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1086 and 1087:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1088 and 1089:

AGRI - LIVESTOCK INSPECTION 101-454

- Page 1090 and 1091:

AGRI - PREDATORY ANIMAL & RODENT CO

- Page 1092 and 1093:

AGRI - PREDATORY ANIMAL & RODENT CO

- Page 1094 and 1095:

AGRI - VETERINARY MEDICAL SERVICES

- Page 1096 and 1097:

AGRI - VETERINARY MEDICAL SERVICES

- Page 1098 and 1099:

AGRI - VETERINARY MEDICAL SERVICES

- Page 1100 and 1101:

AGRI - VETERINARY MEDICAL SERVICES

- Page 1102 and 1103:

AGRI - VETERINARY MEDICAL SERVICES

- Page 1104 and 1105:

Activity: Abandoned Mines The Aband

- Page 1106 and 1107:

Activity: Oil, Gas, and Geothermal

- Page 1108 and 1109:

MINERALS 101-4219 2012-2013 WORK PR

- Page 1110 and 1111:

MINERALS 101-4219 E672 SUSPEND LONG

- Page 1112 and 1113:

GAMING CONTROL BOARD - The State Ga

- Page 1114 and 1115:

Activity: Enforcement Enforcement i

- Page 1116 and 1117:

Activity: Fiscal Management Fiscal

- Page 1118 and 1119:

Activity: Investigations Investigat

- Page 1120 and 1121:

GCB - GAMING CONTROL BOARD 101-4061

- Page 1122 and 1123:

GCB - GAMING CONTROL BOARD 101-4061

- Page 1124 and 1125:

GCB - GAMING CONTROL BOARD 101-4061

- Page 1126 and 1127:

GCB - GAMING CONTROL BOARD 101-4061

- Page 1128 and 1129:

GCB - GAMING COMMISSION 101-4067 PR

- Page 1130 and 1131:

GCB - GAMING COMMISSION 101-4067 E6

- Page 1132 and 1133:

GCB - GAMING CONTROL BOARD INVESTIG

- Page 1134 and 1135:

GCB - GAMING CONTROL BOARD INVESTIG

- Page 1136 and 1137:

PUBLIC UTILITIES COMMISSION - The m

- Page 1138 and 1139:

Activity: Consumer Complaints, Outr

- Page 1140 and 1141:

Activity: Fiscal This activity is r

- Page 1142 and 1143:

Activity: Information Technology Th

- Page 1144 and 1145:

Activity: Rate and Rule Makings Thi

- Page 1146 and 1147:

PUC - PUBLIC UTILITIES COMMISSION 2

- Page 1148 and 1149:

PUC - PUBLIC UTILITIES COMMISSION 2

- Page 1150 and 1151:

PUC - PUBLIC UTILITIES COMMISSION 2

- Page 1152 and 1153:

DEPARTMENT OF BUSINESS AND INDUSTRY

- Page 1154 and 1155:

B&I - BUSINESS AND INDUSTRY - The D

- Page 1156 and 1157:

Activity: Fiscal This activity cove

- Page 1158 and 1159:

Activity: Small Business Advocacy T

- Page 1160 and 1161:

B&I - BUSINESS AND INDUSTRY ADMINIS

- Page 1162 and 1163:

B&I - BUSINESS AND INDUSTRY ADMINIS

- Page 1164 and 1165:

B&I - BUSINESS AND INDUSTRY ADMINIS

- Page 1166 and 1167:

B&I - INDUSTRIAL DEVELOPMENT BONDS

- Page 1168 and 1169:

B&I - INSURANCE DIVISION - The Insu

- Page 1170 and 1171:

Activity: PRODUCER LICENSING This a

- Page 1172 and 1173:

Activity: RATE AND FORM REVIEW AND

- Page 1174 and 1175:

Activity: CAPTIVE INSURANCE PROGRAM

- Page 1176 and 1177:

Activity: REGULATION OF SELF FUNDED

- Page 1178 and 1179:

Activity: RULEMAKING This statutori

- Page 1180 and 1181:

B&I - INSURANCE REGULATION 504-3813

- Page 1182 and 1183:

B&I - INSURANCE REGULATION 504-3813

- Page 1184 and 1185:

B&I - INSURANCE REGULATION 504-3813

- Page 1186 and 1187:

B&I - INSURANCE EXAMINERS 504-3817

- Page 1188 and 1189:

B&I - INSURANCE EXAMINERS 504-3817

- Page 1190 and 1191:

B&I - INSURANCE EXAMINERS 504-3817

- Page 1192 and 1193:

B&I - CAPTIVE INSURERS 504-3818 MAI

- Page 1194 and 1195:

B&I - CAPTIVE INSURERS 504-3818 E80

- Page 1196 and 1197:

B&I - INSURANCE RECOVERY 504-3821 P

- Page 1198 and 1199:

B&I - INSURANCE EDUCATION & RESEARC

- Page 1200 and 1201:

B&I - INSURANCE EDUCATION & RESEARC

- Page 1202 and 1203:

B&I - NAT. ASSOC. OF INSURANCE COMM

- Page 1204 and 1205:

B&I - INSURANCE COST STABILIZATION

- Page 1206 and 1207:

B&I - INSURANCE COST STABILIZATION

- Page 1208 and 1209:

B&I - INSURANCE COST STABILIZATION

- Page 1210 and 1211:

B&I - SELF INSURED - WORKERS COMPEN

- Page 1212 and 1213:

B&I - SELF INSURED - WORKERS COMPEN

- Page 1214 and 1215:

B&I - INDUSTRIAL RELATIONS DIV - Th

- Page 1216 and 1217:

Activity: Employer Compliance This

- Page 1218 and 1219:

Activity: Education, Research and A

- Page 1220 and 1221:

Activity: Enforce Safety Regulation

- Page 1222 and 1223:

Activity: On-site Consultation and

- Page 1224 and 1225:

Activity: Mines Enforcement and Pub

- Page 1226 and 1227:

B&I - INDUSTRIAL RELATIONS 210-4680

- Page 1228 and 1229:

B&I - INDUSTRIAL RELATIONS 210-4680

- Page 1230 and 1231:

B&I - INDUSTRIAL RELATIONS 210-4680

- Page 1232 and 1233:

B&I - INDUSTRIAL RELATIONS 210-4680

- Page 1234 and 1235:

B&I - OCCUPATIONAL SAFETY & HEALTH

- Page 1236 and 1237:

B&I - OCCUPATIONAL SAFETY & HEALTH

- Page 1238 and 1239:

B&I - OCCUPATIONAL SAFETY & HEALTH

- Page 1240 and 1241:

B&I - OCCUPATIONAL SAFETY & HEALTH

- Page 1242 and 1243:

B&I - SAFETY CONSULTATION AND TRAIN

- Page 1244 and 1245:

B&I - SAFETY CONSULTATION AND TRAIN

- Page 1246 and 1247:

B&I - SAFETY CONSULTATION AND TRAIN

- Page 1248 and 1249:

B&I - MINE SAFETY & TRAINING 210-46

- Page 1250 and 1251:

B&I - MINE SAFETY & TRAINING 210-46

- Page 1252 and 1253:

B&I - MINE SAFETY & TRAINING 210-46

- Page 1254 and 1255:

B&I - HOUSING DIVISION - The Housin

- Page 1256 and 1257:

Activity: Weatherization Assistance

- Page 1258 and 1259:

Activity: Housing Financing and Len

- Page 1260 and 1261:

Activity: Special Housing Federal P

- Page 1262 and 1263:

B&I - HOUSING DIVISION 503-3841 TRA

- Page 1264 and 1265:

B&I - HOUSING DIVISION 503-3841 E67

- Page 1266 and 1267:

B&I - HOUSING DIVISION 503-3841 201

- Page 1268 and 1269:

B&I - SPECIAL HOUSING ASSISTANCE 10

- Page 1270 and 1271:

B&I - LOW INCOME HOUSING TRUST FUND

- Page 1272 and 1273:

B&I - LOW INCOME HOUSING TRUST FUND

- Page 1274 and 1275:

B&I - WEATHERIZATION 101-4865 PROGR

- Page 1276 and 1277:

B&I - WEATHERIZATION 101-4865 2011-

- Page 1278 and 1279:

B&I - WEATHERIZATION 101-4865 COST

- Page 1280 and 1281:

B&I - EMPLOYEE MANAGEMENT RELATIONS

- Page 1282 and 1283:

Activity: Resource Management and P

- Page 1284 and 1285:

B&I - EMPLOYEE MANAGEMENT RELATIONS

- Page 1286 and 1287:

B&I - EMPLOYEE MANAGEMENT RELATIONS

- Page 1288 and 1289:

B&I - REAL ESTATE DIVISION - The mi

- Page 1290 and 1291:

Activity: Customer Service Customer

- Page 1292 and 1293:

Activity: Regulation This activity

- Page 1294 and 1295:

B&I - REAL ESTATE ADMINISTRATION 10

- Page 1296 and 1297:

B&I - REAL ESTATE ADMINISTRATION 10

- Page 1298 and 1299:

B&I - REAL ESTATE ADMINISTRATION 10

- Page 1300 and 1301:

B&I - REAL ESTATE EDUCATION AND RES

- Page 1302 and 1303:

B&I - REAL ESTATE EDUCATION AND RES

- Page 1304 and 1305:

B&I - REAL ESTATE EDUCATION AND RES

- Page 1306 and 1307:

B&I - REAL ESTATE RECOVERY ACCOUNT

- Page 1308 and 1309:

B&I - COMMON INTEREST COMMUNITIES 1

- Page 1310 and 1311:

B&I - COMMON INTEREST COMMUNITIES 1

- Page 1312 and 1313:

B&I - COMMON INTEREST COMMUNITIES 1

- Page 1314 and 1315:

B&I - COMMON INTEREST COMMUNITIES 1

- Page 1316 and 1317:

Activity: Events This activity perf

- Page 1318 and 1319:

Activity: Medical The Medical Activ

- Page 1320 and 1321:

B&I - ATHLETIC COMMISSION 101-3952

- Page 1322 and 1323:

B&I - ATHLETIC COMMISSION 101-3952

- Page 1324 and 1325:

B&I - ATHLETIC COMMISSION 101-3952

- Page 1326 and 1327:

Activity: Enforcement Enforcement e

- Page 1328 and 1329:

Activity: Vehicle Inspection Vehicl

- Page 1330 and 1331:

Activity: Administration The Taxica

- Page 1332 and 1333:

Activity: Public Safety Dispatcher

- Page 1334 and 1335:

B&I - TAXICAB AUTHORITY 245-4130 20

- Page 1336 and 1337:

B&I - TAXICAB AUTHORITY 245-4130 20

- Page 1338 and 1339:

B&I - TAXICAB AUTHORITY 245-4130 20

- Page 1340 and 1341:

B&I - TRANSPORTATION AUTHORITY - Th

- Page 1342 and 1343:

3. Regulated Motor Carriers 2012 20

- Page 1344 and 1345:

Activity: General Administration NT

- Page 1346 and 1347:

Activity: Licensing and Application

- Page 1348 and 1349:

B&I - TRANSPORTATION AUTHORITY 101-

- Page 1350 and 1351:

B&I - TRANSPORTATION AUTHORITY 101-

- Page 1352 and 1353:

B&I - TRANSPORTATION AUTHORITY 101-

- Page 1354 and 1355:

B&I - TRANSPORTATION AUTHORITY ADMI

- Page 1356 and 1357:

B&I - LABOR COMMISSION - As the pri

- Page 1358 and 1359:

Activity: Prevailing Wage This acti

- Page 1360 and 1361:

Activity: Employment Agencies The O

- Page 1362 and 1363:

B&I - LABOR COMMISSIONER 101-3900 P

- Page 1364 and 1365:

B&I - LABOR COMMISSIONER 101-3900 2

- Page 1366 and 1367:

B&I - LABOR COMMISSIONER 101-3900 2

- Page 1368 and 1369:

Activity: Legal Representation The

- Page 1370 and 1371:

Activity: General Administration Ge

- Page 1372 and 1373:

B&I - NV ATTORNEY FOR INJURED WORKE

- Page 1374 and 1375:

B&I - NV ATTORNEY FOR INJURED WORKE

- Page 1376 and 1377:

B&I - MANUFACTURED HOUSING DIV - Th

- Page 1378 and 1379:

Activity: Investigations The Invest

- Page 1380 and 1381:

Activity: Titling of Manufactured S

- Page 1382 and 1383:

Activity: Lot Rent Subsidy The Lot

- Page 1384 and 1385:

B&I - MANUFACTURED HOUSING 271-3814

- Page 1386 and 1387:

B&I - MANUFACTURED HOUSING 271-3814

- Page 1388 and 1389:

B&I - MANUFACTURED HOUSING 271-3814

- Page 1390 and 1391:

B&I - MANUFACTURED HOUSING 271-3814

- Page 1392 and 1393:

B&I - MOBILE HOME LOT RENT SUBSIDY

- Page 1394 and 1395:

B&I - MOBILE HOME LOT RENT SUBSIDY

- Page 1396 and 1397:

B&I - MOBILE HOME PARKS 271-3843 PR

- Page 1398 and 1399:

B&I - MOBILE HOME PARKS 271-3843 EN

- Page 1400 and 1401:

B&I - MOBILE HOME PARKS 271-3843 SU

- Page 1402 and 1403:

B&I - MFG HOUSING EDUCATION/RECOVER

- Page 1404 and 1405:

B&I - MFG HOUSING EDUCATION/RECOVER

- Page 1406 and 1407:

B&I - FINANCIAL INSTITUTIONS DIV -

- Page 1408 and 1409:

Activity: Licensing This activity p

- Page 1410 and 1411:

Activity: Examination This activity

- Page 1412 and 1413:

B&I - FINANCIAL INSTITUTIONS 101-38

- Page 1414 and 1415:

B&I - FINANCIAL INSTITUTIONS 101-38

- Page 1416 and 1417:

B&I - FINANCIAL INSTITUTIONS 101-38

- Page 1418 and 1419:

B&I - FINANCIAL INSTITUTIONS 101-38

- Page 1420 and 1421:

B&I - FINANCIAL INSTITUTIONS INVEST

- Page 1422 and 1423:

B&I - FINANCIAL INSTITUTIONS AUDIT

- Page 1424 and 1425:

B&I - FINANCIAL INSTITUTIONS AUDIT

- Page 1426 and 1427:

Activity: Examinations The examinat

- Page 1428 and 1429:

Activity: Enforcement The enforceme

- Page 1430 and 1431:

B&I - MORTGAGE LENDING 101-3910 PRO

- Page 1432 and 1433:

B&I - MORTGAGE LENDING 101-3910 201

- Page 1434 and 1435:

B&I - MORTGAGE LENDING 101-3910 201

- Page 1436 and 1437:

B&I - MORTGAGE LENDING 101-3910 REG

- Page 1438 and 1439:

Activity: Business Development Busi

- Page 1440 and 1441:

Activity: Film Attraction and Devel

- Page 1442 and 1443:

Activity: Government Contract and P

- Page 1444 and 1445:

GOED - GOVERNOR'S OFFICE OF ECONOMI

- Page 1446 and 1447:

GOED - GOVERNOR'S OFFICE OF ECONOMI

- Page 1448 and 1449:

GOED - GOVERNOR'S OFFICE OF ECONOMI

- Page 1450 and 1451:

GOED - GOVERNOR'S OFFICE OF ECONOMI

- Page 1452 and 1453:

GOED - NEVADA FILM OFFICE 101-1527

- Page 1454 and 1455:

GOED - NEVADA FILM OFFICE 101-1527

- Page 1456 and 1457:

GOED - RURAL COMMUNITY DEVELOPMENT

- Page 1458 and 1459:

GOED - RURAL COMMUNITY DEVELOPMENT

- Page 1460 and 1461:

GOED - RURAL COMMUNITY DEVELOPMENT

- Page 1462 and 1463:

GOED - PROCUREMENT OUTREACH PROGRAM

- Page 1464 and 1465:

GOED - PROCUREMENT OUTREACH PROGRAM

- Page 1466 and 1467:

GOED - NEVADA CATALYST FUND 101-152

- Page 1468 and 1469:

GOED - NEVADA SSBCI PROGRAM 101-152

- Page 1470 and 1471:

DEPARTMENT OF TOURISM AND CULTURAL

- Page 1472 and 1473:

Division Budget Highlights (continu

- Page 1474 and 1475:

Activity: Tourism Public Relations

- Page 1476 and 1477:

Activity: Nevada Magazine Nevada Ma

- Page 1478 and 1479:

Activity: Transfers to Other State

- Page 1480 and 1481:

Activity: Nevada Humanities Nevada

- Page 1482 and 1483:

TOURISM - TOURISM DEVELOPMENT FUND

- Page 1484 and 1485:

TOURISM - TOURISM DEVELOPMENT FUND

- Page 1486 and 1487:

TOURISM - TOURISM DEVELOPMENT FUND

- Page 1488 and 1489:

TOURISM - TOURISM DEVELOPMENT FUND

- Page 1490 and 1491:

TOURISM - TOURISM DEVELOPMENT 225-1

- Page 1492 and 1493:

TOURISM - NEVADA MAGAZINE 530-1530

- Page 1494 and 1495:

TOURISM - NEVADA MAGAZINE 530-1530

- Page 1496 and 1497:

TOURISM - NEVADA MAGAZINE 530-1530

- Page 1498 and 1499:

TOURISM - INDIAN COMMISSION 101-260

- Page 1500 and 1501:

TOURISM - INDIAN COMMISSION 101-260

- Page 1502 and 1503:

TOURISM - INDIAN COMMISSION 101-260

- Page 1504 and 1505:

TOURISM - NEVADA HUMANITIES 101-289

- Page 1506 and 1507:

DCA - CULTURAL AFFAIRS ADMINISTRATI

- Page 1508 and 1509:

Activity: Exhibition of Museum Coll

- Page 1510 and 1511:

Activity: Museums Collections Museu

- Page 1512 and 1513:

Activity: Museums Collections Resea

- Page 1514 and 1515:

Activity: General Administration Th

- Page 1516 and 1517:

TOURISM - MUSEUMS & HISTORY 101-294

- Page 1518 and 1519:

TOURISM - MUSEUMS & HISTORY 101-294

- Page 1520 and 1521:

TOURISM - MUSEUMS & HIST - LOST CIT

- Page 1522 and 1523:

TOURISM - MUSEUMS & HIST - LOST CIT

- Page 1524 and 1525:

TOURISM - MUSEUMS & HIST - LOST CIT

- Page 1526 and 1527:

TOURISM - MUSEUMS & HIST - LOST CIT

- Page 1528 and 1529:

TOURISM - MUSEUMS & HIST-NEVADA HIS

- Page 1530 and 1531:

TOURISM - MUSEUMS & HIST-NEVADA HIS

- Page 1532 and 1533:

TOURISM - MUSEUMS & HIST-NEVADA HIS

- Page 1534 and 1535:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1536 and 1537:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1538 and 1539:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1540 and 1541:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1542 and 1543:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1544 and 1545:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1546 and 1547:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1548 and 1549:

TOURISM - MUSEUMS & HIST - NEVADA S

- Page 1550 and 1551:

TOURISM - MUSEUMS & HIST - STATE RA

- Page 1552 and 1553:

TOURISM - MUSEUMS & HIST - STATE RA

- Page 1554 and 1555:

TOURISM - MUSEUMS & HIST - STATE RA

- Page 1556 and 1557:

DTCA - NEVADA ARTS COUNCIL - The Ne

- Page 1558 and 1559:

Activity: Arts and Cultural Outreac

- Page 1560 and 1561:

Activity: Support - Administrative

- Page 1562 and 1563:

TOURISM - NEVADA ARTS COUNCIL 101-2

- Page 1564 and 1565:

TOURISM - NEVADA ARTS COUNCIL 101-2

- Page 1566 and 1567:

TOURISM - NEVADA ARTS COUNCIL 101-2

- Page 1568 and 1569:

TOURISM - NEVADA ARTS COUNCIL 101-2

- Page 1570 and 1571:

Department Budget Highlights (conti

- Page 1572 and 1573:

Activity: Consumer Health Assistanc

- Page 1574 and 1575:

Activity: Fiscal/Accounting/Budget

- Page 1576 and 1577:

Activity: Grant Management of Avail

- Page 1578 and 1579:

Activity: Health Information Techno

- Page 1580 and 1581:

Activity: Pass Through This activit

- Page 1582 and 1583:

Activity: Public Defense Client Ser

- Page 1584 and 1585:

HHS-DO - ADMINISTRATION 101-3150 YO

- Page 1586 and 1587:

HHS-DO - ADMINISTRATION 101-3150 E4

- Page 1588 and 1589:

HHS-DO - ADMINISTRATION 101-3150 E7

- Page 1590 and 1591:

HHS-DO - ADMINISTRATION 101-3150 20

- Page 1592 and 1593:

HHS-DO - GRANTS MANAGEMENT UNIT 101

- Page 1594 and 1595:

HHS-DO - GRANTS MANAGEMENT UNIT 101

- Page 1596 and 1597:

HHS-DO - GRANTS MANAGEMENT UNIT 101

- Page 1598 and 1599:

HHS-DO - CHILDREN'S TRUST ACCOUNT 1

- Page 1600 and 1601:

HHS-DO - INDIGENT SUPPLEMENTAL ACCO

- Page 1602 and 1603:

HHS-DO - PUBLIC DEFENDER 101-1499 P

- Page 1604 and 1605:

HHS-DO - PUBLIC DEFENDER 101-1499 E

- Page 1606 and 1607:

HHS-DO - PUBLIC DEFENDER 101-1499 S

- Page 1608 and 1609:

HHS-DO - DEVELOPMENTAL DISABILITIES

- Page 1610 and 1611:

HHS-DO - DEVELOPMENTAL DISABILITIES

- Page 1612 and 1613:

HHS-DO - CONSUMER HEALTH ASSISTANCE

- Page 1614 and 1615:

HHS-DO - CONSUMER HEALTH ASSISTANCE

- Page 1616 and 1617:

HHS-DO - CONSUMER HEALTH ASSISTANCE

- Page 1618 and 1619:

HHS-DO - CONSUMER HEALTH ASSISTANCE

- Page 1620 and 1621:

Activity: Autism Treatment Assistan

- Page 1622 and 1623:

Activity: Psychological Services Th

- Page 1624 and 1625:

Activity: Early Intervention Servic

- Page 1626 and 1627:

Activity: Home and Community Based

- Page 1628 and 1629:

Activity: Inpatient Services Desert

- Page 1630 and 1631:

Activity: Private Sector Partnershi

- Page 1632 and 1633:

Activity: Social Services Support a

- Page 1634 and 1635:

Activity: Administration-General Di

- Page 1636 and 1637:

Activity: Administration - Informat

- Page 1638 and 1639:

HHS-ADSD - TOBACCO SETTLEMENT PROGR

- Page 1640 and 1641:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1642 and 1643:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1644 and 1645:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1646 and 1647:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1648 and 1649:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1650 and 1651:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1652 and 1653:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1654 and 1655:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1656 and 1657:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1658 and 1659:

HHS-ADSD - FEDERAL PROGRAMS AND ADM

- Page 1660 and 1661:

HHS-ADSD - SENIOR RX AND DISABILITY

- Page 1662 and 1663:

HHS-ADSD - SENIOR RX AND DISABILITY

- Page 1664 and 1665:

HHS-ADSD - SENIOR RX AND DISABILITY

- Page 1666 and 1667:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1668 and 1669:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1670 and 1671:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1672 and 1673:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1674 and 1675:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1676 and 1677:

HHS-ADSD - HOME AND COMMUNITY BASED

- Page 1678 and 1679:

HHS-ADSD - IDEA PART C 101-3276 201

- Page 1680 and 1681:

HHS-ADSD - IDEA PART C 101-3276 E71

- Page 1682 and 1683:

HHS-ADSD - EARLY INTERVENTION SERVI

- Page 1684 and 1685:

HHS-ADSD - EARLY INTERVENTION SERVI

- Page 1686 and 1687:

HHS-ADSD - EARLY INTERVENTION SERVI

- Page 1688 and 1689:

HHS-ADSD - EARLY INTERVENTION SERVI

- Page 1690 and 1691:

HHS-ADSD - EARLY INTERVENTION SERVI

- Page 1692 and 1693:

HHS-ADSD - FAMILY PRESERVATION PROG

- Page 1694 and 1695:

HHS-ADSD - RURAL REGIONAL CENTER 10

- Page 1696 and 1697:

HHS-ADSD - RURAL REGIONAL CENTER 10

- Page 1698 and 1699:

HHS-ADSD - RURAL REGIONAL CENTER 10

- Page 1700 and 1701:

HHS-ADSD - RURAL REGIONAL CENTER 10

- Page 1702 and 1703:

HHS-ADSD - DESERT REGIONAL CENTER 1

- Page 1704 and 1705:

HHS-ADSD - DESERT REGIONAL CENTER 1

- Page 1706 and 1707:

HHS-ADSD - DESERT REGIONAL CENTER 1

- Page 1708 and 1709:

HHS-ADSD - DESERT REGIONAL CENTER 1

- Page 1710 and 1711:

HHS-ADSD - DESERT REGIONAL CENTER 1

- Page 1712 and 1713:

HHS-ADSD - SIERRA REGIONAL CENTER 1

- Page 1714 and 1715:

HHS-ADSD - SIERRA REGIONAL CENTER 1

- Page 1716 and 1717:

HHS-ADSD - SIERRA REGIONAL CENTER 1

- Page 1718 and 1719:

HHS-ADSD - SIERRA REGIONAL CENTER 1

- Page 1720 and 1721:

HHS-ADSD - SIERRA REGIONAL CENTER 1

- Page 1722 and 1723:

DHHS - HEALTH CARE FINANCING & POLI

- Page 1724 and 1725:

Activity: Medical Services Reimburs

- Page 1726 and 1727:

Activity: Health Care Transparency

- Page 1728 and 1729:

Activity: Information Technology Th

- Page 1730 and 1731:

Activity: Personnel and Payroll Per

- Page 1732 and 1733:

HHS-HCF&P - HIFA HOLDING ACCOUNT 10

- Page 1734 and 1735:

HHS-HCF&P - INTERGOVERNMENTAL TRANS

- Page 1736 and 1737:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1738 and 1739:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1740 and 1741:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1742 and 1743:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1744 and 1745:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1746 and 1747:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1748 and 1749:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1750 and 1751:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1752 and 1753:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1754 and 1755:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1756 and 1757:

HHS-HCF&P - ADMINISTRATION 101-3158

- Page 1758 and 1759:

HHS-HCF&P - INCREASED QUALITY OF NU

- Page 1760 and 1761:

HHS-HCF&P - NEVADA CHECK-UP PROGRAM

- Page 1762 and 1763:

HHS-HCF&P - NEVADA CHECK-UP PROGRAM

- Page 1764 and 1765:

HHS-HCF&P - NEVADA CHECK-UP PROGRAM

- Page 1766 and 1767:

HHS-HCF&P - NEVADA MEDICAID, TITLE

- Page 1768 and 1769:

HHS-HCF&P - NEVADA MEDICAID, TITLE

- Page 1770 and 1771:

HHS-HCF&P - NEVADA MEDICAID, TITLE

- Page 1772 and 1773:

HHS-HCF&P - NEVADA MEDICAID, TITLE

- Page 1774 and 1775:

HHS-HCF&P - HIFA MEDICAL 101-3247 P

- Page 1776 and 1777:

Activity: Administration General Ge

- Page 1778 and 1779:

Activity: Administration - Personne

- Page 1780 and 1781:

Activity: Temporary Assistance for

- Page 1782 and 1783:

Activity: Supplemental Nutrition As

- Page 1784 and 1785:

Activity: Medicaid Eligibility The

- Page 1786 and 1787:

Activity: Child Care The purpose of

- Page 1788 and 1789:

Activity: Energy Assistance The Ene

- Page 1790 and 1791:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1792 and 1793:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1794 and 1795:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1796 and 1797:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1798 and 1799:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1800 and 1801:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1802 and 1803:

HHS-WELFARE - ADMINISTRATION 101-32

- Page 1804 and 1805:

HHS-WELFARE - TANF 101-3230 JOB RET

- Page 1806 and 1807:

HHS-WELFARE - ASSISTANCE TO AGED AN

- Page 1808 and 1809:

HHS-WELFARE - FIELD SERVICES 101-32

- Page 1810 and 1811:

HHS-WELFARE - FIELD SERVICES 101-32

- Page 1812 and 1813:

HHS-WELFARE - FIELD SERVICES 101-32

- Page 1814 and 1815:

HHS-WELFARE - FIELD SERVICES 101-32

- Page 1816 and 1817:

HHS-WELFARE - FIELD SERVICES 101-32

- Page 1818 and 1819:

HHS-WELFARE - CHILD SUPPORT ENFORCE

- Page 1820 and 1821:

HHS-WELFARE - CHILD SUPPORT ENFORCE

- Page 1822 and 1823:

HHS-WELFARE - CHILD SUPPORT ENFORCE

- Page 1824 and 1825:

HHS-WELFARE - CHILD SUPPORT ENFORCE

- Page 1826 and 1827:

HHS-WELFARE - CHILD SUPPORT FEDERAL

- Page 1828 and 1829:

HHS-WELFARE - CHILD ASSISTANCE AND

- Page 1830 and 1831:

HHS-WELFARE - CHILD ASSISTANCE AND

- Page 1832 and 1833:

HHS-WELFARE - ENERGY ASSISTANCE PRO

- Page 1834 and 1835:

HHS-WELFARE - ENERGY ASSISTANCE PRO

- Page 1836 and 1837:

HHS-WELFARE - ENERGY ASSISTANCE PRO

- Page 1838 and 1839:

Activity: Fiscal/Accounting/Budget

- Page 1840 and 1841:

Activity: Health Data Management an

- Page 1842 and 1843:

Activity: Infrastructure By coordin

- Page 1844 and 1845:

Activity: Public Health Education &

- Page 1846 and 1847:

Activity: Rural Clinical Services C

- Page 1848 and 1849:

HHS-DPBH - RADIATION CONTROL 101-31

- Page 1850 and 1851:

HHS-DPBH - RADIATION CONTROL 101-31

- Page 1852 and 1853:

HHS-DPBH - RADIATION CONTROL 101-31

- Page 1854 and 1855:

HHS-DPBH - RADIATION CONTROL 101-31

- Page 1856 and 1857:

HHS-DPBH - LOW-LEVEL RADIOACTIVE WA

- Page 1858 and 1859:

HHS-DPBH - CANCER CONTROL REGISTRY

- Page 1860 and 1861:

HHS-DPBH - CANCER CONTROL REGISTRY

- Page 1862 and 1863:

HHS-DPBH - HEALTH STATISTICS AND PL

- Page 1864 and 1865:

HHS-DPBH - HEALTH STATISTICS AND PL

- Page 1866 and 1867:

HHS-DPBH - HEALTH STATISTICS AND PL

- Page 1868 and 1869:

HHS-DPBH - HEALTH STATISTICS AND PL

- Page 1870 and 1871:

HHS-DPBH - HEALTH STATISTICS AND PL

- Page 1872 and 1873:

HHS-DPBH - CONSUMER HEALTH PROTECTI

- Page 1874 and 1875:

HHS-DPBH - CONSUMER HEALTH PROTECTI

- Page 1876 and 1877:

HHS-DPBH - CONSUMER HEALTH PROTECTI

- Page 1878 and 1879:

HHS-DPBH - CONSUMER HEALTH PROTECTI

- Page 1880 and 1881:

HHS-DPBH - IMMUNIZATION PROGRAM 101

- Page 1882 and 1883:

HHS-DPBH - IMMUNIZATION PROGRAM 101

- Page 1884 and 1885:

HHS-DPBH - IMMUNIZATION PROGRAM 101

- Page 1886 and 1887:

HHS-DPBH - WIC FOOD SUPPLEMENT 101-

- Page 1888 and 1889:

HHS-DPBH - WIC FOOD SUPPLEMENT 101-

- Page 1890 and 1891:

HHS-DPBH - WIC FOOD SUPPLEMENT 101-

- Page 1892 and 1893:

HHS-DPBH - COMMUNICABLE DISEASES 10

- Page 1894 and 1895:

HHS-DPBH - COMMUNICABLE DISEASES 10

- Page 1896 and 1897:

HHS-DPBH - COMMUNICABLE DISEASES 10

- Page 1898 and 1899:

HHS-DPBH - HEALTH FACILITIES HOSPIT

- Page 1900 and 1901:

HHS-DPBH - HEALTH FACILITIES HOSPIT

- Page 1902 and 1903:

HHS-DPBH - HEALTH FACILITIES HOSPIT

- Page 1904 and 1905:

HHS-DPBH - HEALTH FACILITIES HOSPIT

- Page 1906 and 1907:

HHS-DPBH - HEALTH FACILITIES-ADMIN

- Page 1908 and 1909:

HHS-DPBH - PUBLIC HEALTH PREPAREDNE

- Page 1910 and 1911:

HHS-DPBH - PUBLIC HEALTH PREPAREDNE

- Page 1912 and 1913:

HHS-DPBH - PUBLIC HEALTH PREPAREDNE

- Page 1914 and 1915:

HHS-DPBH - PUBLIC HEALTH PREPAREDNE

- Page 1916 and 1917:

HHS-DPBH - BIOSTATISTICS AND EPIDEM

- Page 1918 and 1919:

HHS-DPBH - BIOSTATISTICS AND EPIDEM

- Page 1920 and 1921:

HHS-DPBH - BIOSTATISTICS AND EPIDEM

- Page 1922 and 1923:

HHS-DPBH - BIOSTATISTICS AND EPIDEM

- Page 1924 and 1925:

HHS-DPBH - BIOSTATISTICS AND EPIDEM

- Page 1926 and 1927:

HHS-DPBH - CHRONIC DISEASE 101-3220

- Page 1928 and 1929:

HHS-DPBH - CHRONIC DISEASE 101-3220

- Page 1930 and 1931:

HHS-DPBH - CHRONIC DISEASE 101-3220

- Page 1932 and 1933:

HHS-DPBH - CHRONIC DISEASE 101-3220

- Page 1934 and 1935:

HHS-DPBH - CHRONIC DISEASE 101-3220

- Page 1936 and 1937:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1938 and 1939:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1940 and 1941:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1942 and 1943:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1944 and 1945:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1946 and 1947:

HHS-DPBH - MATERNAL CHILD HEALTH SE

- Page 1948 and 1949:

HHS-DPBH - OFFICE OF HEALTH ADMINIS

- Page 1950 and 1951:

HHS-DPBH - OFFICE OF HEALTH ADMINIS

- Page 1952 and 1953:

HHS-DPBH - OFFICE OF HEALTH ADMINIS

- Page 1954 and 1955:

HHS-DPBH - OFFICE OF HEALTH ADMINIS

- Page 1956 and 1957:

HHS-DPBH - OFFICE OF HEALTH ADMINIS

- Page 1958 and 1959:

HHS-DPBH - COMMUNITY HEALTH SERVICE

- Page 1960 and 1961:

HHS-DPBH - COMMUNITY HEALTH SERVICE

- Page 1962 and 1963:

HHS-DPBH - COMMUNITY HEALTH SERVICE

- Page 1964 and 1965:

HHS-DPBH - COMMUNITY HEALTH SERVICE

- Page 1966 and 1967:

HHS-DPBH - COMMUNITY HEALTH SERVICE

- Page 1968 and 1969:

HHS-DPBH - EMERGENCY MEDICAL SERVIC

- Page 1970 and 1971:

HHS-DPBH - EMERGENCY MEDICAL SERVIC

- Page 1972 and 1973:

HHS-DPBH - EMERGENCY MEDICAL SERVIC

- Page 1974 and 1975:

HHS-DPBH - MARIJUANA HEALTH REGISTR

- Page 1976 and 1977:

HHS-DPBH - MARIJUANA HEALTH REGISTR

- Page 1978 and 1979:

HHS-DPBH - CHILD CARE SERVICES 101-

- Page 1980 and 1981:

HHS-DPBH - CHILD CARE SERVICES 101-

- Page 1982 and 1983:

HHS-DPBH - CHILD CARE SERVICES 101-

- Page 1984 and 1985:

Activity: Clinical Services The obj

- Page 1986 and 1987:

Activity: Financial Management of S

- Page 1988 and 1989:

Activity: Fiscal Activities Functio

- Page 1990 and 1991:

Activity: Information Technology (I

- Page 1992 and 1993:

Activity: Personnel and Payroll Thi

- Page 1994 and 1995:

HHS-DPBH - SO NV ADULT MENTAL HEALT

- Page 1996 and 1997:

HHS-DPBH - SO NV ADULT MENTAL HEALT

- Page 1998 and 1999:

HHS-DPBH - SO NV ADULT MENTAL HEALT

- Page 2000 and 2001:

HHS-DPBH - SO NV ADULT MENTAL HEALT

- Page 2002 and 2003:

HHS-DPBH - SO NV ADULT MENTAL HEALT