Relationship Equity im Private Banking - Universität St.Gallen

Relationship Equity im Private Banking - Universität St.Gallen

Relationship Equity im Private Banking - Universität St.Gallen

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

R E L A T I O N S H I P E Q U I T Y I M P R I V A T E B A N K I N G<br />

Section B: Digging Into the Depth of the Client Clusters<br />

1. Customizable CLIENT-O-METER 1 dot = 1 client 2. <strong>Relationship</strong> equity statement<br />

120<br />

100<br />

Unit: CHFmn (CHFk for individual client level)<br />

Client growth potential<br />

2005_Q1<br />

Client population focussed<br />

All Cluster % Indiv % Clust<br />

+ NPV organic development, gross 103.5 0% 36 0%<br />

./. NPV expected client attrition -6.5 0.0 0% 0 0%<br />

= NPV organic development, net 97.0 0% 36 0%<br />

Client age (years)<br />

80<br />

60<br />

40<br />

20<br />

0<br />

0 2'000 4'000 6'000 8'000 10'000 12'000 14'000 16'000<br />

+ NPV share of wallet potential* 12.8 0% 12 0%<br />

+ NPV pricing potential* 0.2 0% 0 0%<br />

+ NPV liability potential* 5.0 0% 1 0%<br />

= NPV anorganic development* 18.0 0.0 0% 13 0%<br />

NPV share of wallet potential vs target 0% 15 0%<br />

Max<strong>im</strong>um directly capturable value 115.0 0% 49 0%<br />

+ Exp. inheritances (from outside of bank) 3.4 0% 0 0%<br />

+ Exp. inheritances (from within bank) 4'286.4 0% 0 0%<br />

= Total indirect new money benefit 4'289.8 0% 0 0%<br />

Outflow risk<br />

NPV of potential legacy out 26.7 0% 61 0%<br />

NPV of potential legacy out (unsecured) 12.5 0% 61 0%<br />

p.m. NPV expected client attrition 6.5 0.0 0% 0 0%<br />

Total wealth (CHFk)<br />

3. Expected value capturing periods by client cluster 1 dot = 1 cluster<br />

40%<br />

Highest value share<br />

Current filter settings NAV PAD<br />

Retired (65+) 30%<br />

Explicit organic value share<br />

GENERAL SETTINGS<br />

30%<br />

4.2<br />

Lowest value share<br />

CUSTOM IZE!<br />

Market: all <strong>St</strong>udent with potential 0.7%<br />

Income/wealth bracket: all / all<br />

20%<br />

Sex: both 0 A B C<br />

Highest duration (years)<br />

<strong>St</strong>udent with potential 5.0<br />

10%<br />

SECTION B SETTINGS Lowest duration (years)<br />

Cluster: all Professional (-30) 2.7<br />

No. of selected clients: 1'000 0%<br />

Total duration (years)<br />

Client number selected: 0 0 1 2 3 4 5 6 All clusters 4.2<br />

* in relation to cluster average Years until capturing of 50% of explicit organic value<br />

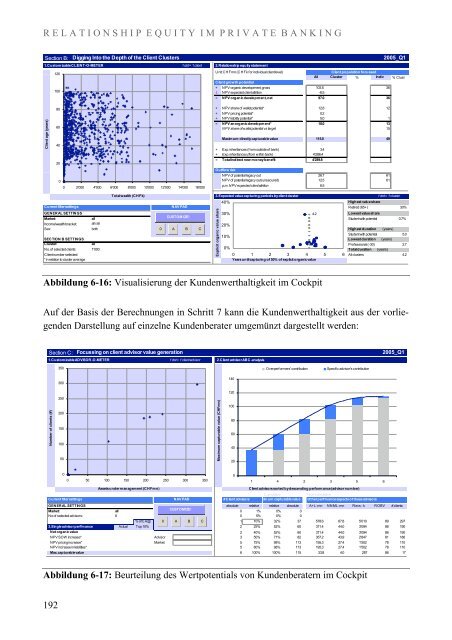

Abbildung 6-16: Visualisierung der Kundenwerthaltigkeit <strong>im</strong> Cockpit<br />

Auf der Basis der Berechnungen in Schritt 7 kann die Kundenwerthaltigkeit aus der vorliegenden<br />

Darstellung auf einzelne Kundenberater umgemünzt dargestellt werden:<br />

Section C: Focussing on client advisor value generation<br />

1. Customizable ADVISOR-O-METER 1 dot = 1 client advisor 2. Client advisor ABC-analysis<br />

2005_Q1<br />

350<br />

Overperformers' contribution<br />

Specific advisor's contribution<br />

300<br />

140<br />

120<br />

250<br />

Number of clients (#)<br />

200<br />

150<br />

100<br />

50<br />

Max<strong>im</strong>um capturable value (CHFmn)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

0 50 100 150 200 250 300 350<br />

Assets under management (CHFmn)<br />

Client advisors sorted by descending performance (advisor number)<br />

Cumulative<br />

Non-cumulative<br />

Current filter settings NAV PAD<br />

# Client advisors Max<strong>im</strong>um capturable value Other perf'mance aspects of these advisors<br />

GENERAL SETTINGS absolute relative relative absolute A+L -mn NNML -mn Revs - k ROBV # clients<br />

Market: all<br />

CUSTOMIZE!<br />

0 1% 0% 0 0.0 0.0 0 0 0<br />

No of selected advisors: 6 0 5% 0% 0 0.0 0.0 0 0 0<br />

%ofCA@ 0 A B C<br />

1 10% 32% 37 578.6 67.8 5'010 89 297<br />

3. Single advisor perf'mance Actual Top 10% 2 25% 52% 60 371.4 44.0 3'094 86 190<br />

Net organic value 0.0 0% 2 40% 52% 60 371.4 44.0 3'094 86 190<br />

NPV SOW increase* 0.0 0% Advisor 0<br />

3 50% 71% 82 357.2 43.9 2'847 81 186<br />

NPV pricing increase* 0.0 0% Market 0<br />

5 75% 98% 113 195.3 27.4 1'502 78 110<br />

NPV increase in liabilities* 0.0 0% 5 80% 98% 113 195.3 27.4 1'502 78 110<br />

Max. capturable value 0.0 0% 6 100% 100% 115 33.8 4.0 287 86 17<br />

0<br />

1 4 2 3 5 6<br />

Abbildung 6-17: Beurteilung des Wertpotentials von Kundenberatern <strong>im</strong> Cockpit<br />

192